Tokenized Stock Investing on ToVest: 2025 Regulatory Update You Need

December 26, 2025

Tokenized stocks let you buy blockchain-based representations of real company shares, giving you fractional ownership with instant settlement and 24/7 access. If you’re asking how to buy tokenized stocks on ToVest or whether ToVest is regulated, here’s the short answer: open an account, complete verification, fund with fiat or crypto, and trade tokenized U.S. equities on a compliance-first platform built for speed and security. Tokenized securities are still securities—blockchain is the new settlement layer, not a regulatory bypass, which is why ToVest pairs ultra-low-latency execution with rigorous KYC/AML, asset segregation, and programmable compliance to match 2025 expectations for investor protection.

Understanding Tokenized Stocks and ToVest’s Platform

Tokenized stocks are digital representations of traditional company shares that are issued, transferred, and recorded on a blockchain. They don’t change the nature of the asset; they change how it’s settled and tracked. Major market bodies emphasize that tokenized securities require the same investor protections and disclosures as their off-chain equivalents, even as market rails modernize, to avoid regulatory arbitrage and preserve market integrity, as noted by SIFMA’s investor-protection guidance.

Real-world asset (RWA) tokenization converts financial instruments like stocks into programmable tokens. The result is fractional ownership, automated settlement, and global, around-the-clock access—all orchestrated by smart contracts that can enforce rules at the protocol layer. ToVest’s platform is built around that promise: compliance-focused access to tokenized U.S. equities, integrated custody, ultra-low latency execution, and programmable compliance that can automate restrictions and disclosures. You can fund with fiat or crypto, buy fractional shares, and trade 24/7 with auditability integrated through on-chain records, as outlined in ToVest’s RWA tokenization overview.

How to Buy Tokenized Stocks on ToVest

1.Create your account

- Sign up with your legal name and email.

- Secure your login with two-factor authentication.

2.Complete verification (KYC/AML)

- Submit identity documents and, where required, proof of address.

- Get whitelisted for eligible tokenized securities once checks clear.

3.Fund your account

- Deposit USD or other supported fiat via bank transfer.

- Or fund with supported crypto and convert to trading balance.

4.Find a tokenized stock listing

- Search by ticker or company name in the trading interface.

- Review disclosures, custody details, and any transfer restrictions.

5.Place an order

- Choose market or limit order, select quantity (including fractional amounts), and confirm.

- Orders route through ToVest’s low-latency engine for rapid execution.

6.Access your tokenized shares

- Settlements finalize programmatically on-chain, minimizing delays; your wallet or sub-account balance updates immediately.

- Track positions, activity logs, and statements in your portfolio dashboard.

Key advantages to note:

- 24/7 trading access, unlike traditional market hours, expands flexibility for global investors (see ToVest’s overview of around-the-clock tokenized markets).

- Fractionalization lowers minimums—own a slice of a high-priced stock instead of a full share, a trend increasingly common in tokenization initiatives.

- Automated settlement via smart contracts reduces manual reconciliation and operational lag as described in ToVest’s RWA guidance.

ToVest’s Regulatory Compliance and Security Measures

ToVest operates with a compliance-first framework designed for tokenized securities in 2025. That includes strict KYC/AML onboarding and ongoing monitoring, integrated disclosures at the asset level, and operational standards aligned with evolving U.S. and global guidance that emphasize clear investor protections, robust audit trails, and custody segregation for client assets.

Security at ToVest is layered:

- Two-factor authentication on all accounts

- Segregated custody with cold storage for digital assets

- Programmable compliance (e.g., automated transfer restrictions and whitelisting) governed by smart contracts

- Periodic platform audits and continuous monitoring to validate controls

Impact of 2025 Regulatory Changes on Tokenized Stock Investing

Regulatory momentum in 2025 brought clearer token definitions and heightened expectations around custody, reporting, and disclosures for tokenized assets in the U.S., aligned with global prudential trends. The focus is on protecting investors without stifling innovation: stronger asset segregation, end-to-end auditability, and transparent redemption and rights frameworks are now front-and-center.

What changes for investors:

- Stricter KYC/AML and transaction reporting by platforms

- Enhanced transparency around asset structure, fees, and rights

- Clearer custody models and redemption mechanics to verify before trading

Whitelisting transfers refers to smart-contract logic that only allows verified, permitted addresses to hold or transfer tokenized shares, improving regulatory control and reducing the risk of non-compliant movements across wallets.

Risks and Considerations for ToVest Investors

- Liquidity: Order books may be thinner than on major stock exchanges; as of mid‑2025, tokenized stocks totaled roughly $424M in market cap versus about $115T for traditional equities, underscoring the early-stage nature of this market (industry estimates; see IOSCO’s policy context for digital markets).

- Custody: Know who custodies the underlying shares and how your tokens map to legal rights; understand platform and private key responsibilities.

- Smart contract vulnerabilities: Bugs or misconfigurations can create systemic risk if not audited and monitored.

