Broker vs. Real Estate Tokenization: Which Gives Better Fractional U.S. Stock Access?

December 31, 2025

Small investors have more ways than ever to buy slivers of valuable assets. But when the goal is fractional U.S. stock access, the route matters. Traditional brokers offer direct, regulated access to partial shares of U.S. equities, typically with $1–$5 minimums and the potential for dividends and voting rights. Real estate tokenization platforms, by contrast, are designed to fractionalize property rights on-chain—not public company equity—though some offer synthetic, “stock-like” products that do not confer shareholder rights. Tokenization is growing fast—the tokenized real estate market was valued at an estimated $2.7 billion in 2022 and is forecast to reach $18.2 billion by 2032, reflecting rising institutional interest—but its sweet spot is property and other real-world assets, not stocks. For true fractional U.S. stock ownership today, regulated brokers remain the superior choice, while tokenization expands access to real estate and alternative assets with 24/7, on-chain infrastructure.

Understanding Fractional Ownership of U.S. Stocks

Fractional ownership in stocks allows you to buy less than one whole share of a public company. This lets you invest small amounts into high-priced equities, diversify faster, and maintain balanced portfolios when rebalancing does not neatly match whole shares. Crucially, fractional stock ownership is distinct from fractional real estate ownership: public stocks represent legal equity in a company, while tokenized real-world assets represent digitized rights in property or instruments—rights that may differ from common stockholder privileges.

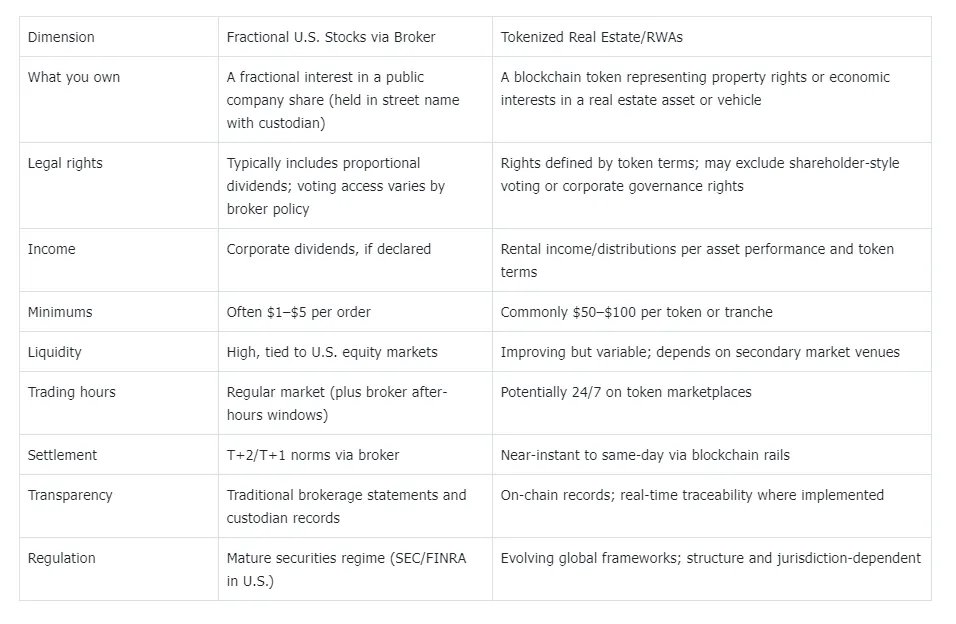

Comparison at a glance:

How Traditional Brokers Provide Fractional U.S. Stock Access

Modern brokers simplify fractional share investing: open a digital brokerage account, fund it, and place a dollar-based order on supported U.S. stocks or ETFs. Leading fractional share platforms routinely support minimums as low as $1, making well-known names accessible on mobile and web with no-commission trading models common today. Roundups from sources like NerdWallet document brokers with strong fractional programs, low minimums, and beginner-friendly tools, helping investors compare choices by costs, usability, and asset coverage.

The benefits are straightforward: direct exposure to the underlying equity, potential eligibility for dividends and corporate actions, deep market liquidity, and robust investor protections under established securities laws. Brokerages custody assets and are members of the Securities Investor Protection Corporation, which offers limited protection for client securities if a brokerage fails (see SIPC’s overview of protections). Providers such as Charles Schwab even brand fractional purchases (e.g., Stock Slices with a $5 minimum) to make the process easy for first-time investors.

Real Estate Tokenization Platforms and Fractional Stock Exposure

Real estate tokenization converts property rights into transferable digital tokens on a blockchain, enabling smaller investment tickets and efficient distribution. Platforms commonly advertise low buy-ins—often $50–$100 per tokenized asset—opening real estate exposure to a broader global audience.

Despite the tech’s promise, tokenization platforms generally do not provide actual fractional ownership of U.S. public company shares. Where “stock-like” exposure exists, it is often synthetic or derivative in nature—tracking a stock’s price without conferring shareholder dividends, proxy voting, or the full legal bundle of rights tied to real equity. In short: brokers = direct U.S. stock access; tokenization = real estate and RWAs, with occasional synthetic stock trackers that do not equate to owning stock.

