Real Estate Tokenization Services Compared: Best Crypto Access to US Stocks

December 19, 2025

Overview of Real Estate Tokenization and Crypto Stock Access

Real estate tokenization converts property ownership into digital tokens recorded on a blockchain, enabling fractional ownership, faster settlements, and programmable income rights. In practical terms, it means investors can buy and trade small slices of buildings or portfolios with lower minimums and near-real-time settlement compared to traditional processes that may take weeks, not hours, to close, as outlined in a leading development guide to tokenization platforms. As the market matures, analysts expect rapid expansion and deeper institutional participation; industry forecasts point to accelerating adoption across private markets as infrastructure, compliance, and liquidity venues improve, according to Deloitte’s tokenized real estate outlook.

Crypto doesn’t just unlock property. Tokenized stocks bring price exposure to US equities on-chain, creating 24/7 markets accessible with stablecoins. Offerings vary by jurisdiction and structure (synthetic vs. backed), but the direction is clear: investors increasingly want the ability to buy fractional US stocks with crypto alongside fractional ownership real estate on a single, modern stack. Gemini’s tokenized stocks overview illustrates how this bridge to US equities is emerging.

ToVest Real Estate Tokenization Platform

ToVest’s platform is designed for speed, security, and breadth. We aggregate tokenized real-world assets—residential and commercial real estate, funds, and tokenized equities—into a low-latency trading environment that delivers deep market data, transparent order books, and actionable analytics. Institutional-grade security controls, continuous monitoring, and rigorous KYC/AML keep the experience safe while preserving the convenience of digital payments and stablecoin funding.

For investors, fractional ownership reduces minimums and expands diversification options; for issuers, our infrastructure simplifies onboarding, distribution, and secondary liquidity. Whether your priority is daily rental income, exposure to commercial properties, or access to tokenized US stocks, ToVest is designed to provide a unified, compliant gateway.

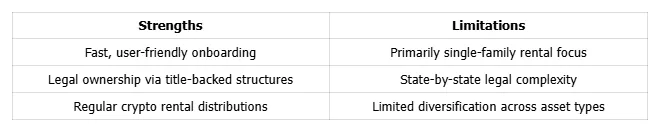

RealT Platform Features and Limitations

RealT focuses on US rental homes where tokens represent equity interests in LLCs backed by title deeds, with regular crypto-based rental distributions and straightforward onboarding. This makes it attractive for investors seeking direct exposure to single-family rentals while operational management is handled on-platform, as highlighted in an industry roundup of tokenization companies.

However, the strategy can be concentrated. RealT primarily lists single-family rentals and may face legal complexity as offerings scale across states with varying securities and property laws. For investors seeking broader asset classes (commercial, funds, or stocks), the menu may feel narrow.

Pros and cons at a glance:

Lofty’s Approach to Fractional Ownership and Rental Income

Lofty leans into accessibility and transparency. Operating on the Algorand blockchain, Lofty enables investments from as little as $50 and distributes daily rental income. As of September 2023, the platform reported 148 tokenized properties across 11 states, roughly 7,000 active users, and around $2 million in rental payouts, according to Lofty’s guide to real estate tokenization.

Fractional ownership here means multiple investors collectively own shares in a property and receive income in proportion to their stake. Lofty’s DAO LLC structure also provides token holders voting rights on key property management decisions, supported by clear financial disclosures—an attractive package for hands-on retail investors who value governance features with low entry thresholds.

Harbor’s Compliance and Institutional Focus

Harbor was designed as a compliance-first stack for private real estate and other private market assets, facilitating issuance, investor onboarding, and secondary trading with a strong regulatory spine. In practice, it emphasizes:

- End-to-end KYC/AML and accreditation checks

- Document workflow and cap table management

- Controlled secondary liquidity mechanisms

- Transparent audit trails for regulators and issuers

This positioning makes Harbor suitable for institutions and sponsors prioritizing legal clarity and operational controls, as profiled in a review of top tokenization platforms.

