By 2026 you will regret it if you don't know this Roadmap of ToVest!

24 ธันวาคม 2568

The next two years will compress a decade of change in capital markets. Tokenization is moving from experiments to production, AI is rewiring risk controls, and settlement rails are going global and near‑instant. This article lays out ToVest’s roadmap to 2026—what the platform is, why its model matters, and how it hardwires regulatory compliance without slowing innovation. In short: ToVest is a tokenized asset trading platform designed to make fractionalized US stocks and real estate accessible 24/7 with institutional‑grade controls. If you’ve wondered “What is ToVest?” or “How does ToVest ensure regulatory compliance?”—this is your field guide to how we operate, the tradeoffs we manage, and the milestones ahead.

What is ToVest?

ToVest is a specialized digital trading platform enabling investors to access tokenized real‑world assets—most notably fractionalized US stocks and real estate—through blockchain-based issuance and settlement. The experience is designed for tech‑savvy, transparency‑focused investors who want global, crypto-native access with the safeguards institutions expect. For an overview of our mission and model, see the ToVest overview on our site.

What sets ToVest apart from traditional brokers and crypto exchanges is how it blends market access with programmable ownership. Investors can fund with crypto or fiat, trade a diversified menu of tokenized assets with real-time market data, and benefit from ultra‑low latency execution, leverage and margin options (where permitted), and 24/7 global trading typical of a modern blockchain trading platform.

There are tradeoffs. Economic exposure is provided through tokenized instruments rather than direct share certificates, and some protections tied to legacy securities accounts may not apply in all jurisdictions. We publish clear disclosures so users understand how tokenized assets differ from traditional instruments. (Not to be confused with being “vested” in a retirement plan; see a plain‑English explainer on vesting from Bankrate.)

ToVest’s Vision for the Future of Tokenized Asset Trading

Our vision is simple: lower barriers to high‑quality, regulated market access by turning real‑world assets into programmable, fractional units that can move globally with the speed and transparency of blockchains. The goal is an institutional‑grade experience—clean UX, deep liquidity, risk‑aware leverage, robust disclosures—served in a format that works for both crypto‑native and traditional investors.

The operating philosophy behind this vision is adaptability. Compliance leaders increasingly emphasize continuous monitoring, stakeholder training, and iterative improvement over one‑off checklists—an approach that aligns with agile roadmapping in product and risk functions, enabling platforms to respond quickly to changing requirements and investor needs (see Scytale’s overview of compliance best practices and 6clicks’ compliance framework guidance).

Technologically, our roadmap leans on:

- Advancements in blockchain settlement and interoperability to expand asset coverage and reduce friction.

- AI for market surveillance, anomaly detection, and service automation.

- Modern payments, including on‑chain rails, for faster, cost-effective funding and withdrawals with clear audit trails.

