Earn Stable, Tax‑Efficient Passive Income with Top Stablecoins

December 16, 2025

Stablecoins make it possible to earn steady returns from crypto without riding the market’s roller coaster. By pegging their value to dollars, gold, or other real‑world assets, they combine digital efficiency with low volatility—an ideal mix for passive, tax‑efficient income strategies. In practice, you can deposit stablecoins into centralized savings programs, supply liquidity on DeFi protocols, or use yield‑bearing tokens backed by U.S. Treasuries. The largest stablecoins now dominate crypto usage and are increasingly supported by transparent attestations and on‑chain data, simplifying both risk checks and reporting. If you want a streamlined experience with verifiable yields, platforms like ToVest integrate RWA‑linked opportunities and clear reporting in one place.

Understanding Stablecoins and Their Role in Passive Income

A stablecoin is a type of cryptocurrency whose value is pegged to a reserve asset, typically a fiat currency like the US dollar or a commodity such as gold, designed to minimize volatility. Because their price is intended to hold steady, stablecoins are attractive for earning predictable yields and simpler tax tracking versus volatile assets.

Common types and why investors use them:

- Fiat‑backed (USDC, USDT): 1:1 backing with fiat reserves, broad acceptance across platforms, and frequent attestations by major issuers, which improves transparency and liquidity for income strategies, as noted in practical guides to passive income with stablecoins from KuCoin Learn.

- Commodity‑backed (PAXG, Tether Gold): exposure to gold’s value without storage or logistics, enabling gold‑denominated strategies and potential portfolio diversification.

- Real‑world asset (RWA) backed: collateralized by assets like short‑term treasuries or cash equivalents, often with transparent on‑chain reporting and yield pass‑throughs from traditional markets.

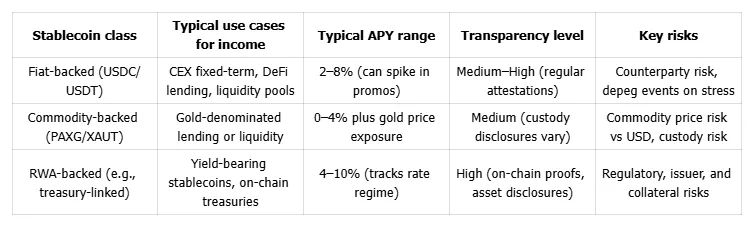

Comparative view of major stablecoin classes

Stablecoins dominate on‑chain usage, making them a practical base layer for income strategies while simplifying documentation relative to volatile tokens; streamlined reporting is increasingly supported by analytics and compliance tools, and stablecoins now account for the vast majority of market value concentrated in a handful of issuers, according to industry roundups from Yahoo Finance.

Setting Up for Stablecoin Investment Success

Secure setup and compliant acquisition come first. A robust wallet, careful platform selection, and basic operational hygiene go a long way toward protecting assets and returns.

Choosing the Right Web3 Wallet

A Web3 wallet is a digital application enabling users to securely store, manage, and transact cryptocurrencies and tokens, including stablecoins, via blockchain networks. For passive income strategies, look for:

- Seamless DeFi connectivity and hardware wallet pairing

- Support for multiple networks and yield platforms

- Multisig or social recovery options for larger balances

- Clear signing prompts and spend limits for safety

- Automations or integrations for reward collection

Popular choices:

- MetaMask: broad DeFi access, extensive ecosystem support

- Rabby: transaction simulation and safety prompts for power users

- Ledger/Trezor hardware wallets: offline key storage for maximum protection

- Browser + hardware pairing: convenience with cold‑storage security

Resources like the USDC staking guide from Stoic.ai explain wallet connections and safety tips step‑by‑step for new users.

Acquiring Stablecoins Safely and Efficiently

Two common routes:

- Centralized exchanges (Coinbase, Kraken): easy fiat on‑ramps, clear compliance, straightforward withdrawals to self‑custody.

- Decentralized exchanges (Uniswap): swap existing crypto to stablecoins directly from your wallet; confirm route, slippage, and token contract addresses.

