Expert Blueprint: Creating a Balanced Global Equity Portfolio with Minimal Fees

January 8, 2026

Building a diversified global stock portfolio doesn’t have to be complex—or expensive. This blueprint shows you how to assemble a balanced mix of world equities and bonds using a few low-cost funds, then maintain it with disciplined rebalancing. Whether you’re investing from the U.S., Africa, or Southeast Asia, you can start small and scale up over time. ToVest removes barriers by offering fractional, tokenized access to U.S. stocks and real assets with 24/7 trading, blockchain-backed transparency, and flexible funding options. The goal: give you a straightforward, expert-backed process to achieve global diversification at minimal cost while staying aligned with your personal risk and timeline.

Understanding a Balanced Global Equity Portfolio

A balanced global equity portfolio blends international stocks with bonds to pursue growth and resilience across market cycles. Balance comes from diversifying across regions, sectors, and asset classes so no single risk—like a country, currency, or industry—dominates results. This is global diversification in practice: spreading exposure across the world to reduce the impact of any one market shock.

A practical framework is the core-satellite approach, where a broad, low-cost core allocation anchors your portfolio, and small, targeted satellites aim to enhance returns or manage risk around the edges. This structure is a proven way to keep costs and complexity in check while still allowing thoughtful tilts toward specific opportunities, as outlined in core-satellite guidance from Arta Finance’s portfolio playbook (Level Up Your Portfolio) [artafinance.com].

Global core funds also help minimize home bias by providing diversified exposure across developed and emerging economies, which can improve risk-adjusted returns over time, as emphasized in Amundi’s core ETF portfolio guidance [amundietf.dk].

Defining Your Investment Objectives and Risk Tolerance

Start by clarifying your primary objective—retirement, financial independence, or wealth preservation—and your time horizon. Risk tolerance is your capacity and willingness to endure volatility and temporary losses without abandoning your plan. Both your need for return and your comfort with drawdowns shape your equity/bond mix.

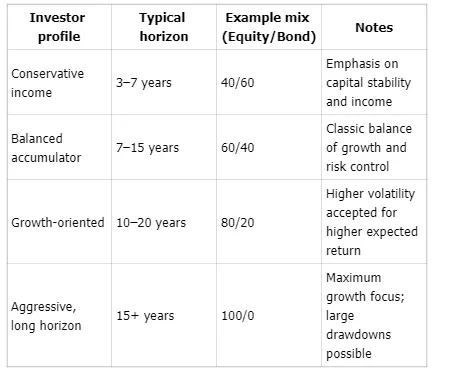

Common splits illustrate how allocation maps to risk profiles. The White Coat Investor’s survey of model portfolios shows viable ranges from 100% equity for aggressive, long-horizon investors to 60/40 for balanced investors and 40/60 for conservative savers [whitecoatinvestor.com].

Sample equity/bond mixes by investor type and horizon:

Building the Core of Your Global Equity Portfolio

Your core is the engine of long-term results. Keep it simple with one or two low-cost index funds or ETFs:

- One-fund core: a total world stock market fund that owns thousands of companies across developed and emerging markets.

- Two-fund core: global equities plus a broad investment-grade bond fund for ballast.

This setup reduces home bias, keeps fees minimal, and ensures you’re riding the growth of global markets instead of trying to pick winners. A core portfolio is the stable center of your holdings—generally broad, cap-weighted index funds that track global stocks and high-quality bonds.

Selecting Low-Cost Funds and ETFs for Minimal Fees

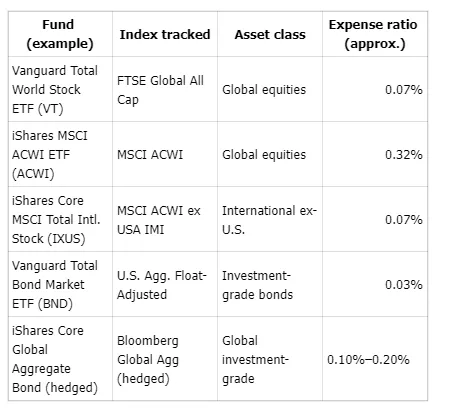

Costs compound just like returns, so minimizing them is a durable edge. For core holdings, target expense ratios around 0.10% or lower where available. State Street’s core portfolio construction guidance highlights how ultra-low-cost, broad-market funds—some with expense ratios in the 0.03%–0.06% range—can materially improve long-run outcomes [ssga.com].

