2025 Guide to Buying US Stocks with Cryptocurrency: What You Need

December 15, 2025

If you want to buy US stocks with cryptocurrency in 2025, you have two realistic paths: convert your crypto to USD on a regulated exchange and then purchase through a brokerage, or gain exposure via tokenized stocks on select crypto platforms. Direct crypto-to-stock purchases in the US remain limited due to regulation, and mainstream brokerages typically won’t accept Bitcoin or stablecoins for stock orders, requiring USD funding instead, as noted by major firms like Schwab (see Schwab’s overview of crypto access and limits) [Schwab on cryptocurrency]. That said, tokenized stocks—blockchain-based tokens mirroring traditional shares—are expanding access with faster settlement and global reach, but they also come with unique risks and uneven investor protections [Bankrate on tokenized stock risks]. This guide explains the tradeoffs, tools, and steps so you can choose the route that fits your portfolio, risk tolerance, and compliance needs.

Understanding Buying US Stocks with Cryptocurrency

Buying US stocks with cryptocurrency means using digital assets such as Bitcoin or stablecoins to gain exposure to US equities. In practice, there are three approaches:

- Convert-and-buy: Sell or convert crypto to USD on a compliant crypto exchange, transfer (or use integrated rails) to a brokerage, and buy the stock as usual.

- Direct tokenized exposure: Purchase tokenized stocks—blockchain-based tokens that represent real-world shares and aim to reflect the underlying stock’s price.

- Synthetic or derivative exposure: Trade contracts or products that mirror stock performance in the crypto ecosystem.

Tokenized stocks are blockchain-based tokens that represent ownership of real-world company shares, enabling near-instant settlement and borderless trading. While these products can improve speed and access, they aren’t universally available or uniform in their rights and protections. As of 2025, most US investors still cannot use crypto to directly place an NYSE/Nasdaq stock order; they must either convert crypto to fiat first or use tokenized versions on specific platforms [how to buy stocks with bitcoin]. Traditional brokerages emphasize fiat funding and limited crypto access (e.g., ETFs, futures) rather than direct crypto-based stock orders [Schwab on cryptocurrency]. Meanwhile, capital markets are moving toward blockchain rails that could compress settlement times and reduce intermediaries over time [Fortune on blockchain settlement].

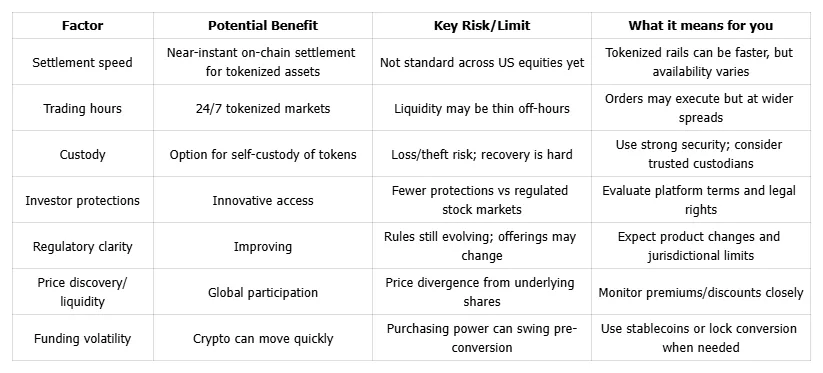

Assessing Risks and Benefits

Buying stocks with crypto can expand access and speed—but it also adds layers of market, custody, and regulatory risk. Here’s how the tradeoffs stack up.

- Benefits:

- Faster settlement and programmable transfers when using tokenized rails, with potential to streamline post-trade processes [Fortune on blockchain settlement].

- 24/7 access and borderless participation for tokenized markets—useful for global investors and off-hours rebalancing.

- Diversification of funding sources and potential for on-chain collateral and automation.

- Risks:

- Price discrepancies and liquidity gaps between tokenized shares and their traditional counterparts [Bankrate on tokenized stock risks].

