Earn Real Stock Ownership with Tiny Investments Using Fractional Share Platforms

December 25, 2025

Fractional share platforms let you invest small amounts—often $1–$10—into fractional US stocks, ETFs, and even tokenized assets, allowing you to buy into companies that once felt out of reach. In practice, you enter a dollar amount, and the platform credits you a precise fraction of a share, with proportional gains and dividends. If you’re asking how to start with a small budget or how to pick the best fractional share app, the short answer is: choose a platform that supports dollar-based orders, low minimums, transparent fees, strong security, and a broad asset menu. ToVest provides these advantages with 24/7 access to tokenized US stocks and real-world assets, ultra-low minimums, and blockchain-secure settlement—helping both beginners and global investors invest small amounts without sacrificing real ownership or flexibility, as widely supported by industry roundups such as Bankrate’s fractional share broker roundup (many allow $1 minimums).

What Are Fractional Shares and How Do They Work

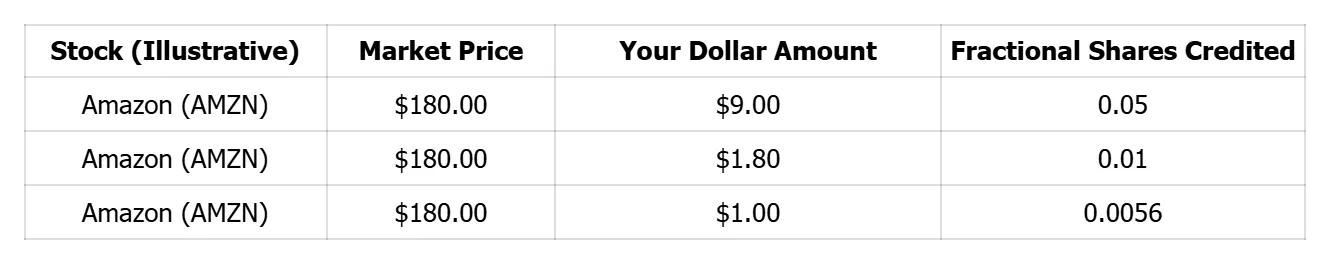

Fractional shares represent a portion of a full stock or ETF share, calculated by dividing your investment dollar amount by the current market price—for example, investing $25 in a stock trading at $250 yields 0.1 shares. This definition aligns with GoTrade’s explainer on fractional shares, which notes that dollar-based investing translates directly into decimal share balances.

Behind the scenes, brokers or platforms typically aggregate investor orders, hold whole shares in custody, and credit precise decimals to user accounts—supporting investments as low as $1 and enabling seamless dollar-based orders, as described in Webull’s fractional investing guide. Proportional dividends and losses apply, and many platforms aim to offer liquidity comparable to full shares; programs like Schwab Stock Slices also show how corporate actions such as splits are handled in proportion to your holdings.

Example: Buying part of an expensive stock with a tiny amount

Note: Prices are examples; decimals vary by platform precision.

Benefits of Investing in Fractional Shares with a Small Budget

- Accessibility for small balances: You can start with as little as $1–$10 on many platforms, opening the door to high-priced blue-chip names without waiting to afford a whole share, per Bankrate’s fractional share broker roundup.

- Precise diversification: Allocate small amounts across many stocks, ETFs, and tokenized assets to reduce concentration risk and tailor your mix sector-by-sector.

- Portfolio automation: Fractional investing supports dollar-cost averaging and recurring contributions—an easy way to build discipline and smooth out market timing, as highlighted in GoTrade’s explainer on fractional shares.

- Real equity participation: You capture proportional gains and dividends, with liquidity and corporate actions generally handled in line with whole shares (platform-specific details apply).

