How to Build a Diversified Global Stock Portfolio in 2026

January 5, 2026

Building a diversified global stock portfolio in 2026 is simpler than it seems: define your goals, choose a low-cost global core, add targeted satellites, and manage currency, cost, and tax frictions. If you’re starting global stock investing from your country, you can access international markets through brokers, broad global ETFs, or tokenized shares that offer fractional access. ToVest provides open, secure, fractional exposure to tokenized U.S. equities and real assets with real-time trading and advanced risk controls—ideal for investors seeking international portfolio diversification with fewer barriers. The steps below show exactly how to construct, implement, and maintain a diversified global stock portfolio 2026-ready.

Define Your Investment Goals and Risk Tolerance

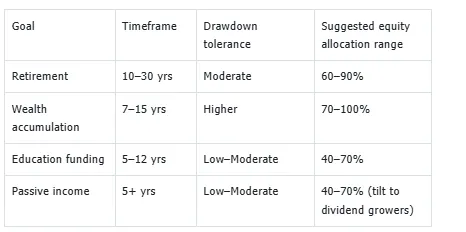

Start by quantifying what you’re investing for, your timeframe, and your drawdown tolerance—the maximum loss you can accept without abandoning your plan. Risk tolerance is the degree of variability in returns you’re willing to withstand, and it should align with your objectives. Common goals include retirement, wealth accumulation, education funding, or passive income. Clear parameters matter: asset allocation is the primary driver of long-term portfolio returns, according to Vanguard’s asset allocation research.

A simple goal-setting table can guide your equity mix:

Tip: If you’re uncertain, start conservatively and increase equity exposure as your comfort and savings capacity grow.

Understand the Benefits of Global Diversification

Global diversification means spreading investments across countries and regions to reduce dependence on any single market or sector. Vanguard finds that diversifying across countries can reduce portfolio volatility and country-specific risk. Benefits include:

- Access to sectors or companies underrepresented in your home market, as FINRA’s international investing guidance notes.

- Lower exposure to single-country downturns and policy shocks.

- Participation in growth across both developed and emerging markets.

Many investors exhibit “home bias,” overweighting domestic stocks relative to global market weights, which can limit opportunity and increase concentrated risk.

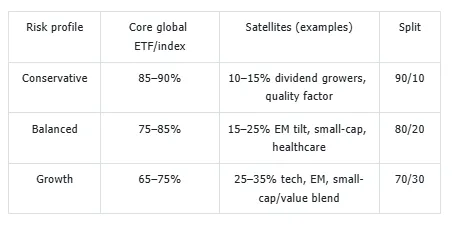

Choose a Core-Satellite Portfolio Structure

A core-satellite strategy combines a low-cost, broadly diversified core with smaller “satellite” positions that target specific opportunities. The core is typically a total-market ETF or index fund covering both U.S. and international stocks. Satellites can emphasize regions (e.g., emerging markets), factors (small-cap, quality), or themes (e.g., technology). BlackRock highlights this design for cost efficiency, control, and flexibility.

Cap satellites at roughly 10–25% of your equity portfolio to keep risk in check.

Sample core-satellite allocations:

Allocate by Geography and Market Capitalization

Use global market-cap weights as a baseline, then adjust to your goals. A total-world fund such as Vanguard Total World Stock ETF reflects the global mix of developed and emerging markets, with the U.S. as the largest share.

Market capitalization is the total value of a company’s shares. Large-cap companies are typically more stable; small- and mid-caps can offer higher growth with higher volatility . Emerging markets offer higher growth potential but generally higher volatility, as MSCI emphasizes.

Diversify across:

- Regions: U.S., Europe, Asia-Pacific, and emerging markets.

- Market caps: large-, mid-, and small-cap.

- Avoid overconcentration in any single country or sector.

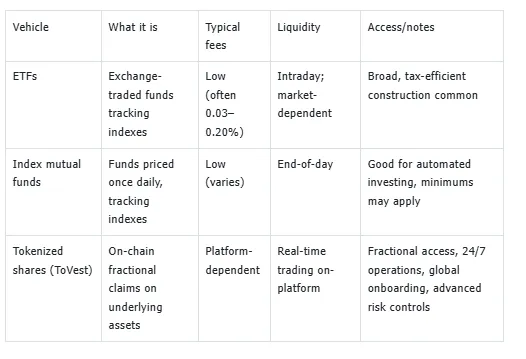

Select Cost-Efficient and Liquid Investment Vehicles

Choosing the right instruments affects both returns and execution.

