Tokenized Stock Platform Showdown: Comparing Fees, Liquidity, and Global Reach

December 25, 2025

Investors searching for the best tokenized stock platform with global access are comparing three primary factors: total cost to trade, liquidity and execution quality, and how well a provider manages compliance and custody across borders. Tokenized stocks are blockchain-based representations of real shares held in custody, enabling users to trade equities 24/7, buy fractional amounts, and settle instantly. Early markets remain small—projected to reach hundreds of millions of dollars by mid-2025—but analysts identify credible paths to larger adoption if a small portion of global equities is tokenized by 2030. This guide explains the core mechanics, highlights platform-level fee and liquidity differences, and outlines the compliance, custody, and risk factors that matter before funding an account.

Overview of Tokenized Stock Platforms

Tokenized stocks are digital tokens backed one-to-one by underlying shares held with a qualified custodian. They enable investors to access equities on blockchain rails with continuous trading, fractional ownership, and programmable settlement, often beyond traditional market hours. Industry primers emphasize that the core value lies in 24/7 availability, smaller trade sizes (for example, buying $10 of a high-priced stock), and portability across on-chain ecosystems that can connect to lending, collateral, or automated strategies see Chainlink’s education hub on tokenized equities and Webull’s practical overview of tokenized stocks and providers.

Though still in early stages, the tokenized equity market has reached hundreds of millions of dollars by mid-2025, with projections suggesting much higher ceilings if even 1% of global stocks migrate on-chain this decade, given the compounding effects of 24/7 access, fractionalization, and interoperability across DeFi and exchange venues Tiger Research’s market map and outlook. Platforms like ToVest reduce barriers for global users by combining fractionalization with real-time analytics and low-latency execution, while contextual examples across the landscape include Backed Finance, Dinari, and Injective.

Comparing Fee Structures and Pricing Models

Costs vary widely by venue and are influenced by both crypto-native and brokerage-style models. Expect four major fee categories:

- Commission fees: Per-trade or percentage-based charges on buys and sells.

- On-chain (gas) fees: Network fees paid to miners/validators; often lower on high-throughput chains and Layer 2 networks.

- Custody and compliance costs: Fees covering regulated custody, corporate actions, and ongoing compliance operations.

- Subscriptions or premium tiers: Monthly or annual plans that bundle features like premium data, routing, or reduced commissions.

Tokenization can compress legacy costs because programmable settlement and smart contracts streamline back-office processes and enable near-instant clearing, ultimately benefiting retail investors through lower overall frictions overview from Chainlink. Enterprise comparisons similarly note that platform design—such as chain choice, custody model, and compliance tooling—drives end-customer pricing Rapid Innovation’s platform comparison.

