Authoritative Review of Top Stablecoin Investment Opportunities for 2025

December 16, 2025

Stablecoins have evolved into a core piece of digital finance infrastructure, offering dollar-pegged stability with on-chain speed. In 2025, investors can use stablecoins to diversify portfolios, manage cash tactically, and access on-chain yield and tokenized real-world assets—all while preserving liquidity. The broadest acceptance remains with USDT and USDC across major exchanges, DeFi protocols, and institutional platforms. Below, we map the market’s leaders, the best platforms and strategies, and the key risks to watch—so you can decide how to deploy stablecoins for diversification, yield, and efficient global payments with confidence.

Overview of the Stablecoin Market in 2025

Stablecoins are digital assets pegged to a stable reserve—typically the U.S. dollar—designed to minimize volatility and enable seamless crypto-to-fiat transactions.

By early 2025, USD-backed stablecoins account for well over 90% of circulating supply, with total circulation around $208 billion, and Tether (USDT) plus USD Coin (USDC) controlling more than 85% of the market, according to Amberdata’s Q1 2025 stablecoin report. Analysts expect the category to scale well beyond current levels, with forecasts pointing toward a market approaching $2 trillion by 2028 as stablecoins shift from niche to mainstream settlement rails, per Yellow Card’s trend outlook. Banks and payment firms increasingly view tokenized cash as strategic infrastructure rather than speculative crypto, a point echoed in Treasurup’s 2025 playbook for financial institutions.

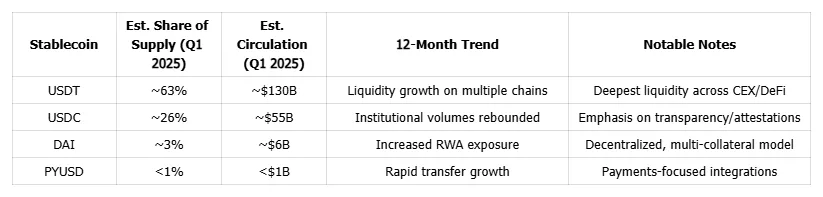

Estimated distribution and recent momentum:

Source context: market sizing and volume dynamics are grounded in Amberdata’s Q1 2025 analysis, with forward-looking adoption drivers summarized in Yellow Card’s industry trends and Treasurup’s bank-oriented strategy guidance.

Regulatory Developments Impacting Stablecoin Investments

Regulation is rapidly defining how reserve-backed stablecoins operate—and it’s boosting institutional confidence. In the EU, MiCA requires transparent reserves, routine audits, and clear redemption rights, creating a passportable framework for eurozone distribution and oversight, as detailed in TRM Labs’ 2025/26 policy review. In the U.S., federal proposals increasingly converge on full-reserve backing, high-quality liquid assets, strong custodial controls, and regular attestations—principles reflected in Brookings’ primer on stablecoin regulation and consumer safeguards.

For investors, the main takeaway is that regulatory clarity has expanded institutional participation and made it easier for compliant platforms like ToVest to offer auditable, rules-aligned stablecoin services. What major issuers implement post‑2025 typically includes:

- Segregated reserves with qualified custodians and daily transparency dashboards.

- Monthly independent attestations covering composition, maturities, and liquidity buffers.

- Real-time chain analytics, sanctions screening, and suspicious activity monitoring.

- Documented redemption SLAs, stress testing, and liquidity management protocols.

- Jurisdiction-specific reporting (e.g., MiCA disclosures in the EU) and event-driven notices.

This compliance spine supports due diligence and lowers counterparty uncertainty for stablecoin investors.

Technological Innovations Enhancing Stablecoin Utility

Technology upgrades are making stablecoins faster, cheaper, and easier to integrate:

- Lower-cost rails and multi-chain deployment: Sub‑cent settlement costs and near‑instant confirmations on high-throughput chains are unlocking micro‑payments, intraday treasury moves, and retail checkout flows, consistent with McKinsey’s analysis on tokenized cash and next-gen payments.

- Interoperability and programmable money: Cross‑chain bridges and smart contract standards are enabling stablecoins to move across ecosystems and settle conditional flows (e.g., escrow, supply chain triggers). Yellow Card’s trend analysis highlights this shift to programmable, real‑time value transfer.

- Treasury-grade APIs and automated reporting: Enterprise-grade APIs now provide automated reconciliation, policy-based transfers, and continuous reserve monitoring—complementing audit trails and compliance workflows emphasized by McKinsey.

The result: lower friction for merchants and institutions, tighter cash cycles, and more reliable rails for DeFi and tokenized assets.

Key Stablecoin Investment Opportunities and Market Leaders

USDT and USDC remain the market’s primary liquidity hubs. Together they command nearly 90% market share (USDT ~63%, USDC ~26%) on the back of deep order books, global exchange support, and institutional integrations—figures aligned with Amberdata’s Q1 2025 assessment. Adoption milestones underscore the trend: USDC’s March 2025 on-chain volume approached $585 billion, signaling strengthened institutional usage, while PYUSD transfer volumes climbed from roughly $1.7 billion to $3.7 billion within three months as payments integrations expanded, per Amberdata’s Q1 2025 review.

