7 Best Tokenized Stock Platforms for Non‑US Investors in 2025

25 ธันวาคม 2568

Tokenized stocks are digital representations of real equities issued on public blockchains, enabling fractional, 24/7 trading via crypto rails without traditional brokerage barriers. For non‑US investors, this can mean simpler access to US names, faster settlement, and the ability to fund and withdraw in fiat, stablecoins, or crypto. As the market matures, choosing the right platform matters for custody safety, liquidity, and legal clarity. Below, we compare leading tokenized stock platforms on access, performance, regulatory posture, and practical fit for different investor needs—drawing on what major issuers and exchanges actually support in 2025 and where they operate. For a landscape view of the most active tickers (e.g., SPYX, AAPLX, COINX), see Webopedia’s overview of the biggest tokenized stocks, which also explains how these markets work at a high level.

ToVest

ToVest bridges traditional US equities with blockchain flexibility for non‑US investors, offering instant, fractional trading and true 24/7 market access with low‑latency execution and resilient security. Behind the interface, ToVest ensures on‑chain transparency with a defensible custody stack and proof‑of‑reserves reporting so you can verify assets, not just trust claims.

The platform’s data layer is built for decision‑making: real‑time market depth, granular historical feeds, and portfolio analytics are integrated with sophisticated, opt‑in leverage and risk controls to support both novice and institutional investors. Globally, ToVest emphasizes consistent access to tokenized US stocks and ETFs, fast settlement finality, and clear disclosures on where assets are held and how they’re segregated. For more on our approach and oversight, see ToVest’s background and governance.

Backed Finance

Backed Finance is a Swiss‑based pioneer in tokenized stocks and ETFs, issuing instruments across multiple chains with industry‑standard custody. Tokens are structured for legal clarity and issued to common standards such as ERC‑20 (Ethereum) and SPL (Solana), while underlying assets are held with regulated Swiss custodians for enhanced protections and settlement finality. Coingape’s roundup of RWA platforms highlights custodial rigor and proof‑of‑reserves as differentiators in this segment.

Backed’s footprint includes widely tracked tokens like AAPLX (Apple), COINX (Coinbase), and SPYX (S&P 500 exposure), which have built meaningful liquidity and awareness across the sector, as summarized in Webopedia’s tokenized stocks overview. Availability is jurisdiction‑dependent, so always verify whether specific tickers are supported in your country and on your chosen exchange.

Securitize Markets

Securitize offers an institutional‑grade, regulated platform built for compliant token issuance, custody, and secondary trading. It partners with leading custodians and infrastructure providers—including Anchorage, BitGo, Fireblocks, and Copper—while issuing on ERC‑20 rails and supporting multi‑chain operations, giving investors robust settlement and clearer recourse frameworks. Coingape’s RWA platform survey underscores these partner integrations as best‑practice signals.

Securitize has become a benchmark venue for advanced on‑chain investment vehicles such as BlackRock’s BUIDL and Apollo’s ACRED, illustrating how tokenization can extend beyond single‑name equities into institutional funds. Global investors benefit from standardized reporting, but should always review each asset’s legal wrapper and local availability before funding.

Kraken

Kraken is a long‑standing centralized exchange known for conservative compliance, deep liquidity in major markets, and broad global reach. In jurisdictions where tokenized stock products are supported by approved issuers, Kraken’s infrastructure—fiat and stablecoin rails, fast order matching, and robust security—makes it a practical venue for accessing high‑volume pairs and trading outside US market hours. BingX’s guide to xStocks highlights why 24/7 access and stablecoin settlement have been catalysts for demand, particularly in regions with higher brokerage frictions.

As with any centralized venue, compare conversion and withdrawal fees, confirm which tokenized equities are legally available in your country, and review listing disclosures to understand rights and restrictions.

Bybit

Bybit caters to active, crypto‑native traders with fast execution, deep order books, and fractional lots—features that translate well to tokenized equities when supported in your region. Popular tickers such as AAPLX and COINX have become reference markets across the sector, with liquidity patterns described in Webopedia’s coverage of top tokenized stocks.

For non‑US investors, Bybit’s advantages include 24/7 trading, stablecoin settlement, and lower minimums. Verify local availability and any regulatory caveats that may apply to tokenized equities in your jurisdiction before trading.

Coinbase

Coinbase is favored for its regulated custody, operational transparency, and a global user base that supports mainstream liquidity conditions. Its institutional services and conservative compliance approach position it as a natural on‑ramp for tokenized assets, especially for allocators prioritizing custody assurances and detailed reporting. The Motley Fool’s overview of blockchain stocks cites Coinbase’s scale and infrastructure as core reasons institutions engage with the platform.