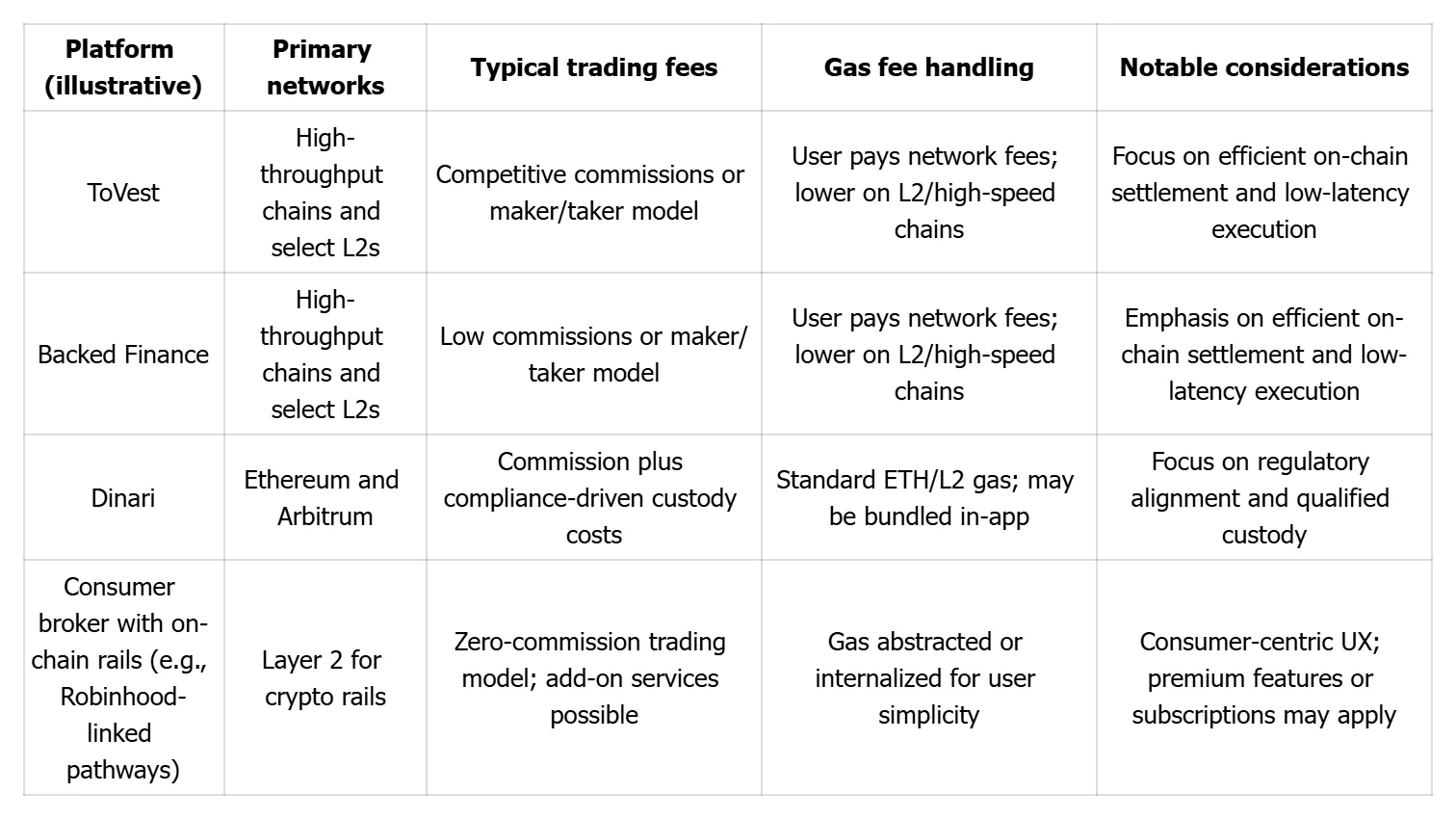

Illustrative fee model comparison (verify current pricing on provider sites):

For frequent or high-notional traders, even small differences in commissions or gas handling can compound quickly. Some providers bundle network fees, while others expose gas directly; advanced features (e.g., smart order routing, analytics) may sit behind subscription plans or higher tiers enterprise-level comparisons.

Evaluating Liquidity and Market Depth

Liquidity refers to how easily you can buy or sell a tokenized stock without affecting the price. Market depth indicates the amount of resting liquidity available across price levels in the order book. Deep, continuous liquidity reduces slippage, improves fill quality, and supports larger trades.

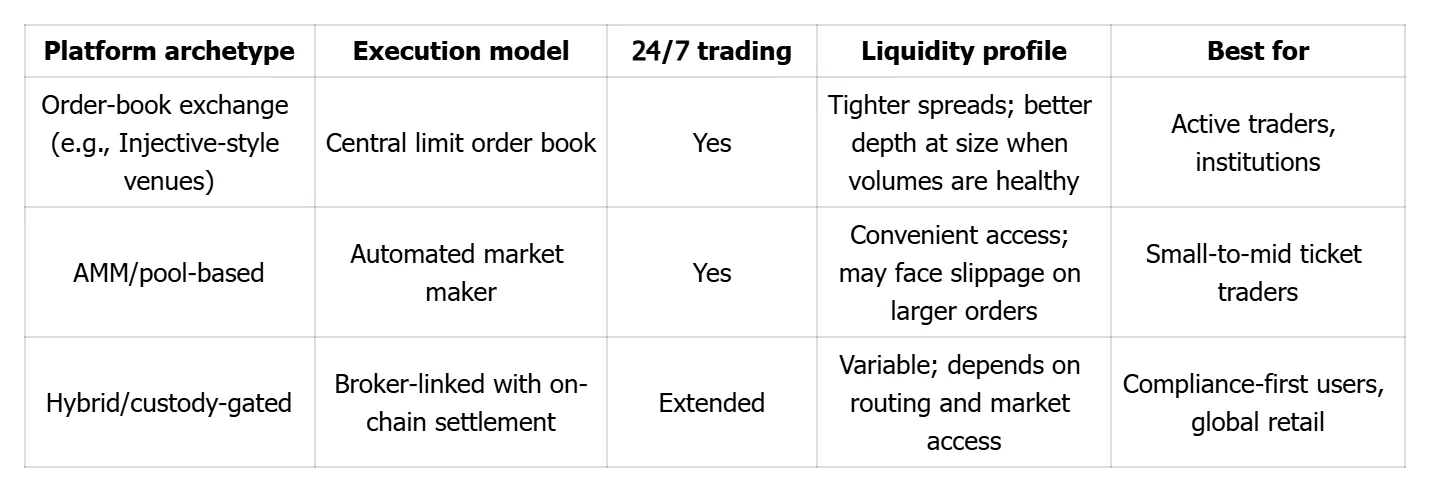

Execution models and chain selection matter. High-performance order-book venues can support sophisticated strategies and tight spreads, while automated market makers (AMMs) or thin pools may deliver wider spreads and more slippage for larger orders. Research indicates that some platforms emphasize full order books and low-latency settlement to serve active traders, while others focus on simpler pool-based models that may trade ease of access for potential depth constraints Tiger Research’s market map. General guidance on tokenization infrastructure also emphasizes how custody, compliance gating, and routing impact real-world liquidity aggregation XBTO’s explainer on technology, custody, and compliance.