RedSwan’s Commercial Real Estate Tokenization

RedSwan specializes in commercial real estate, targeting larger deals with digital onboarding and smart contract automation. By connecting listings to marketplaces and decentralized venues, it aims to open historically gated commercial assets to a broader investor base with more flexible liquidity options. Industry trackers have noted that RedSwan has facilitated tokenization for multibillion-dollar real estate pipelines, underscoring its capacity to handle scale, as referenced in a comparative platforms analysis. Deloitte’s tokenization outlook further explains how decentralized exchanges can unlock accessibility and secondary liquidity for traditionally illiquid assets.

DigiShares’ Customizable Tokenization Solutions

DigiShares provides a modular, white-label platform that lets issuers tailor experiences—from investor records and onboarding to secondary market integrations and compliance workflows. A modular platform allows issuers to configure processes and branding for different asset types without rebuilding the core infrastructure. For sponsors prioritizing customizable real estate tokenization across mixed portfolios, DigiShares stands out for its flexibility and issuer control, as noted in sector overviews of leading providers.

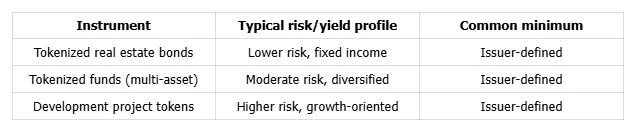

Brickblock's Diverse Financial Instruments and Offerings

Brickblock caters to investors and issuers seeking more than direct equity slices, offering tokenized real estate bonds, funds, and development projects that vary by yield, risk, and duration. This versatility supports diversified strategies but can require more diligence to understand structures and covenants, according to comparative research on top tokenization platforms.

Illustrative view of Brickblock’s product spectrum:

Key Comparison Criteria for Tokenization Platforms

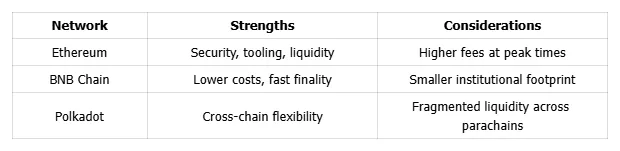

Blockchain Technology and Costs

Blockchain selection determines speed, security, ecosystem depth, and tokenized asset transaction costs.

- Ethereum: Deep liquidity and security but can incur higher gas fees during congestion.

- BNB Chain (Binance Smart Chain): Lower fees and faster confirmations, with a growing ecosystem.

- Polkadot: Interoperability focus with cross-chain compatibility and modular design.

Trade-offs for investors:

A recognized development guide underscores how network choices impact fees, UX, and interoperability across issuers and exchanges.

Liquidity and Market Accessibility

Liquidity is the ability to buy or sell fractional shares quickly at fair prices. Tokenization transforms a historically illiquid market by enabling settlement in hours instead of weeks, per leading implementation guides. Democratized access also allows investors to start with smaller tickets because tokenization lowers minimums and permits fractional ownership for smaller capital amounts.

Regulatory Compliance and Security

Compliance is non-negotiable. Robust platforms enforce KYC/AML, investor accreditation checks, and link on-chain tokens to off-chain legal registries to preserve enforceable ownership rights. Blockchain’s immutability further strengthens records against tampering and reduces fraud risk, as explained by 4IRE’s analysis of blockchain in real estate. Seek STO frameworks, audited smart contracts, role-based controls, and two-factor authentication.

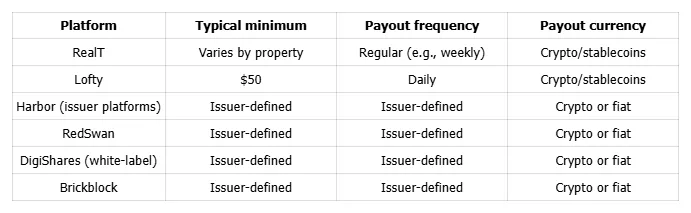

Investment Minimums and Income Distribution

Minimums and payout mechanics vary widely by platform and issuer. Some platforms use smart contracts to automate rental income distributions in crypto at defined intervals, a pattern documented in academic work on automated income flows.