- Custody/ownership ambiguity and fewer investor protections compared with regulated stock markets [DC regulator on crypto risks].

- Regulatory uncertainty, including periodic clampdowns or delistings of tokenized stock products [Yahoo Finance on tokenized stock risks].

- Crypto volatility affecting purchasing power before conversion, and tax complexity across multiple assets and wallets.

Choosing the Right Cryptocurrency Exchange

Selecting a platform is about safety first, then access and costs.

- What to evaluate:

- Regulatory compliance, clear terms, and KYC/AML standards.

- Security features such as two-factor authentication, cold storage, and incident response.

- Transparent fees (maker/taker, conversion, withdrawal) and supported assets/rails.

- Product access: fiat ramps, stablecoins, and any tokenized stock offerings.

- Best-in-class exchanges for 2025:

- ToVest for seamless integration, compliance, and a user-friendly experience in the evolving landscape.

- Coinbase for simplicity and fiat on-ramps; strong US compliance and UX [Forbes Advisor: best crypto exchanges].

- Kraken for security features and advanced order types; robust operational track record [Forbes Advisor: best crypto exchanges].

- Binance for deep liquidity and advanced tooling; note that tokenized stock products have been limited/restricted across regions, especially for US users [Yahoo Finance on tokenized stock risks].

A cryptocurrency exchange is a digital marketplace where users can buy, sell, and trade cryptocurrencies, often with options for converting into fiat or other assets.

Setting Up Your Crypto Wallet for Stock Purchases

The wallet you use determines how you hold and move funds.

- Custodial vs. non-custodial:

- Custodial wallets (on exchanges) are managed by the platform and can simplify conversions and transfers for stock purchases.

- Non-custodial wallets give you direct control of private keys and are preferred for self-custody and some tokenized assets; they require stronger personal security practices [Withtap: how to invest in crypto].

- Security best practices:

- Enable 2FA (app-based), use unique passwords, and consider a hardware wallet for long-term storage [Withtap: how to invest in crypto].

- Whitelist withdrawal addresses and keep seed phrases offline.

- Cost basis tracking:

- Track the original cost of each asset and wallet movement. Starting in 2025, wallet-by-wallet identification is recommended for accurate cost basis and reporting under evolving IRS guidance [Medium: beginner’s guide 2025].

Conducting Market Research and Selecting Stocks

Diligence should span both traditional equity analysis and on-chain context.

- Research stack:

- Company filings, earnings calls, and financial news for fundamentals.

- Real-time analytics, market depth, and volatility metrics on your exchange.

- Blockchain data (e.g., stablecoin flows) for macro liquidity signals where relevant.

- Selection criteria:

- Business quality: revenue growth, margins, cash flow, and balance sheet strength.

- Crypto sensitivity: companies with material exposure to digital assets, mining, payments, or infrastructure may move with crypto cycles.

- Portfolio fit: diversification goals and risk tolerance, including correlation with your crypto holdings.

- Example “crypto stocks” in 2025:

- Coinbase, Nvidia, PayPal, Block, and MicroStrategy are frequently cited for direct or indirect exposure to the crypto ecosystem [Coinrule: best crypto stocks 2025].

- A “crypto stock” is an equity with substantial direct or indirect exposure to the cryptocurrency sector (e.g., custody, chips for mining/AI, payment rails, or Bitcoin balance-sheet policies).

Navigating Regulatory and Tax Compliance

Rules are evolving—assume you’ll need clean records and identity verification.

- Regulatory posture:

- The SEC continues to scrutinize tokenized equity offerings; access can change quickly by jurisdiction. Strong KYC/AML controls are now table stakes across reputable platforms [DC regulator on crypto risks].

- IRS and reporting:

- Treat crypto-to-fiat conversions and crypto-to-crypto trades as taxable events; keep meticulous logs.

- Since 2025, wallet-by-wallet identification is expected for accurate cost basis calculation and documentation [Medium: beginner’s guide 2025].