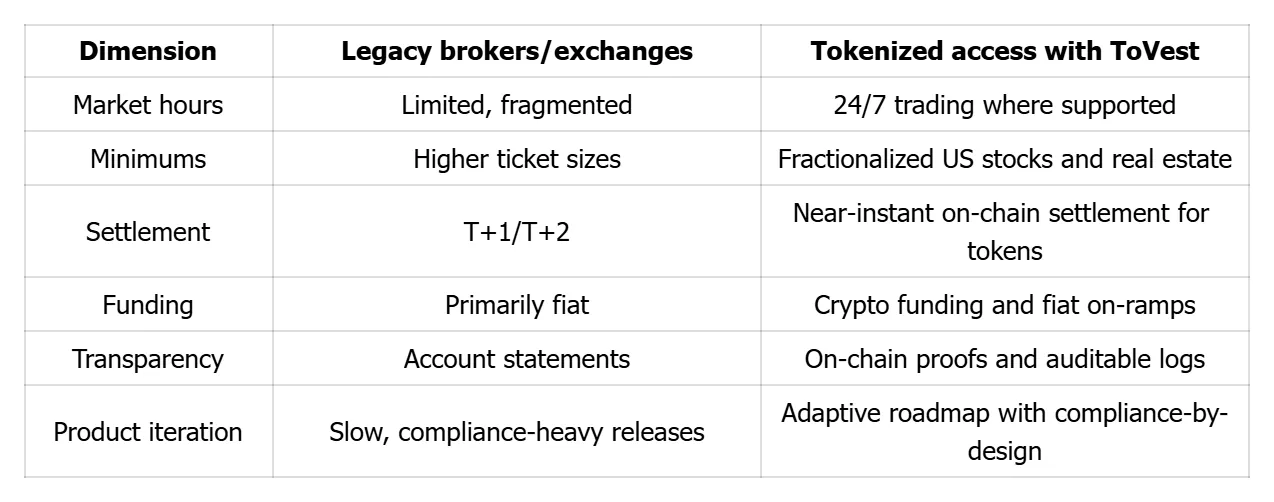

A quick comparison of legacy vs. tokenized access helps clarify the shift:

Key Elements of ToVest’s Adaptive Roadmap

Adaptive roadmaps replace static milestones with live feedback loops, letting teams reprioritize using real‑time telemetry, risk signals, and regulatory change tracking. This continuous-improvement posture—common in mature compliance programs—reduces blind spots and speeds safe shipping (see Scytale’s compliance best practices and 6clicks’ framework guidance).

Real-time telemetry and feedback

- Instrument everything: order flow, latency, slippage, liquidity depth, custody events, and user friction.

- Convert telemetry into action via service‑level objectives and automated rollback/kill‑switches for safety.

- Use quantitative user feedback and A/B testing to refine onboarding, funding, and trade flows.

Federated data governance

- Apply access controls and lineage tracking so product teams can move fast without compromising privacy or compliance.

- Standardize schemas for trade data, KYC/AML records, and incident logs to simplify audits and regulator requests.

Cross-functional alignment

- Create a single operating cadence for product, compliance, legal, security, and finance—shared dashboards, shared OKRs.

- Gate major launches with joint reviews covering market risk, conduct risk, data protection, and financial controls.

Compliance by design: how ToVest ensures regulatory compliance

Our compliance program follows a rigorous, documented lifecycle aligned with industry guidance:

- Identify applicable regulations and obligations across jurisdictions, then map them to internal controls and owners (see Scytale’s compliance best practices).

- Perform risk assessments to prioritize controls by impact and likelihood, then document policies and procedures with versioning and approval workflows (Penneo outlines an 8‑step compliance process emphasizing policy documentation and change management).

- Train employees on role‑specific requirements and conduct regular refreshers; log attestations for audit evidence.

- Implement technical and procedural controls (KYC/AML, transaction monitoring, segregation of duties, access controls), and monitor continuously with alerts and escalations.

- Conduct scheduled internal audits and control testing, remediate findings, and track completion; maintain evidence trails for regulator and partner reviews (6clicks’ framework guidance highlights verification and continuous improvement).

- Manage third‑party risk with vendor due diligence, DPAs, and ongoing monitoring.

- Practice incident response with playbooks for fraud, data, and operational events; report as required and run post‑mortems to improve controls.

- Keep everything provable: centralized policy repositories, audit logs, evidence packs, and board-level reporting.

We also leverage technology to scale readiness—secure e‑signatures and workflow automation for policy attestations and approvals, policy distribution, and audit evidence management (as described in Penneo’s 8‑step approach).

Security, custody, and risk management

- Hardened custody with multi‑sig/HSMs, segregation of client assets, and withdrawal controls.

- Real‑time surveillance for market abuse patterns, sanctions screening, and wallet analytics.

- Treasury and liquidity risk frameworks to manage leverage, margin, and stablecoin exposures.

Liquidity, market access, and 24/7 operations

- Multiple liquidity venues and market‑maker relationships to stabilize spreads and depth.

- Redundant settlement and payments paths for always‑on funding and withdrawals with clear reconciliation.

Client trust: transparency and education

- Plain‑language disclosures on how tokenized assets work, associated rights, and key risks.

- Public status pages, incident transparency, and regular updates on roadmap progress, including compliance changes.

By 2026, the winners in digital asset trading will be those who combine constant innovation with equally constant verification. ToVest’s roadmap is built to do both—ensuring access remains open, performance stays high, and compliance is maintainable.