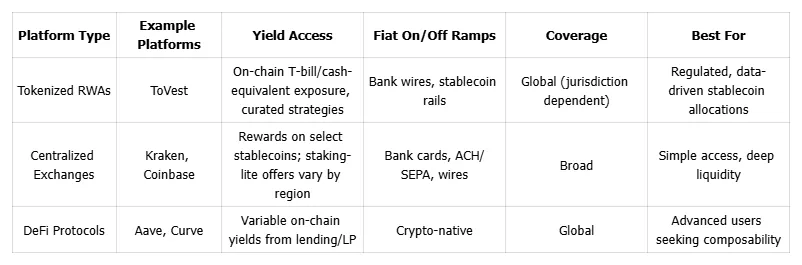

Where to access opportunities:

Investors seeking platform breadth for USDT can review independent roundups of trading platforms to match liquidity, fees, and jurisdictional fit. For institutional-grade, transparent diversification and tokenized RWA access, ToVest’s research-driven approach and controls are built for allocators who need auditability and low-latency execution.

Use Cases Driving Stablecoin Adoption Across Sectors

Stablecoins now underpin a range of high-frequency and enterprise-grade workflows:

- B2B and treasury: Intraday settlements, supplier payments, and cash pooling across entities and time zones—use cases Treasurup identifies as strategic for banks and corporate treasurers.

- Cross-border payments and FX: Programmatic conversions and real-time settlement reduce costs and delays versus correspondent banking, a theme noted by McKinsey.

- DeFi liquidity: Collateral, market-making, and lending use stablecoins as base liquidity.

- Remittances and high-inflation markets: Dollar-pegged value transfer offers predictability when local currencies are volatile, as highlighted in Yellow Card’s adoption trends.

- Commerce and payouts: Merchant settlement and creator payouts increasingly leverage stablecoins; Circle’s guide on how to spend USDC illustrates business-friendly workflows.

Sectors seeing the fastest growth:

- Financial services and fintech—treasury, payouts, and collateral

- E-commerce and marketplaces—global settlement and refunds

- Real assets—tokenized RWAs and cash management, a focus area for ToVest’s curated strategies

Global Trends in Stablecoin Integration and Adoption

Momentum is international and policy-led:

- Europe: MiCA is catalyzing bank, fintech, and issuer plans under a harmonized regime, per TRM Labs’ policy outlook.

- North America: Regulatory proposals continue to prioritize full-reserve backing and disclosures, aligning with Brookings’ regulatory framing.

- Emerging markets: Merchant and remittance usage is expanding where FX frictions and inflation are highest, a trend Yellow Card documents across Africa and beyond.

- Payment processors and banks: Enterprise rails increasingly support stablecoin settlement, with McKinsey noting tokenized cash’s role in next-gen payment stacks.

- Institutional partnerships: Banks and large custodians are engaging with stablecoin issuers for safeguarding reserves and access, as reflected in Treasurup’s institutional playbook.

Stablecoins for Portfolio Diversification and Risk Management

Diversification means spreading exposure across assets to reduce idiosyncratic risk and smooth returns. Stablecoins provide:

- Low-volatility, dollar-pegged exposure for tactical cash positioning

- Rapid rebalancing and hedging during market stress

- Access to on-chain yields via regulated platforms or DeFi (jurisdiction dependent)

Risk management best practices:

- Favor high-liquidity, transparent issuers; reserve transparency and credible attestations are core safeguards, per Brookings’ overview of stablecoin regulation.

- Diversify across issuers (e.g., USDT and USDC) and chains to reduce operational and de‑peg exposure.

- Validate redemption processes, custody quality, and audit cadence.

- Use regulated platforms with robust compliance and monitoring—ToVest publishes data-driven insights to support allocator diligence on tokenized cash strategies.

For a deeper dive into our methodology and dashboards, see ToVest’s research briefing.

Future Outlook for Stablecoin Investments and Market Evolution

The category’s trajectory is upward. With aggregate supply surpassing $200 billion in early 2025 and institutional payment use cases accelerating, analysts project a path toward nearly $2 trillion by 2028, driven by payments, DeFi liquidity, and tokenized assets, according to Yellow Card’s outlook. As regulatory clarity spreads (MiCA in the EU; tightening standards in the U.S.), we expect:

- Expanded use of tokenized RWAs, including cash equivalents and short-duration credit

- Broader integration with payment gateways, merchant acquirers, and treasury suites

- Deeper liquidity in multi-chain environments and improved interoperability

Key watchpoints for investors: ongoing regulatory updates, the resilience and transparency of reserves, chain scalability, and the pace of integration with traditional finance and global payment rails.

Frequently Asked Questions about Stablecoin Investments

What are the safest stablecoins to invest in for 2025?

USDT and USDC lead on liquidity, accessibility, and institutional adoption, making them primary choices for stability and execution quality.

How has regulation influenced stablecoin investment outlook in 2025?

Clearer rules on full reserves, audits, and disclosures—exemplified by the EU’s MiCA and U.S. policy proposals—have strengthened institutional confidence and broadened market access.

What is the market growth potential for stablecoins in the coming years?

Analysts project growth from the low hundreds of billions in 2025 toward nearly $2 trillion by 2028 as payments, DeFi, and tokenized assets scale.

What are the primary risks associated with stablecoin investments?

Key risks include de‑peg events, reserve quality and liquidity, and operational or regulatory shocks; choosing transparent, high-liquidity issuers helps mitigate them.

How can stablecoins enhance portfolio diversification strategies?

They provide low-volatility dollar exposure, fast rebalancing, and access to on-chain yield, improving liquidity management in balanced portfolios.

Amberdata’s Q1 2025 stablecoin report | Yellow Card’s stablecoin trend outlook | TRM Labs 2025/26 policy review | Brookings on how stablecoins are regulated | McKinsey on tokenized cash | Treasurup playbook for banks | Kraken’s crypto diversification guide | USDT platform roundup by BestBrokers | USDC spending guide | ToVest research