Key Comparison Criteria for Fractional U.S. Stock Access

For investors deciding between brokers and tokenization, evaluate these core dimensions: ownership and legal rights, liquidity and trading hours, costs and minimums, transparency and automation, and regulatory and counterparty risk.

At-a-glance comparison:

Ownership and Legal Rights

Brokered fractional shares represent direct economic exposure to the underlying stock, usually with proportional dividends and, depending on broker policy, access to corporate actions or voting. In tokenized models, a security token represents ownership in a legal asset, but the embedded rights are defined by the token’s documentation and may exclude shareholder-style privileges; some offerings provide only economic or synthetic exposure. It is important to read the legal terms and offering documents to understand exactly what rights you’re acquiring.

Liquidity and Trading Hours

U.S. brokers provide real-time execution and deep order books during regular and extended market sessions. Tokenized marketplaces can enable 24/7 trading and near-instant settlement, a significant advantage for globally distributed investors, but liquidity depth and spreads vary, and secondary market activity can be sporadic.

Costs and Investment Minimums

Many leading brokers support dollar-based orders with minimums as low as $1, lowering barriers for small, frequent contributions. Tokenized platforms often feature low entry points—commonly $50–$100—alongside leaner operating costs through smart contract automation. Smart contract automation uses code to handle distribution, cap table updates, and reporting, which can help reduce administrative overhead; some industry commentary suggests platform and administration fees around 1–2% depending on structure.

Transparency and Automation

Brokerages rely on regulated custody, established audits, and standard reporting. Tokenization stands out for on-chain transparency: an immutable blockchain ledger is a decentralized record that cannot be altered, providing tamper-resistant proof of transactions and near real-time traceability. Smart contracts can automate cash flows and compliance workflows at scale, benefits highlighted in industry analyses of tokenized real estate’s operational impact.

Regulatory and Counterparty Risks

Brokerage accounts operate within mature securities regimes with defined investor protections and recourse (e.g., SIPC membership). Tokenized assets face evolving regulation across jurisdictions, dependency on smart contract quality, and platform solvency considerations. As industry guides note, cross-border compliance and technology risks are integral parts of the risk assessment for tokenized offerings.

Advantages and Limitations of Brokers for Fractional Stocks

Pros:

- Direct ownership of U.S. equities with proportional dividends and potential voting access

- High liquidity, tight spreads, mature market infrastructure

- Strong investor protections via regulated custody and SIPC-member brokerages

- Simple mobile experiences for dollar-based investing

Cons:

- Limited to public securities; not programmable or on-chain

- Trading largely bound to market and after-hours windows

- Fractional availability and voting policies vary by broker

Advantages and Limitations of Real Estate Tokenization for Stock Exposure

Advantages:

- Global, 24/7 market access with near-instant settlement

- Ultra-low minimums and fractional access to historically illiquid assets

- On-chain transparency with programmable distributions and reporting

- Expanding universe of RWAs, including institutional-grade real estate

Limitations:

- Not a path to true U.S. stock ownership; “stock-like” products are often synthetic

- Regulatory uncertainty, cross-border compliance complexity

- Platform solvency and smart contract risk; liquidity depth still developing

- Rights vary by token and may exclude dividends/voting tied to public equities

Practical Recommendations for Small Investors Seeking Fractional U.S. Stock Access

- If your primary goal is fractional U.S. stock ownership, use a regulated broker. You’ll gain direct equity exposure, mature protections, and reliable liquidity.

- Use tokenized platforms to diversify into real estate and other real-world assets, not as a substitute for owning public company shares.

- If exploring tokenization, conduct thorough due diligence: review offering documents, token rights, fee schedules, secondary market access, and regulatory status.

- Simple decision flow:

- Need fractional U.S. stocks with dividends/voting rights? Choose a fractional-share broker.

- Interested in 24/7, programmable exposure to real estate/RWAs? Consider reputable tokenization platforms with transparent, audited structures.

Note: ToVest’s architecture integrates tokenized U.S. stocks and institutional-grade real estate on a compliant, 24/7 trading stack designed for instant settlement and global access—bridging the benefits of brokerage-grade transparency with on-chain automation for RWAs.

Frequently Asked Questions

What are fractional shares and how do they work?

Fractional shares are portions of a single stock, enabling small investments and diversification without purchasing whole shares.

Can fractional stock investors receive dividends and voting rights?

Yes—dividends are typically paid proportionally; voting access depends on each broker’s policy.

Are fractional stock investments safer through brokers or tokenization?

Generally, brokers offer more safety due to established regulations, custodial safeguards, and investor protections.

How do trading hours differ between brokers and tokenization platforms?

Brokers follow market hours (plus limited after-hours), while many tokenized venues operate 24/7.

What should investors consider about regulatory risks in tokenized assets?

Rules are evolving, and token holders may face additional compliance, smart contract, and platform counterparty risks.