For larger accounts, Coinbase’s negotiated pricing and reporting can simplify both execution and audit workflows. Access to specific tokenized equities varies by region, so check eligibility and rights disclosures prior to funding.

Binance

Binance remains a dominant global venue with top‑tier liquidity and extensive asset coverage. Where fully supported, its depth of market and seamless transitions between crypto and tokenized exposures can be appealing to non‑US traders who prioritize execution quality. Yellow Research’s survey of must‑have crypto apps notes Binance’s global reach and product breadth as key strengths.

Regulatory status and product menus vary by country, and tokenized stock offerings may be limited or unavailable in certain regions. Conduct due diligence on local compliance requirements, listing rights (e.g., dividends, voting), and withdrawal options.

eToro

eToro blends traditional equities, tokenized assets, and social investing features in a retail‑friendly interface. With a large global user base and commission‑free stock trading in many countries, it offers simple onboarding and educational tools that help new investors navigate emerging asset classes. Yellow Research indicates spread‑based fees around 1% for many crypto/tokenized trades, which can be competitive at smaller sizes.

Confirm whether you have direct access to tokenized equities or only synthetic exposures in your region, as product access and legal rights can differ by country.

How to Choose the Best Tokenized Stock Platform as a Non-US Investor

Use this process to match a platform to your goals and constraints:

- Confirm legal coverage: Check the platform’s jurisdiction, KYC requirements, and whether tokenized equities are available in your country with full disclosures on rights.

- Verify custody and reserves: Look for regulated custodians, clear segregation, and proof‑of‑reserves reporting before funding. Coingape’s RWA platform analysis outlines why these are essential.

- Compare execution and rails: Review 24h volumes, order book depth, trading hours (24/7 vs market hours), and payout options (fiat, stablecoins, crypto).

- Total cost review: Compare spreads, commissions, withdrawal fees, and currency conversion costs.

- Fit for purpose: Evaluate data tools, leverage controls, APIs, and support.