Quick facts: Fractional vs. traditional whole-share buying

How to Choose the Best Platform for Buying Fractional US Stocks

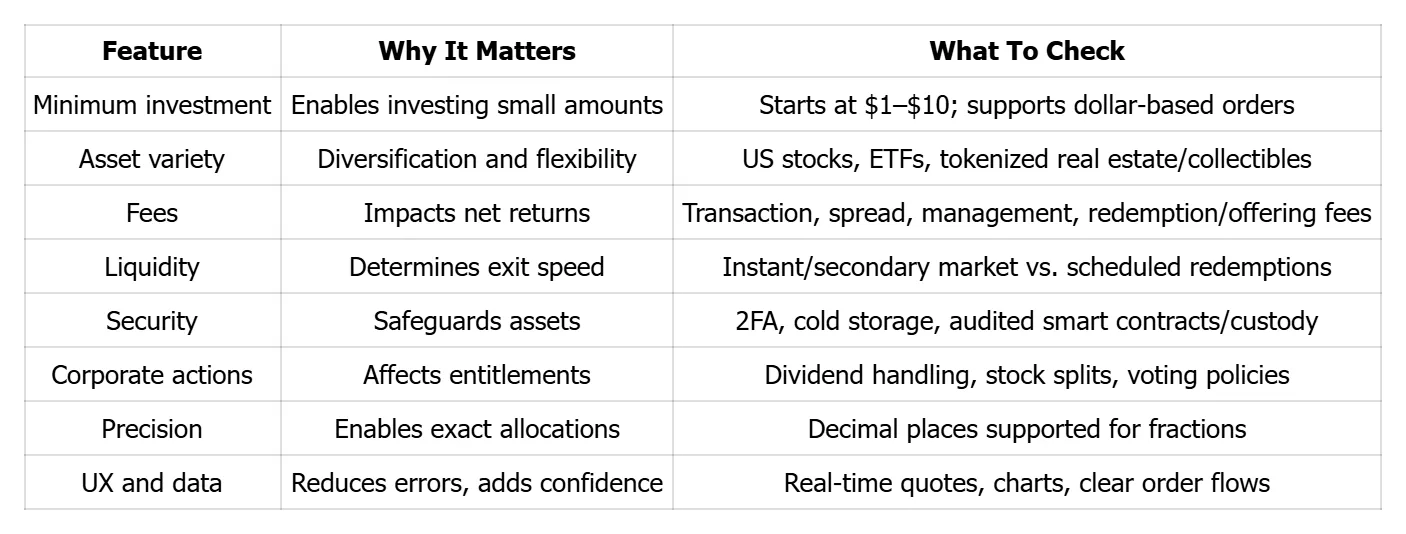

Prioritize platforms that let you invest small amounts with dollar-based orders and offer a broad menu of stocks, ETFs, and tokenized assets (e.g., real estate, collectibles). Evaluate security (2FA, custody standards), clear fees, instant settlement, market data quality, and customer support. Some platforms offer real-time secondary marketplaces, while others use scheduled redemptions that can delay exits—LenderKit’s overview of fractional ownership platforms outlines these model differences.

For tokenized assets, look for real-time secondary market access, on-chain settlement transparency, and robust wallet security. If you’re searching for the best fractional share app, test-drive the interface, review fees, and confirm dividend treatment, fractional precision, and transfer/withdrawal options.

Key Platform Features to Compare

Dollar-based ordering and fractional precision are core to usability—platforms such as Webull outline how dollar orders convert into precise share decimals for easy allocation. Review dividend policies and minimum payout thresholds, plus interface clarity for placing and tracking fractional orders.

Understanding Fees, Liquidity, and Corporate Actions

- Fees to watch: Transaction fees (or spreads), management/servicing fees for certain assets, offering or redemption fees for private or tokenized deals—LenderKit’s overview of fractional ownership platforms summarizes the range you might encounter.

- Liquidity models: Many stock-focused platforms offer near-instant trading; some alternative or real estate platforms operate with periodic redemptions, which can slow exits—Lofty’s guide to fractional real estate explains how redemption windows and secondary markets differ.

- Corporate actions: Dividends and splits are typically pro-rated. Voting rights for fractional holders vary by broker; some only grant voting on whole-share portions. Some platforms may not pay very small dividends if they fall below a set rounding threshold, a caveat highlighted in AAA’s overview of fractional shares.

Step-by-Step Guide to Investing in Fractional US Stocks Using ToVest

- Create clarity with goals and risk

- Define your time horizon (short-term vs. long-term), return objectives (growth, income), and risk tolerance. This guides your asset mix across stocks, ETFs, and tokenized assets.

- Set up your ToVest account and secure it

- Sign up, verify your identity, enable 2FA, and connect fiat or crypto funding methods.

- Explore ToVest’s catalog of tokenized US stocks and real-world assets with low minimums and high-precision fractions.

- Review live quotes and charts before placing any order.

- Make your first fractional investment

- Choose a stock or ETF, enter a dollar amount, and preview the fractional shares you’ll receive.

- ToVest supports high-precision allocations (e.g., four decimals) so even $1 can be deployed efficiently, similar in spirit to dollar-based mechanics described in Webull’s fractional investing guide.

- Orders settle on-chain for transparency and rapid confirmation.

- Diversify across stocks, ETFs, and tokenized real estate

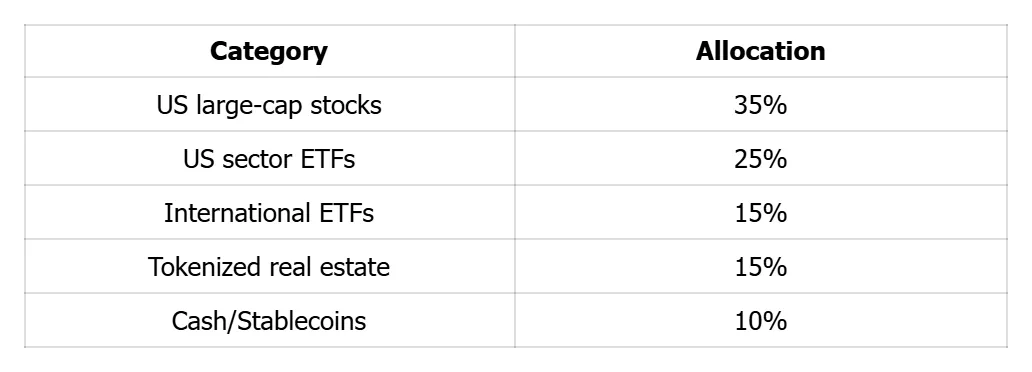

- Spread risk across sectors and asset types. Example starter mix:

