8 Essential Steps ToVest Takes to Ensure Regulatory Compliance

January 8, 2026

ToVest ensures regulatory compliance through a disciplined, technology-enabled program that blends governance, automation, and continuous oversight. Our approach is designed for a global, blockchain-based platform that tokenizes access to fractional U.S. assets while aligning with applicable laws across jurisdictions. In practice, this means codified policies, risk-based controls, and continuous monitoring—supported by automated evidence trails and clear accountability. Where required, ToVest secures licenses and registrations and adheres to obligations such as Know Your Customer/Anti–Money Laundering and, when applicable, Money Services Business registration under the U.S. Financial Crimes Enforcement Network guidelines, which define MSB registration and reporting expectations for financial innovators (see FinCEN’s Money Services Business registration overview). Together, these eight steps describe how ToVest stays compliant, legal, and audit-ready.

Governance and Policy Framework

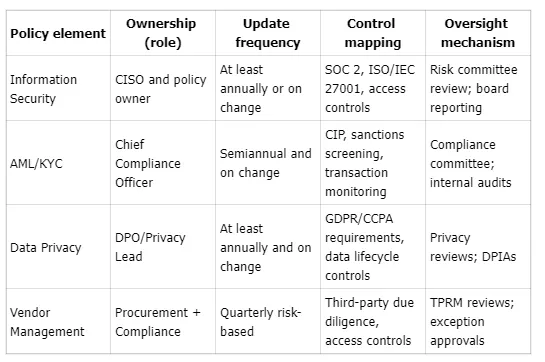

ToVest’s governance and policy framework is a formal system of written policies, procedures, and clear lines of authority that ensures controls align with legal and regulatory requirements. We maintain a codified structure with defined ownership, a compliance calendar, and role-based responsibilities to ensure every regulatory obligation is tracked, executed, and reviewed on schedule. This compliance governance model enables consistent oversight and policy management—even as rules evolve.

Modern regulatory compliance software features (for example, ownership workflows, versioning, and approvals) help organizations keep policies current and aligned to controls, which is critical for day-to-day adherence (see regulatory compliance software features from CookieYes). ToVest applies the same discipline: policy updates are risk-driven, mapped to controls, and actively overseen.

Key policy elements at ToVest:

This structured oversight ensures day-to-day operations meet or exceed current standards.

Risk Assessment and Control Design

Risk assessment and control design is a periodic process that identifies, evaluates, and prioritizes potential compliance risks, then develops targeted controls and remediation plans. ToVest conducts risk mapping at defined intervals, linking risks to business processes—so each exposure has a responsible owner, a control, and a timeline for remediation. Software-enabled workflows and standardized templates accelerate prioritization and documentation (see this 2024 guide to regulatory compliance management software from MyFieldAudits).

Key risk categories we continuously evaluate:

- KYC/AML and sanctions

- Data privacy and data residency

- Technology and cybersecurity (including cloud and key management)

- Vendor/third-party and supply-chain dependencies

- Operational integrity (financial reporting, business continuity)

- Product and market conduct (disclosures, communications)

Automation streamlines the identification and ranking of risks, reduces manual workload, and keeps remediation timely.

Automated Evidence Collection

Automated evidence collection uses integrations and software to gather and log compliance artifacts—documents, logs, attestations—directly from systems as proof that controls are operating. ToVest connects across cloud, identity, and productivity platforms to collect audit evidence with minimal manual effort, creating tamper-evident trails and clear ownership (see best compliance software for modern businesses from Scrut). Independent assessments note that leading tools connect to 75+ platforms, automatically logging evidence and cutting audit cycle time by up to 50% (see this roundup of compliance software companies from Springs Apps).