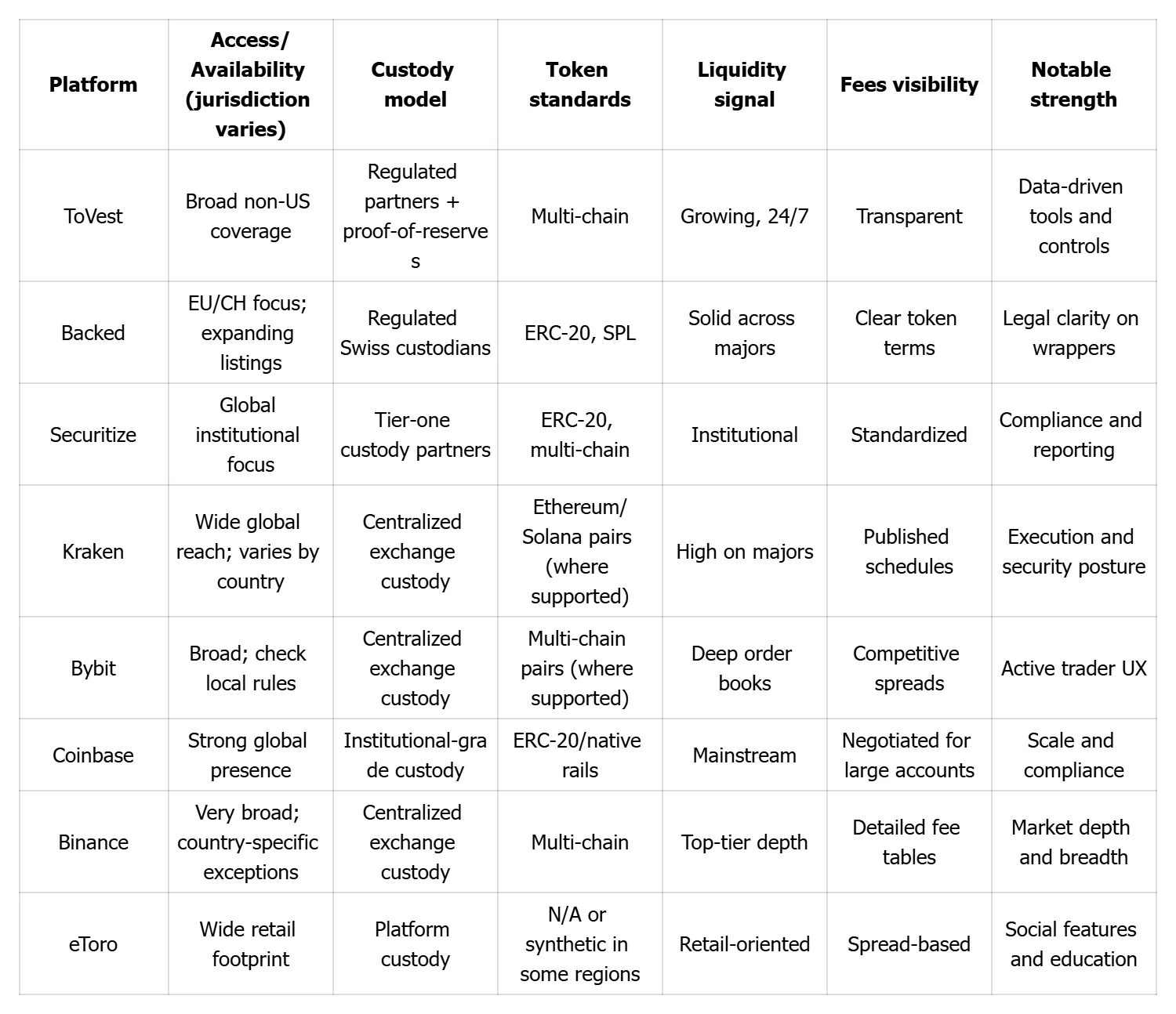

Quick comparison snapshot:

Key Features to Compare in Tokenized Stock Platforms

- Token standards and security: ERC‑20, SPL, or multichain issuance; platform security controls; insurance coverage.

- Custody arrangements: A custody arrangement is the structure by which digital or tokenized assets are held, managed, and secured—often via regulated third parties to protect assets and ensure settlement finality.

- Asset breadth: Coverage of US single stocks, ETFs, fixed income, and real estate.

- Trading mechanics: 24/7 vs limited hours, fractionalization, leverage options, and API access.

- Fees: Spread vs commission, withdrawal and network costs, and currency conversion.

- Data and reporting: Market depth, historical data, tax reports, and proof‑of‑reserves.

XBTO’s RWA tokenization primer outlines why these choices matter as standards evolve across assets and chains.

Regulatory and Jurisdiction Considerations for Non-US Investors

Rules and product availability differ by country; many platforms enforce geo‑restrictions and apply asset‑specific eligibility screens. Coingape’s RWA review emphasizes that custody clarity and disclosures vary by issuer, which directly impact investor rights. Some tokenized stocks may carry reduced rights (e.g., no voting or dividends) or be structured as derivatives rather than direct equity interests.

A legal wrapper is the contractual structure giving a tokenized asset its legal standing and rights, including entitlement to dividends, voting, and legal recourse. Review both local investor protections and platform‑level compliance features before you trade.

Understanding Liquidity and Custody in Tokenized Stock Trading

Liquidity is the ease and speed with which a tokenized asset can be bought or sold without significantly moving the price. In 2025, SPYX (tokenized S&P 500 exposure) reached an estimated $10.3M market cap, while AAPLX and COINX hovered near $2.0M and $1.9M, respectively, with daily volumes that vary by venue, per Webopedia’s sector snapshot. Liquidity can cluster on certain exchanges and pairs, so always check 24h volume and order book depth where you plan to trade.

Leading issuers rely on regulated custodians and robust reserve disclosures. Comparing proof‑of‑reserves and custody partners—and confirming how claims are audited—can materially reduce counterparty risk relative to opaque setups.

Frequently Asked Questions

What are tokenized stocks and how do they work?

Tokenized stocks are blockchain‑based representations of real stocks, allowing investors to trade fractional shares 24/7 via crypto rails, typically backed by custodians holding the underlying exposure.

How can non-US investors access tokenized US stocks safely?

Choose platforms with regulated custody and proof‑of‑reserves, and confirm your country’s eligibility and asset rights before funding.

What are the typical fees involved in trading tokenized stocks?

Expect spreads, potential commissions, withdrawal/network fees, and currency conversion; high‑liquidity tickers generally have tighter spreads.

Are there risks associated with tokenized stock platforms?

Yes—jurisdictional differences in protections, custody/counterparty risk, liquidity variability, and potentially limited rights compared to traditional shares.

How do custody arrangements affect investor protections?

Regulated, transparent custody enhances protection and recourse in disputes or insolvency, while opaque setups raise the risk of default and rehypothecation.