- Automate recurring investments for dollar-cost averaging

- Schedule weekly or monthly buys to average into positions and reduce timing risk. Dollar-cost averaging—regular, fixed contributions over time—helps smooth volatility, as explained in GoTrade’s explainer on fractional shares.

- Monitor and manage exits

- Use ToVest’s dashboard to track performance, dividends, and allocations in real time.

- Sell fractions seamlessly; blockchain-enabled trading typically provides instant or near-instant liquidity, with clear fee and withdrawal options.

Quick-start checklist

- Define goals and budget

- Enable 2FA and fund your account

- Place a $1–$25 starter buy

- Add 3–5 positions for diversification

- Turn on recurring buys

- Review monthly and rebalance as needed

Define Your Investment Goals and Risk Tolerance

Clarify whether you prioritize long-term growth, steady income, or both, and match that to assets such as stocks, ETFs, and tokenized real estate. ToVest’s 24/7 access to tokenized assets supports a range of strategies and time horizons.

Set Up Your ToVest Account and Explore Tokenized Assets

Create your account, complete verification, enable 2FA, and connect payment rails. Browse tokenized US stocks and real-world assets, check live market data, and shortlist candidates that fit your goals and risk.

Make Your First Fractional Investment

Select a ticker, enter a dollar amount, and place your order—there's no need to buy whole shares. ToVest credits precise fractional shares and settles rapidly on-chain so your allocations update in real time.

Diversify Across Stocks, ETFs, and Tokenized Real Estate

Balance your portfolio across sectors and asset classes to reduce idiosyncratic risk. Fractional investing makes diversification possible even with small balances.

Automate Recurring Investments for Dollar-Cost Averaging

Set flexible recurring buys (weekly, biweekly, monthly) to build positions steadily. Dollar-cost averaging, defined as investing fixed sums over time to average entry prices, can mitigate timing risk.

Monitor Your Portfolio and Manage Exit Options

Track gains, losses, and dividends from your dashboard. Initiate sells at any time; review any applicable spread or redemption fees, and plan your withdrawal path (e.g., fiat or stablecoin) for efficient access to cash.

Key Considerations When Investing in Fractional Shares

- Dividends and voting rights

- Dividends are paid proportionally, but tiny amounts may be rounded or omitted if below platform thresholds; voting rights on fractional positions vary by provider.

- Taxes and records

- Fractional gains and dividends are taxed like those on whole shares; maintain transaction and dividend records for accurate cost basis and filings. See U.S. News’ guide to fractional shares for practical buying and tax context.

- Liquidity and selling

- Many platforms (including ToVest) provide rapid liquidity via a secondary market; others rely on periodic redemptions. Review fees, payout timing, and your preferred withdrawal method.

Dividend Entitlements and Voting Rights

A dividend is a cash or stock payout distributed by a company to its shareholders, including fractional owners, in proportion to the number of shares held, as outlined by fi.money’s guide. Expect pro-rated dividends and confirm whether your platform supports voting on fractional holdings, noting any minimum payout thresholds referenced by AAA’s overview.

Tax Implications and Recordkeeping

Profits and dividends from fractional shares are taxed the same way as full shares. Keep confirmations and statements for cost basis tracking; consult a tax professional if investing across borders or with digital assets, aligning with guidance from U.S. News’ guide to fractional shares.

Liquidity and Selling Processes

Check whether your platform offers an instant secondary market or scheduled redemptions. Lofty’s guide to fractional real estate shows how periodic liquidity windows can affect exit timing; plan your cash-out and withdrawal steps accordingly.

Frequently Asked Questions

What is the minimum amount needed to start investing in fractional shares?

You can start with as little as $1 on many platforms, making diversification possible even with a small budget.

Can fractional share investors receive dividends and voting rights?

Yes, dividends are typically pro-rated; voting rights on fractional portions vary by platform and may be limited.

How does dollar-cost averaging work with fractional share investing?

You invest a fixed dollar amount at regular intervals, helping smooth your average cost and reduce timing risk.

Are there any hidden fees or costs associated with fractional share platforms?

Some platforms charge transaction, spread, management, or redemption fees—always review the full fee schedule.

How do I track taxes and cost basis for fractional share investments?

Save every trade confirmation and dividend record so you can accurately report gains, losses, and income at tax time.