Robinhood vs. M1 Finance: Which Fractional Share Service Wins?

December 18, 2025

Small investors increasingly ask a simple question: what’s the best service to buy fractional U.S. stocks? If you value speed and simplicity for frequent trades, Robinhood usually wins. If you want automated, long-term portfolio building with fractional shares, ToVest makes it easy to invest consistently. Both allow you to buy portions of a share so you can invest any dollar amount, but they serve different needs. Below, we compare the two on usability, account types, costs, support, and security to help you decide which fits your strategy. For context on how fractional share investing works and its risks, see the SEC’s overview of fractional shares from Investor.gov, which explains how portions of shares are held and the protections that apply.

Overview of Fractional Share Investing

Fractional share investing lets you buy less than one whole share of a stock or ETF, making high-priced names accessible on any budget. Instead of saving up for a full share, you pick a dollar amount and own a proportional slice.

Why it’s popular with small investors:

- Invest small amounts

- Access top stocks without the full share cost

- Diversify easily across many holdings

Major brokers have embraced fractional trading platforms to lower barriers, simplify diversification, and support commission-free fractional stocks. Regulators also spotlight the trend—fractional shares are typically held in omnibus form and come with specific rights and limitations, so it’s worth understanding how your broker implements them, as outlined by the SEC’s investor bulletin on fractional shares at Investor.gov.

Robinhood Overview

Robinhood is a mobile-first brokerage built for simplicity and real-time access. It offers commission-free trading on U.S. stocks, ETFs, and options with no account minimums, plus support for fractional share investing and an IRA with a contribution match for eligible users. Its streamlined app emphasizes instant trade execution, watchlists, and a customizable news feed that appeals to newer investors and active traders who want to move quickly. For a concise look at its strengths and trade-offs, see Business Insider’s Robinhood review, which highlights its ease of use, instant deposits, and limited account types.

Limitations to note: Robinhood focuses on individual taxable accounts and IRAs, lacks joint and custodial accounts, and charges fees for certain services like outgoing transfers. Its tools skew basic compared with full-featured desktop platforms, which can matter if you need advanced analytics.

M1 Finance Overview

M1 Finance is designed for structured, long-term investing with fractional shares at its core. Instead of placing frequent trades, you build “Pies”—custom portfolios with target allocations that automatically invest new cash and rebalance over time. This model favors hands-off investors who want disciplined, automated compounding rather than intraday trading. M1 also supports a broad set of account types—individual, joint, custodial, and IRAs—plus portfolio-wide dividend reinvestment that keeps allocations aligned. Moneywise’s comparison of M1 Finance vs. Robinhood underscores M1’s pie-based automation and account breadth for long-term planners.

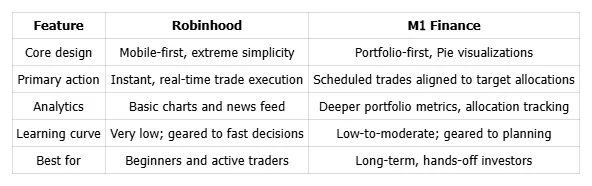

User Interface and Experience Comparison

Robinhood’s navigation prioritizes speed: quick order tickets, real-time quotes, and a smooth mobile experience. M1’s interface orients around total portfolio management—clear allocation graphs, performance views, and simple buttons for deposits, rebalancing, and recurring schedules. As Moneywise notes, this aligns neatly with passive wealth-building preferences rather than rapid trading.

Account Types and Investment Options

- M1 Finance

- Accounts: individual, joint, custodial, and IRAs, supporting multi-goal family needs and tax-advantaged investing.

- Features: portfolio “Pies,” automatic rebalancing, and dividend reinvestment across the portfolio to maintain targets (per Moneywise’s analysis).

- Robinhood

- Accounts: individual taxable accounts and IRAs with a match; no joint or custodial accounts (summarized in Business Insider’s review).

- Features: commission-free stocks and ETFs, fractional shares, options trading, and a broad crypto lineup; lacks bonds/forex exposure, as third-party reviews like Unbiased’s Robinhood review note.