- ETF (Exchange-Traded Fund): A pooled fund trading intraday on exchanges, generally offering diversified exposure and liquidity, per the SEC’s ETF investor bulletin.

- Expense ratio: The annual fund fee that reduces investor returns; lower is generally better, as outlined in Vanguard’s fees and expenses guide.

Evidence from SPIVA shows that low-cost index funds tend to outperform many active managers over long horizons. Prefer highly liquid vehicles with tight bid-ask spreads to minimize trading costs, as the SEC notes in its ETF overview.

Comparison of vehicles:

ToVest’s tokenized stock investing simplifies global access with fractional sizing, real-time execution, and analytics for risk and allocation monitoring (see the ToVest platform).

Manage Currency and Macro Risks in Your Portfolio

Currency risk is the impact of exchange-rate moves on foreign investment returns. The CFA Institute shows that international diversification improves risk-adjusted outcomes over time, but currencies can amplify or dampen returns in the short run.

- Hedged vs. unhedged: Currency-hedged ETFs deliver equity exposure without exchange-rate swings, while unhedged funds leave currency open—choose based on your base currency, horizon, and views.

- Rebalance exposures: Periodic rebalancing prevents creeping concentration in a single currency or region.

- Macro playbook: Use a rules-first framework for geopolitical events, rate cycles, or commodity shocks—FINRA’s international investing guidance outlines key considerations for global risks.

Apply Effective Risk Management and Rebalancing Strategies

Rebalancing is the process of resetting your portfolio to target weights after markets move. Vanguard research shows that systematic rebalancing helps restore risk targets and reduces unintended concentrations.

Common methods:

- Calendar-based: Rebalance annually or semiannually.

- Threshold-based: Rebalance when an allocation drifts by, say, 5 percentage points.

Add guardrails such as position limits (e.g., no single satellite >10%) and stress tests (e.g., simulate a 30% EM drawdown) to keep risk aligned with your plan.

Optimize for Tax Efficiency and Implementation

A tax-advantaged account is one that offers tax benefits on contributions, gains, or withdrawals, such as IRAs under U.S. rules. Practical tactics include:

- Place high-turnover or income-heavy assets in tax-advantaged accounts when possible.

- Favor tax-efficient ETFs with low turnover to reduce taxable distributions.

- Use tax-loss harvesting—selling investments at a loss to offset gains—to improve after-tax returns.

Always review fund domicile and the prospectus for withholding taxes, reporting, and distribution policies; the SEC’s mutual fund guide outlines what to look for.

Monitor, Review, and Adjust Your Portfolio Regularly

Set an annual review to check performance, costs, and whether your allocations still match your goals—and to reflect changes in global market structure.

Use a quick checklist:

- Performance vs. suitable benchmarks (e.g., global total market).

- Total costs and any tracking error for index funds.

- Regional, sector, and currency exposures vs. targets.

- Tax placement, distributions, and realized gains/losses.

- Rebalance and update satellites based on your rules.

Sample annual calendar:

- January: Rebalance, harvest losses as applicable from prior year.

- April/May: Cost and tracking error review; adjust positions if needed.

- September: Risk review—stress tests, scenario analysis, currency exposure.

- December: Tactical adjustments and tax planning for year-end.

Frequently Asked Questions

Why should I diversify beyond U.S. stocks and which regions offer the best opportunities?

Diversifying globally reduces reliance on one market and taps growth across Europe, Asia-Pacific, and emerging markets, which can house sectors and innovators underrepresented in the U.S.

How can I balance growth and defensive investments in a global portfolio?

Blend growth exposures (e.g., tech, small-cap) with defensives like dividend growers or listed infrastructure to pursue upside while cushioning drawdowns.

What is the ideal asset allocation for maximum diversification and risk control?

Use a global market-cap core complemented by satellites across regions and factors; align the mix with your risk tolerance and rebalance regularly.

What are the key risks to watch in global investing and how can I mitigate them?

Watch for currency swings, geopolitical events, and country-specific downturns; mitigate with broad diversification, hedging where appropriate, and disciplined rebalancing.

Should I use ETFs, active funds, or other investment vehicles for global exposure?

Many investors prefer low-cost ETFs for core exposure and selective active or thematic satellites; tokenized stock investing through ToVest adds fractional access and efficient implementation.