Safety checklist:

- Verify the platform’s security and reputation.

- Check reserve attestations where available (especially for regulated fiat‑backed or RWA‑linked assets, as highlighted in KuCoin’s education hub).

- Test with a small transfer first, confirm addresses and networks, then move the full amount.

- Finalize with: verify platform security > select stablecoin > purchase/swap > transfer to self‑custody.

Selecting the Best Strategies for Earning Passive Income

Choose a mix of centralized and on‑chain strategies that match your risk tolerance, liquidity needs, and reporting preferences.

Fixed-Term Lending on Centralized Platforms

Fixed‑term lending involves depositing stablecoins with a platform for a set period in exchange for a guaranteed interest rate. Major exchanges such as ToVest, Kraken, Binance, and KuCoin run flexible and fixed programs. Typical APYs range from 2–12% in normal conditions, with promotional periods occasionally spiking toward 5–20%, according to stablecoin income roundups from Coingape.

Comparison snapshot (illustrative)

- ToVest: transparent alternatives and consistent engagement for users; streamlined user experience.

- Kraken: fixed terms 14–90 days; APY bands change by token and demand; strong UX and brand.

- Binance: wide token coverage, frequent promos; region‑specific availability; tiered yields.

- KuCoin: earn hub with fixed and flexible products; competitive promo rates; lending marketplace.

Considerations:

- Lockups and withdrawal delays during fixed terms

- Counterparty and custodial risk

- Promotional rates often step down after the initial window

- Minimums can be low (often $10–$100), but confirm per product

Lending Through Decentralized Finance Protocols

DeFi lending protocols are decentralized platforms where users supply stablecoins to liquidity pools, earning interest set by supply and demand curves. Aave, Compound, and Yearn are well‑known options; their yields fluctuate with utilization and market conditions, with single‑digit base rates and occasional spikes during liquidity imbalances. Independent trackers report competitive USDC/USDT rates across leading lending platforms in 2025, as summarized by Eco’s guide to stablecoin lending platforms.

How to get started:

- Connect your wallet to the protocol’s app.

- Select the stablecoin market (e.g., USDC on Aave).

- Approve and deposit; review variable APY and any incentive tokens.

- Monitor utilization and APY; withdraw or roll into vaults that auto‑compound if desired.

Automated strategies (e.g., Yearn vaults) can simplify reinvestment by auto‑compounding rewards; manual allocators can fine‑tune positions across pools for higher, but more hands‑on, returns.

Staking and Yield Farming Stablecoins

- Staking: locking stablecoins in a protocol to support network or protocol functions for periodic rewards.

- Yield farming: deploying stablecoins in liquidity pools or vaults to capture trading fees, incentives, or token emissions.

Popular approaches include supplying DAI/USDC to Aave or Curve or using yield‑bearing stablecoins like sDAI and aUSDC that pass through protocol earnings. Typical APYs range around 3–16% depending on incentives and market conditions; automation platforms such as Yearn or Beefy can compound rewards for a truly passive experience. A practical overview of yield‑bearing stablecoins is covered by Transak’s primer.

Key risks: smart‑contract bugs, incentive changes, temporary loss in certain pools, and governance or oracle exploits.

Investing in Real-World Asset Backed Stablecoin Protocols

RWA‑backed stablecoins are fully or partially collateralized by real‑world assets—like U.S. Treasuries or cash reserves—often offering transparent disclosures and yield pass‑throughs. Recent innovations include treasury‑backed tokens (e.g., USDY by Ondo) and public‑sector pilots, illustrating the shift toward compliant, yield‑bearing designs. Coverage of yield‑bearing stablecoins in 2025 from Cointelegraph highlights the trend toward RWA collateral for stability and income.

Why investors consider them:

- Potentially higher baseline yields when rates are elevated

- Clearer audit trails and on‑chain proofs

- Reduced exposure to purely algorithmic mechanics

ToVest aggregates RWA‑linked opportunities with unified reporting and on‑chain verification, helping investors evaluate collateral, yield sources, and liquidity in one dashboard; see ToVest research for how transparent data improves risk assessment and tax prep.