Exchange-traded funds are pooled investments that track an index or basket of assets and trade on exchanges like a stock. When choosing funds, compare:

- Expense ratio, liquidity (average volume/spreads), and tracking error versus the benchmark

- Tax efficiency and how distributions are handled in your country

- Research support and analytics from sources like Morningstar and provider platforms; a roundup of portfolio analysis tools curated by The Wealth Mosaic can help you evaluate and simulate costs and risk [thewealthmosaic.com].

Illustrative core fund options (check your market access and current prospectus):

Note: Availability, tickers, and fees vary by region and broker; confirm details before investing.

Adding Satellite Investments to Enhance Diversification

Satellites are smaller allocations (typically 5%–30% combined) that complement the core with targeted exposures. A satellite allocation might aim for excess return or risk management by tilting to factors, regions, or alternatives.

Practical satellite ideas:

- Small-cap value stocks for factor diversification and potential return premium

- Emerging markets to capture higher growth and demographic trends

- REITs for real-asset and income exposure

- Thematic sleeves (e.g., technology, healthcare, energy transition) to express long-horizon convictions; leading institutions highlight durable themes shaping the next decade of global investing [goldmansachs.com].

Example core/satellite allocations:

- Balanced: Core 80% (global equity/bond), Satellites 20% (10% small-cap value, 5% EM equity, 5% REITs)

- Growth: Core 70%, Satellites 30% (10% EM equity, 10% small-cap value, 5% quality factor, 5% thematic)

- Conservative: Core 90%, Satellites 10% (5% dividend stocks, 5% short-duration bond/REIT mix)

Rebalancing and Monitoring Your Portfolio

Rebalancing is the process of restoring your target weights after markets move. It controls risk and methodically sells relative winners to buy laggards. Many investors rebalance annually or when an asset class drifts more than 5 percentage points from target, a simple rule discussed in balanced portfolio guidance [wealthag.com].

Helpful practices:

- Use your broker or app dashboards to track allocation drift, fees, and performance; portfolio tools can streamline reviews and reporting [thewealthmosaic.com].

- Reinvest dividends according to your target mix.

- Keep an eye on regional and sector concentration to avoid unintended bets.

Strategies for Starting Global Stock Investing from Your Country

If your local broker doesn’t offer broad international access, you can still invest globally in a few steps:

- Choose a compliant platform: Register with a regulated provider like ToVest that supports international access and fractional investing.

- Complete onboarding: Verify identity (KYC), pass compliance checks, and set up two-factor security.

- Fund your account: Use bank transfer or stablecoins such as USDT or USDC, then convert to your base trading currency as needed.

- Build your core: Buy a total world equity ETF and, if desired, a core bond fund; add satellites later.

- Automate and maintain: Set periodic contributions and enable allocation alerts or rebalancing reminders.

ToVest’s blockchain-powered model converts ownership interests in real assets into digital tokens, known as tokenization, enabling fractional, 24/7 trading with on-chain transparency and fast settlement. This democratizes access to global markets with small starting amounts and flexible payments. Learn more about our mission and safeguards on the ToVest about page [tovest.com/en-US/about].

Managing Risks in a Global Equity Portfolio

Key risks include market drawdowns, currency swings, and overexposure to single regions or sectors. Manage them with clear allocation limits, disciplined rebalancing, and, where appropriate, dynamic risk tools. Institutional strategies like Global Balanced Risk Control use volatility overlays to adjust exposure up or down to a target risk level—a concept individual investors can approximate with simple guardrails on equity weights [morganstanley.com].

Further safeguards:

- Hold an emergency cash buffer; avoid forced selling during drawdowns.

- Add inflation protection (e.g., TIPS) within the bond sleeve when appropriate.

- Run periodic stress tests and scenario analysis; document your rules in a brief investment policy statement.

- Review currency exposure and consider hedged bond funds if your base currency is volatile.

Frequently asked questions

What is the ideal equity to bond ratio for a balanced global portfolio?

There isn’t a single ideal mix; many investors use 60% stocks and 40% bonds for moderate risk, adjusting higher or lower based on time horizon and comfort with volatility.

Can a diversified global portfolio be built using only a few ETFs?

Yes—one global equity ETF plus one broad bond ETF can deliver extensive market coverage at very low cost.

How often should I rebalance my global equity portfolio?

Once a year is sufficient for most investors, or sooner if an asset class drifts more than a preset threshold (for example, 5 percentage points) from target.

What are the best ways to minimize fees when investing globally?

Choose low-expense index funds or ETFs, avoid unnecessary trading, and use platforms with transparent pricing to keep total costs down.

How can I start investing in global stocks from my country?

Open and fund an account with a platform like ToVest that supports fractional, tokenized access to U.S. stocks and real assets, then follow the onboarding steps to build your core and automate contributions.