Stablecoin vs. Traditional Savings: Which Delivers Higher Returns in 2025?

December 17, 2025

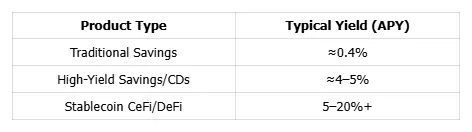

Stablecoins and traditional savings accounts both aim to protect purchasing power, but they take very different routes to do it—and their returns reflect that. In 2025, typical savings yields range from roughly 0.4% in standard accounts to 4–5% in high-yield accounts and CDs, while stablecoin strategies on centralized and decentralized platforms commonly offer 5–20%+ APY. The trade-off is risk: stablecoin yields are higher but come with collateralization, platform, and technical risks that bank deposits largely avoid. For investors seeking efficiency and global access, stablecoins can complement deposit-insured cash holdings. For conservative savers, traditional accounts remain the baseline. Below, we compare stability, access, costs, adoption, yields, and how to get started—anchored in ToVest’s belief that prudent, data-driven diversification, including tokenized real-world assets, can enhance risk-adjusted outcomes.

Understanding Stablecoins and Traditional Savings

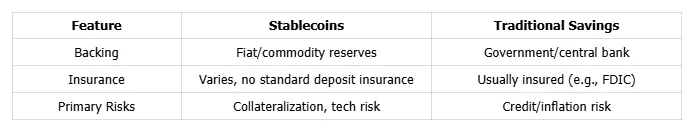

Stablecoins are digital assets designed to maintain a stable value. “Stablecoins are pegged to fiat currencies or commodities, providing price stability based on reserves and mechanisms” (BCB Group insights). Traditional savings accounts are deposit products at regulated banks, typically backed by deposit insurance and subject to government and central bank oversight to promote financial stability.

The appeal and use cases differ. Stablecoins offer high liquidity, cross-border utility, and integration into digital finance rails used by exchanges, fintechs, and on-chain protocols. Traditional savings accounts provide conservative capital storage, steady but modest interest, and deposit insurance—ideal for emergency funds and near-term needs.

Stability and Security Comparison

Stablecoins rely on liquid reserves, collateral, and issuance rules to keep their pegs, whereas bank deposits benefit from systemic protections. As one summary puts it: “Traditional assets are backed by governments or tangible assets, offering a long history of relative stability” (BCB Group insights). User protection likewise differs: deposit insurance for bank accounts versus transparency, attestations, and audits for leading stablecoins.

For investors, the key is verifying reserve quality, legal structure, and disclosure rigor for stablecoins, and understanding deposit coverage limits and bank credit exposure for savings.

Liquidity and Accessibility Differences

Stablecoins deliver instant settlement and global reach. They have “high liquidity on crypto exchanges and operate 24/7, unlike traditional assets limited by market hours” (BCB Group insights). Bank-based access, in contrast, can be gated by business hours and processing cutoffs, especially for international transfers.

Accessibility is another differentiator. “Stablecoins are borderless and accessible with a smartphone and internet, benefiting underbanked and cross-border remittance users” (Capgemini POV). For anyone transacting globally or moving funds across platforms, the always-on nature of stablecoins is a practical advantage.

Cost Efficiency and Transparency Analysis

Stablecoins can cut middlemen and settlement layers. “Stablecoins offer cost efficiencies by reducing intermediary fees, foreign exchange spreads, and processing charges” (Capgemini POV). On many networks, a stablecoin transfer can cost under $0.01 per transaction (Wells Fargo Advisors analysis). By contrast, traditional rails often include 1.5–3% merchant card fees and higher international wire charges (Capgemini POV).

Transparency also differs. Stablecoin transfers settle on public blockchains, enabling auditability and real-time monitoring of flows, while bank ledgers remain private and periodic. For institutional treasurers and fintechs, that visibility can improve reconciliation and risk management.

Market Adoption and Growth Trends

The stablecoin market has scaled rapidly. “The stablecoin market cap exceeds $280 billion, driven by USDT, USDC, and growing euro- and GBP-linked coins,” with increasing corporate use for settlement, treasury, and liquidity management (BCB Group insights). Meanwhile, traditional savings adoption remains steady but slower to innovate, constrained by regulatory parameters and legacy infrastructure.

This divergence matters for returns and user experience. As stablecoin rails deepen, on-chain money markets and payment venues multiply—expanding yield and utility—while insured deposit products prioritize capital preservation and policy alignment.