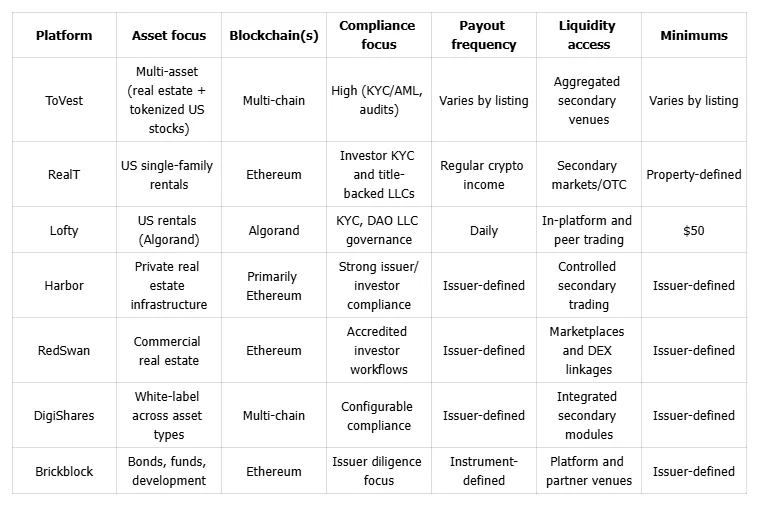

Evaluating Tokenization Platforms: Side-by-Side Review

Quick takes:

- RealT: Best for simple, yield-focused exposure to US rentals; narrower asset scope.

- Lofty: Strong for low minimums, daily income, and token-holder governance.

- Harbor: Suited to institutional workflows and compliant private placements.

- RedSwan: Commercial scale with routes to broader liquidity.

- DigiShares: Flexible rails for issuers building branded experiences.

- Brickblock: Diversified instruments beyond direct equity slices.

- ToVest: Unified access to property tokens and tokenized US stocks with real-time analytics.

Recommendations for Investors Seeking Fractional US Stock Access via Crypto

- Start with your objective: direct rental income, commercial exposure, diversified funds, or equity-like exposure to US stocks.

- Verify regulatory footing: KYC/AML, audited contracts, and enforceable legal wrappers are essential; avoid platforms that skip these steps.

- Check minimums and payout cadence: daily vs. monthly distributions, and whether returns are in crypto or fiat.

- Confirm secondary liquidity: look for platforms with active order books, marketplace integrations, or DEX access.

- For US stock exposure with crypto, validate whether the platform offers tokenized equities (and how they’re structured and custodied); many real estate tokenization platforms do not list equities.

- If you want both property and tokenized US stocks in one place, ToVest’s multi-asset architecture and real-time market analytics provide a secure and efficient route to build and rebalance positions.

Frequently Asked Questions

What is real estate tokenization and how does it work?

Real estate tokenization transforms property ownership into blockchain-based tokens, allowing investors to buy, trade, and receive income from fractional shares with transparent records.

What are the advantages of investing through tokenized real estate platforms?

Key benefits include fractional access, lower entry costs, faster settlement, automated distributions, and immutable ownership records.

How do tokenized stocks differ from real estate tokens?

Tokenized stocks mirror the price or rights of company shares, while real estate tokens represent interests in physical properties; they follow different regulations and return drivers.

What should investors consider regarding regulatory compliance?

Ensure platforms enforce KYC/AML, investor accreditation (where applicable), audited contracts, and legal registries linking tokens to real assets.

How can liquidity be managed in real estate tokenization?

Choose platforms with active secondary trading or DEX integrations to enter and exit positions more efficiently than traditional real estate markets.