Leveraging Cross-Chain Yield Opportunities

Cross‑chain yields involve moving stablecoins across blockchains to capture better APYs, reduce fees, or diversify protocol risk using audited bridges and aggregators. Benefits include rate differentials across ecosystems and access to niche incentives that don’t exist on your primary chain. Stoic.ai’s USDC staking guide outlines how to evaluate routes, safety checks, and net yield after gas.

Best‑practice checklist:

- Assess bridge security (audits, bug bounties, uptime history).

- Model gas and slippage versus expected yield uplift.

- Prefer audited, battle‑tested contracts; use hardware wallets for large moves.

- Rehearse with small transfers and confirm destination chain addresses.

- Document cross‑chain hops for compliance and later reconciliation.

Managing and Optimizing Your Stablecoin Earnings

- Track APYs, utilization, and reserve status regularly; yields move with demand and macro rates.

- Automate compounding where possible (e.g., vaults or exchange auto‑earn features) to reduce idle cash drag.

- Rebalance across platforms and stablecoin types to maintain target risk/return and liquidity windows.

- Monitor protocol health: audits, TVL trends, governance changes, and oracle dependencies.

- Key metrics to watch:

- Net APY after fees and gas

- Yield stability and historical bands

- Liquidity depth and exit costs

- Protocol track record, audits, and incident history

Ensuring Tax Efficiency in Stablecoin Investments

Tracking Transactions and Income

Accurate records make optimization and compliance easier:

- Log deposits, withdrawals, transfers, interest, staking rewards, LP fees, airdrops, and incentive tokens.

- Tag each entry with amount, timestamp, wallet, platform, and purpose (earn, swap, bridge).

- Connect wallets to portfolio and tax software that supports stablecoin categorization and export.

Complying with Tax Regulations

In many jurisdictions, interest, staking rewards, and farming incentives are taxed as income when received; swaps or disposals can trigger capital gains depending on cost basis and holding period. Cross‑chain activity, large airdrops, and RWA‑linked yields may have additional reporting needs—consult a qualified crypto tax professional. Using transparent, audited protocols helps substantiate income and pass compliance checks; practical overviews of crypto savings and reporting considerations are discussed by Bitcoin.Tax’s 2025 roundup.

Utilizing Transparent Platforms for Reporting

Favor platforms that provide:

- Downloadable, time‑stamped transaction histories

- Clear APY statements and fee disclosures

- On‑chain proofs of reserves or collateral

- Direct integrations with tax software

ToVest offers consolidated earnings reports and verifiable on‑chain data to simplify year‑end reconciliation and ongoing oversight.

Frequently Asked Questions

What Are the Safest Stablecoins for Passive Income?

The safest options are typically fiat‑backed stablecoins such as USDC and USDT that publish attestations and maintain large, liquid reserves.

How Does Yield Farming Differ from Staking Stablecoins?

Yield farming moves stablecoins between protocols to capture fees and incentives, while staking locks assets in one protocol for a set or variable reward.

What Tax Considerations Should I Keep in Mind When Earning Stablecoin Income?

Interest and rewards are often taxable as income, and swaps can create capital gains; keep detailed records and consult a local crypto tax professional.

Can I Earn Passive Income Without Active Management?

Yes—auto‑compounding vaults and yield‑bearing stablecoins can deliver returns with minimal ongoing management.

How Do I Protect My Stablecoin Investments from Risks?

Use reputable, audited platforms; diversify across protocols; enable hardware wallet security; and monitor reserves, APYs, and protocol health over time.

Sources cited: Chainalysis on stablecoin adoption; KuCoin Learn on passive income methods and attestations; Yahoo Finance on stablecoin market concentration; Coingape and Eco on yield ranges; Transak on yield‑bearing stablecoins; Cointelegraph on RWA‑backed innovations; ToVest research on transparent, RWA‑linked opportunities; Bitcoin.Tax on savings accounts and reporting considerations.