Indicative liquidity features:

Some tokens still trade with modest volumes, which can lead to execution gaps during off-peak hours. For larger orders, consider slicing, liquidity aggregation, or venues that support institutional-grade routing.

Global Reach, Compliance, and Custodial Coverage

A core promise of tokenized stocks is borderless market access—24/7 trading, smaller minimums, and cross-border participation in U.S. and EU equities subject to local regulations and platform-level controls Chainlink’s education hub. The legitimacy of a token largely hinges on custodial backing: genuine tokenized stocks are supported by real shares held with qualified custodians, and programmable compliance enforces KYC/AML, investor eligibility, and regional restrictions where required XBTO’s compliance and custody overview.

Provider examples:

- Dinari: Emphasizes U.S.-aligned compliance, issuance on Ethereum/Arbitrum, and qualified custody partnerships, reflecting the model many institutions expect for asset-backed tokens Tiger Research landscape.

- EU and global expansion models: Some venues connect to EU-regulated partners operating under frameworks like MiFID II, extend listings to dozens of equities, and restrict access dynamically based on residency and eligibility rules general compliance context.

Interoperability standards are poised to lower cross-border frictions over time, enabling compliant transfers across chains and venues while preserving identity and eligibility checks.

Key Tradeoffs and Risks for Investors

Advantages

- Fractional ownership reduces capital requirements, allowing small, diversified allocations to high-priced names Webull primer.

- Continuous 24/7 access and near-instant settlement enhance flexibility and can reduce counterparty and operational frictions Chainlink overview.

- On-chain composability enables the use of tokenized stocks as collateral or in yield strategies, subject to platform rules and risk controls Tiger Research market map.

Risks

- Liquidity can be uneven, resulting in wider spreads and slippage on less-traded tokens, particularly during off-peak hours Webull primer.

- Security exposure spans smart contracts, bridges, wallets, and operational processes; not all venues apply the same rigor to audits and controls XBTO’s tokenization stack overview.

- Regulatory uncertainty persists; rules vary by country and can change quickly, impacting availability or affecting redemption rights Tiger Research landscape.

Bottom line: tokenized stocks combine powerful accessibility benefits with liquidity, security, and policy risks that must be weighed before committing significant capital.

Selecting the Right Platform for Your Needs

A practical decision framework:

- Prioritize what matters most—cost, liquidity, compliance, or global access.

- Map needs to features—frequent traders may prefer low-commission and L2 rails; institutions need deep order books and clear compliance; global users want broad regional support and frictionless KYC/AML.

- Verify custody and settlement—look for qualified custodians, transparent backing, and clear redemption mechanics.

If you want data-rich analytics, fractionalized access to U.S. stocks and real estate, and low-latency execution with compliance-first infrastructure, consider ToVest’s globally accessible approach to tokenized assets learn about ToVest.

Quick comparison checklist:

- Fees: Are commissions, gas, and custody costs transparent?

- Liquidity: Is there consistent depth and smart routing support?

- Global reach: Does it support your jurisdiction with clear KYC/AML?

- Security: Are contracts audited and assets held by qualified custodians?

- Support and disclosures: Are listings, redemption terms, and risks clearly documented?

Frequently asked questions

What factors affect the fees on tokenized stock platforms?

Fees are driven by network (gas) costs, platform commissions, custody/compliance charges, and optional subscriptions for advanced tools or data.

How does liquidity impact trading performance on these platforms?

Higher liquidity and deeper order books reduce slippage, allowing entry or exit from positions at more stable, predictable prices.

What should global investors consider regarding regulatory compliance?

Confirm the platform’s regulatory status, custody arrangements, and whether it enforces KYC/AML and regional access rules relevant to your residency.

What are the main risks associated with tokenized stock trading?

Key risks include thin liquidity in some tokens, smart contract or operational security vulnerabilities, and evolving regulations that may change access or redemption rights.

How can investors evaluate platform security and custody arrangements?

Look for qualified custodians, transparent asset-backing and redemption terms, and independent smart contract audits disclosed by the provider.