Examples of evidence ToVest maintains:

- Access and SSO logs

- Change-management and deployment traces

- Policy acknowledgments and training records

- Financial reconciliations and reports

- System snapshots and configuration baselines

- Vendor due diligence files and certifications

Continuous Monitoring and Telemetry

Continuous monitoring and telemetry provide automated, real-time surveillance of compliance posture—detecting anomalies, configuration drift, or policy gaps as they occur. ToVest operates dashboards and posture checks that flag deviations early, enabling fixes well before audits. Real-time compliance monitoring is increasingly favored by regulators because it demonstrates ongoing control effectiveness—not just point-in-time checks (see the 2025 regulatory enforcement recap from Smarsh). Our compliance telemetry feeds alerting, trend analysis, and executive reporting for rapid, risk-based response.

Control Testing and Audit Support

Control testing and audit support involve systematic reviews of controls—via planned testing—and efficient preparation of audit artifacts for regulators or third parties. ToVest runs internal test schedules tied to control frequency (daily, weekly, quarterly), bundles evidence into purpose-built “packs,” and provides controlled auditor access to reduce friction and time-to-signoff. Modern tools also provide auditor collaboration portals and integrations that minimize manual overhead and speed reviews (see this overview of best compliance tools for SMBs in 2025 on LinkedIn).

A simple breakdown:

- Internal testing: frequency-based tests (design and operating effectiveness), sample selection, and remediation tracking.

- External audit preparation: scoped access, pre-built evidence packs, single source of truth for requests.

- Summary reporting: executive dashboards, control maturity trends, and regulatory-ready summaries.

Vendor and Supply-Chain Compliance

Vendor and supply-chain compliance is the oversight that ensures all third-party providers meet applicable regulations and ToVest’s flow-down obligations. ToVest conducts thorough third-party risk assessments, collects attestations and certifications, and standardizes due diligence using regulatory templates for consistency and speed (see regulatory software solutions guidance from MyFieldAudits). Third-party risk scoring supports continuous oversight and triggers enhanced reviews where needed.

Checklist we apply:

- Pre-contract due diligence and risk scoring

- Contracts with explicit compliance clauses and right-to-audit

- Periodic assessments and evidence refresh (e.g., SOC reports, pen tests)

- Transparent remediation actions and timelines

- Continuous monitoring of key vendor controls and access

Training, Culture, and Incident Playbooks

Compliance training and culture focus on ongoing education that equips employees and stakeholders to understand, detect, and respond to requirements and incidents. ToVest delivers role-based instruction, simulation testing, and clear escalation paths so issues are surfaced early and handled consistently. Best practices include regular communications, scenario-based playbooks, and tracking of completion rates and outcomes (see the industry summary of compliance software features from CookieYes).

Flow we follow: Onboarding → periodic role-based learning → testing/assessment → simulated drills → escalation channel.

Regulatory Change Management

Regulatory change management is a structured process for horizon scanning, tracking authoritative sources, and translating regulatory changes into operational updates. ToVest leverages regtech capabilities for real-time updates, change logs, and automated policy workflows to ensure our controls and training stay aligned. In 2025 and beyond, real-time change management is critical as enforcement focuses on day-to-day control effectiveness and recordkeeping, not just annual attestations (as highlighted in Smarsh’s 2025 enforcement recap). Our steps:

- Monitoring of global regulatory developments and supervisory guidance

- Team notifications and impact assessments

- Policy/procedure revision with version control

- Staff retraining and attestation

- Documentation of change actions and evidence for audits

Frequently Asked Questions

What are the key elements of ToVest’s compliance governance?

ToVest’s governance centers on clear policy ownership, a living compliance calendar, and formal procedures that align every business activity with applicable laws and standards.

How does ToVest keep compliance automated and efficient?

We integrate with cloud, identity, and productivity systems to enable automated evidence collection and streamlined workflows, significantly reducing manual audit effort.

In what ways does ToVest train employees on compliance requirements?

ToVest provides role-based training with periodic refreshers, simulated drills, and defined escalation procedures to ensure rapid, consistent responses.

How does ToVest manage third-party compliance risks?

We conduct due diligence and risk scoring, embed compliance clauses in contracts, and perform periodic assessments with transparent remediation tracking.

How does ToVest maintain readiness for regulatory audits?

We schedule internal control tests, prepackage evidence, and provide scoped auditor access through integrated tools to accelerate reviews.