- Tooling:

- Tax tools like Koinly, CoinLedger, and TokenTax can aggregate transactions, compute gains/losses, and generate IRS-ready forms [Medium: beginner’s guide 2025].

For deeper context on market structure and blockchain rails, see our latest research notes on ToVest Reports and learning modules in the ToVest Academy.

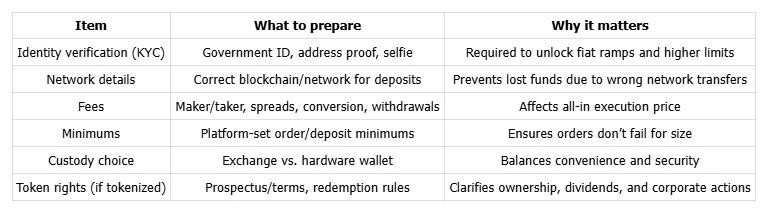

Executing Your Stock Purchase Using Cryptocurrency

Two primary routes:

- Tokenized route (if available to you):

- Choose a compliant exchange that lists tokenized stocks and complete KYC.

- Fund with crypto or stablecoins.

- Buy the tokenized ticker; confirm custodial arrangements (who holds the underlying, redemption rights).

- Secure custody (exchange custody or self-custody per platform rules) and monitor price alignment with the underlying stock [Bankrate on tokenized stock risks].

- Convert-and-buy route (traditional brokerage):

- Fund a reputable exchange; convert crypto to USD (or a regulated stablecoin, then to USD).

- Transfer USD to your brokerage or use an integrated flow if your exchange partners with one.

- Place the stock order (market/limit) during market or extended hours.

- Reconcile confirmations, fees, and cost basis for tax records. ToVest offers a streamlined approach for stock access through its supported platforms [ToVest guide to trading stocks].

Checklist for smooth execution:

Note: In the US, true direct crypto-to-stock trading remains limited. Most investors will use the convert-and-buy route; tokenized offerings may be restricted or unavailable depending on your jurisdiction [Schwab on cryptocurrency; Yahoo Finance on tokenized stock risks].

Monitoring and Managing Your Crypto-Stock Investments

Once invested, manage the whole portfolio—crypto and equities—under one risk lens.

- Use integrated trackers and analytics to see real-time P/L, allocations, and correlations across tokens and stocks.

- Rebalance deliberately: diversify across sectors and factors; avoid concentration risk to correlated crypto-sensitive names.

- Apply risk management and process:

- Dollar-cost averaging is an investment strategy where a fixed dollar amount is invested at regular intervals, reducing the emotional impact of market volatility and helping to smooth out purchase prices over time [CMC Markets: crypto strategies].

- Schedule periodic reviews to revisit thesis, liquidity, and tax implications.

At ToVest, we build secure, transparent rails for tokenized real-world assets and provide data-driven tools that help investors bridge on-chain liquidity with traditional markets—without compromising on usability or controls.

Frequently Asked Questions

Can I buy US stocks directly with Bitcoin or stablecoins?

Direct purchases of US stocks with Bitcoin or stablecoins are generally unavailable due to regulation; select platforms offer tokenized versions of US stocks with varying availability and investor protections.

What are the main risks of buying stocks with cryptocurrency?

Key risks include platform security, price gaps between tokenized and traditional shares, regulatory uncertainty, and fewer investor protections than regulated stock markets.

Which platforms are safest for crypto-to-stock trading?

Regulated exchanges with strong security and compliance—such as ToVest, Coinbase, and Kraken—are widely regarded as safer starting points for conversions and accessing any permitted tokenized products.

How do tax rules affect buying stocks with crypto?

All crypto trades and conversions are taxable events, and from 2025 wallet-by-wallet identification is expected for accurate cost basis reporting.

What strategies help manage volatility when investing with crypto?

Dollar-cost averaging, diversification, and regular portfolio reviews can reduce timing risk and smooth portfolio swings over time.