Yield Potential: Stablecoins vs. Traditional Savings

Returns in 2025 differ meaningfully by product and platform:

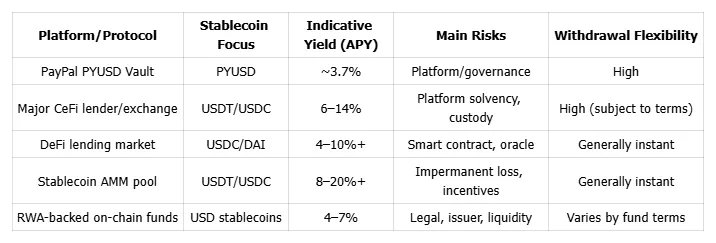

PayPal’s PYUSD Vault offers about 3.7% APY, competitive with high-yield bank accounts but below the top decentralized finance rates (Ainvest coverage). Stablecoin yields are generated by lending, market-making, and on-chain incentives, while savings yields come from banks’ loan books and securities portfolios.

Always weigh risk-adjusted return. Stablecoin rates can be higher and more variable, with risks spanning platform solvency, smart contract bugs, liquidity shocks, and peg volatility. Bank deposits offer lower but predictable yields with deposit insurance and stronger recourse.

Risks and Regulatory Considerations

Stablecoins carry specific risks, including governance failures, poor collateralization, operational lapses at issuers or platforms, and broader systemic risks in interconnected crypto markets (BCB Group insights). Traditional savings accounts face inflation and bank credit risks but benefit from mature regulatory regimes and deposit insurance.

Regulation is evolving. “Stablecoin regulations are evolving rapidly, with frameworks like the EU’s MiCA and the UK’s crypto regime enhancing protection” (BCB Group insights). DeFi—decentralized finance—delivers lending, trading, and other financial services via smart contracts without traditional intermediaries. While powerful, DeFi adds complexity and technical risk that investors must understand before committing capital.

How to Start Investing with Stablecoins for High Returns

A practical, risk-aware setup:

- Choose a reputable platform or wallet. Assess security, audits, and regulatory posture. Institutional-grade overviews and research can help you benchmark options (see ToVest’s research hub).

- Complete KYC if required and fund your account via bank transfer or card.

- Select a stablecoin (e.g., USDT, USDC, EUR- or GBP-pegged options) aligned with your base currency and use case.

- Evaluate yield opportunities—centralized lending products, DeFi lending pools, liquidity provision, or market-making—alongside their risks, lock-ups, and fee structures.

- Review security features, insurance/guarantees (if any), counterparty exposure, and clear exit procedures. Test small withdrawals before scaling.

Platform options at a glance:

- Centralized finance (CeFi): Simple UX, custody managed by the platform, yields typically 5–14% APY. Risks: platform solvency, rehypothecation, custody concentration.

- Decentralized finance (DeFi): Self-custody, transparent smart contracts, yields up to 20%+ APY in some pools. Risks: smart contract exploits, oracle failures, impermanent loss, governance changes.

Look for transparent reserve attestations, robust custodial policies, and strong regulatory adherence. For diversification, consider complementing stablecoin positions with tokenized real-world assets (e.g., on-chain T-bills) to balance risk and duration exposures (learn more via ToVest Academy).

Best Stablecoin Investment Opportunities in 2025

Evaluate opportunities by four pillars: yield (APY), reserve quality and peg mechanics, regulatory status and disclosures, and security provisions (audits, insurance, custody).

Examples and comparisons (illustrative, variable by jurisdiction and time):

- PayPal PYUSD Vault: ~3.7% APY; straightforward interface; backed by a major payments firm; limited upside versus DeFi; high liquidity.

- Centralized platforms (e.g., leading global exchanges, lenders): 6–14% APY on USDT/USDC; simple onboarding; platform and custody risk; generally flexible withdrawals.

- DeFi protocols (e.g., lending markets and stablecoin pools): up to 20%+ APY at times; transparent mechanics; smart contract and market risks; withdrawals usually instant unless liquidity is thin.

Match your strategy to your risk tolerance, liquidity needs, and operational competence. Consider position sizing rules, stopgaps (e.g., circuit-breakers, alerts), and periodic rebalancing.

Frequently Asked Questions

Do stablecoins offer higher returns than traditional savings?

Yes, stablecoins typically offer higher yields—often 5–20% APY or more—while traditional savings rates in 2025 are around 0.4–5%. However, stablecoin returns come with additional risks and less regulatory protection.

What risks should I consider with stablecoin investments?

Investing in stablecoins involves risks such as platform insolvency, loss of peg, smart contract vulnerabilities, and lack of deposit insurance. It's important to conduct thorough research and understand reserve structures.

How are stablecoin yields generated?

Stablecoin yields are derived from lending activities, exposure to money-market instruments, and decentralized finance pools. In DeFi, yields can also be influenced by trading fees and platform incentives.

Can stablecoins replace traditional savings accounts long term?

Stablecoins serve as effective tools for payments and trading but are not yet a complete replacement for low-risk, deposit-insured savings accounts. High-yield stablecoin products remain more investment-oriented than traditional savings.

What factors should I evaluate beyond yield percentages?

In addition to APY, evaluate the reserve backing, legal structure, platform security, insurance options, liquidity, and how easily you can access your funds.