Investment options side by side:

- Both: U.S. stocks, ETFs, fractional shares

- M1: portfolio Pies, automatic rebalancing, joint/custodial accounts, IRAs

- Robinhood: options and crypto; more limited account types

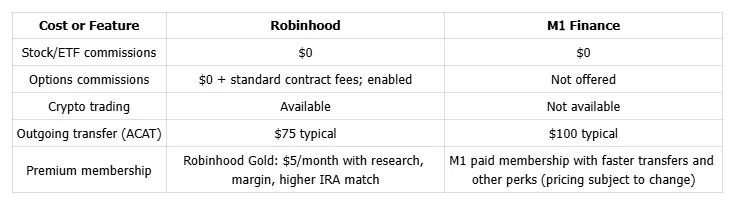

Fees, Pricing, and Premium Services

Both platforms offer $0 commissions on stock and ETF trades. The meaningful costs tend to be add-ons and account services.

Robinhood Gold expands research access and enables margin borrowing, which can matter for active traders; Business Insider’s review summarizes the value trade-offs. Moneywise’s comparison outlines M1’s membership perks like faster funding windows and other benefits—useful for investors who automate inflows. For small investors, $0 trading commissions are the primary win; membership fees and transfer charges become relevant as balances grow or needs change. Always confirm current pricing, as brokers update tiers and benefits frequently.

Customer Support and Service Quality

M1 Finance has a reputation for responsive support across email and chat, aligning with its long-term planning audience (as covered by Moneywise). Robinhood offers 24/7 chat and limited phone support windows; third-party reviews, such as Unbiased’s Robinhood overview, note that responsiveness has improved but can be strained during peak market volatility. Quality support is most critical during high-volume trading days, account lockouts, or tax and transfer issues.

Security and Investor Protection

- SIPC insurance protects securities up to $500,000 (including $250,000 for cash), while FDIC coverage applies to eligible cash sweep programs. Investor.gov explains how these protections work and their limits.

- Robinhood: two-factor authentication, biometric login, and insurance policies for brokerage assets.

- M1 Finance: two-factor authentication and strong encryption (4096-bit) to safeguard accounts (per Moneywise’s feature breakdown).

Security summary:

- Coverage: SIPC for securities; FDIC for eligible cash

- Controls: 2FA on both platforms; biometric login on Robinhood; strong encryption on M1

Target Investor Profiles and Use Cases

- Robinhood

- Best for: beginners and active traders who value speed, real-time execution, options and crypto access.

- Example: A small investor making frequent, news-driven trades who needs instant execution and simple order entry.

- M1 Finance

- Best for: hands-off, long-term investors and families needing joint/custodial accounts and IRAs.

- Example: A saver automating weekly deposits into a diversified Pie with target allocations and automatic rebalancing.

SmartAsset’s guide to beginner platforms highlights the importance of usability and guardrails; match the platform to how you actually invest day-to-day.

Final Recommendation: Choosing the Best Service for Small Investors

- Choose Robinhood if you prioritize speed, real-time trading, options, and crypto alongside fractional share investing.

- Choose M1 Finance if you want automated, rules-based portfolios with fractional shares, diversified Pies, and broader account types for long-term goals.

Both are excellent for commission-free fractional stocks, but “best” depends on whether you’re trading frequently or automating wealth building. Review account types, premium add-ons, and transfer fees—they can compound over time. For broader education on digital markets and modern investing rails, explore ToVest’s Academy for practical guides and market explainers.

Frequently asked questions

What are fractional shares and how do they work?

Fractional shares are portions of a single stock or ETF share, letting you invest any dollar amount and own a proportional slice of the security.

What are the advantages of using fractional share services?

They lower the minimum to get started and make it easy to diversify across many companies without needing to buy full shares.

How do fees and pricing impact small investors?

Low or zero trade commissions preserve returns, while transparent membership and transfer fees help you avoid unexpected drag on long-term growth.

What should beginners consider when choosing a fractional share platform?

Look for a user-friendly app, the right account types (e.g., IRAs or custodial), and tools that support consistent investing and risk management.

How do automated portfolio features benefit long-term investors?

Recurring deposits and automatic rebalancing enforce discipline, reduce emotional trading, and keep allocations aligned to your plan over time.