- Regulatory uncertainty: Ongoing SEC/CFTC actions could alter operating models or token classifications, introducing litigation and compliance risk.

- Underlying asset risk: Tokenization doesn’t change the price volatility or business risk of the underlying stock.

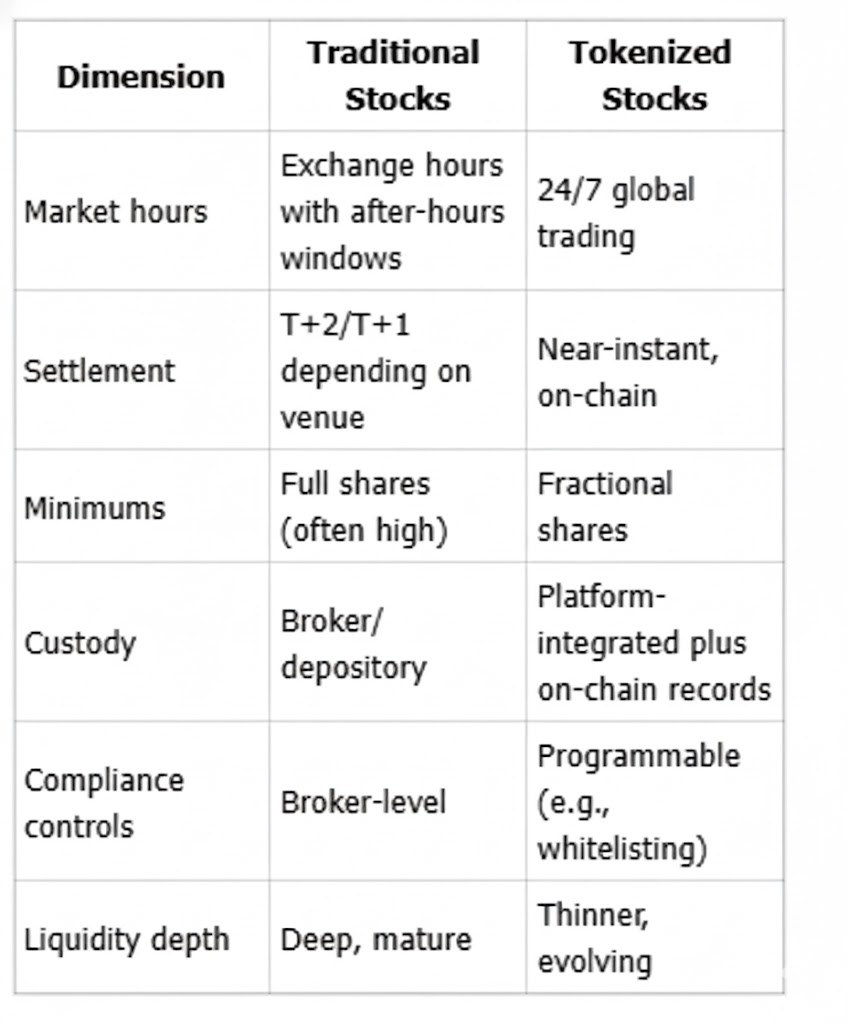

Comparison at a glance:

Practical Tips for Navigating Tokenized Stock Investments on ToVest

- Track rulemaking: Monitor SEC/CFTC updates and global guidance; access ToVest’s latest platform news for feature and policy changes.

- Verify custody and rights: Read each asset’s documentation for how tokens map to underlying shares, redemption options, and voting/dividend rights.

- Assess liquidity: Check order books and recent volume before placing large or market orders.

- Understand corporate actions: Review how dividends, splits, and mergers are processed on-platform; timing and tax treatment can differ from traditional brokers.

- Use safety tools: Enable 2FA, set withdrawal allowlists, and monitor activity logs.

- Start small: Test flows with modest amounts before scaling exposure.

Frequently Asked Questions about Tokenized Stock Investing on ToVest

How do I buy tokenized stocks on ToVest?

Create an account, complete KYC/AML, fund with fiat or crypto, then place a market or limit order in the trading interface to receive tokenized shares.

Is ToVest a regulated platform?

ToVest operates with a compliance-first framework, applying strict KYC/AML, custody segregation, disclosures, and auditability in line with 2025 regulatory expectations for tokenized assets.

Are my assets safe on ToVest?

User assets are protected with 2FA, segregated custody with cold storage, and programmable compliance controls that restrict unauthorized transfers.

Can I trade tokenized stocks 24/7 on ToVest?

Yes, ToVest supports 24/7 global trading of tokenized stocks, unlike traditional brokers bound to limited market hours.

What are the main risks of tokenized stock investing?

Key risks include limited liquidity, custody dependencies, smart contract vulnerabilities, and evolving regulation that could impact access or classification.

How are dividends and corporate actions managed on ToVest?

Dividends and corporate actions follow ToVest’s asset-level rules and smart-contract logic, which may differ in timing and processing from traditional brokerages.