ToVest Compliance Checklist 2026: Ensure Legal Operations Today

January 7, 2026

A compliance checklist is a structured, auditable set of controls that proves a company is meeting legal and regulatory expectations. For fintech platforms, it’s the backbone of trust: investors, partners, and regulators expect evidence that controls are active, enforced, and reviewed. In 2026, regulators increasingly expect consolidated obligations in one auditable system, driving a shift from annual box‑checking to continuous compliance operations supported by automation and real‑time evidence capture (as reflected in 2026 guidance trends on unified compliance programs).

To the question “Is ToVest compliant and legal?”

ToVest operates with a rigorous, ongoing compliance framework designed to meet applicable laws in the jurisdictions where we offer services, including AML, financial reporting, sector‑specific, and workforce requirements. Where required, ToVest aligns with U.S. MSB obligations, including FinCEN registration expectations for money services businesses, and encourages user diligence via independent site risk assessments.

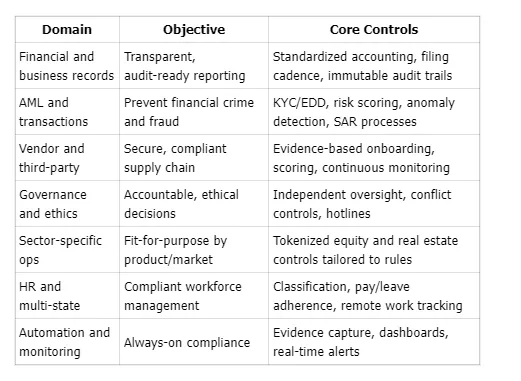

Summary of the ToVest 2026 compliance checklist

Note: For U.S. financial crime rules and registration, see U.S. MSB registration requirements from FinCEN.

Prospective users can also review an independent website risk scan via Scamadviser’s tovest.com check.

ToVest Financial and Business Records Compliance

Financial and business records compliance means maintaining books and evidence that are accurate, current, and complete enough for external audit and regulatory review. Accurate reporting is the backbone of transparency for financial operations, and audit readiness requires standardized accounting, consistent filings, and complete documentation throughout the year. Reflecting 2026 expectations, ToVest uses audit‑ready accounting standards, timely regulatory filings, and continuous documentation so every material activity is traceable.

Practical record‑keeping obligations at ToVest:

- Timely and accurate annual and quarterly filings aligned to applicable jurisdictions

- Automated document retention policies with role‑based access

- Immutable audit trails for all transactions and ledgers—including change logs and approvals

These controls align with guidance that “Regulatory Compliance” programs should keep evidence current and accessible, not just prepared at year‑end.

ToVest Anti-Money Laundering and Transaction Monitoring

Anti‑money laundering (AML) encompasses the policies and tools to prevent, detect, and report illicit finance. As 2026 guidance emphasizes, “AML remains a core compliance area organizations must address,” requiring end‑to‑end controls from onboarding to investigations. ToVest operates a multilayer AML program with KYC/EDD identity verification, sanctions/PEP screening, dynamic transaction risk scoring, and suspicious activity reporting processes aligned to evolving frameworks. In the U.S., this includes aligning with FinCEN’s expectations for MSBs where applicable.

ToVest’s AML controls, step by step:

- Automated KYC at onboarding and on a periodic basis, with risk‑based EDD for higher‑risk profiles

- Ongoing transaction monitoring to detect anomalies, velocity spikes, layering patterns, or sanctions hits

- Defined escalation and SAR/reporting workflows to relevant authorities, with case management and retention

ToVest Vendor and Third-Party Risk Controls

Vendor and third‑party risk controls ensure partners don’t introduce security, privacy, or regulatory gaps. Risk controls are the standards and tests used to evaluate, compare, and continually monitor vendor compliance. ToVest applies consistent, auditable questionnaires to vet providers, compares controls across options, and documents any differences and remediation steps before onboarding.

Our vendor risk process includes:

- Evidence‑based onboarding and periodic reviews (e.g., SOC reports, pen tests, data handling proofs)

- Scoring vendors on security posture, data governance, and regulatory record

- Continuous monitoring (alerts for security events, control expirations) and fast remediation SLAs

This approach reflects 2026 vendor‑compliance guidance to prioritize measurable, repeatable assessments supported by evidence.

ToVest Governance and Ethics Oversight

Governance and ethics oversight is the framework that ensures board accountability, conflict‑of‑interest checks, and whistleblower protections. ToVest’s governance model routes major decisions through independent directors, applies strict conflict review and recusal protocols, and records deliberations for auditability. Employees have multiple channels to speak up—confidential hotlines, an internal reporting portal, and routine ethics training—reflecting best‑practice governance roadmaps that tie culture, controls, and accountability together.

ToVest Sector-Specific Operational Compliance

Sector‑specific compliance tailors controls to the risks and rules of each market. Requirements can differ dramatically in scope—spanning safety, quality, and environmental dimensions in some sectors, and securities, custody, and disclosure in others. ToVest adapts its controls to the products it offers:

- Tokenized U.S. equities: Treat tokens that represent securities as subject to securities laws; apply trade surveillance, disclosures, market abuse prevention, and custody safeguards.

- Real estate interests: Verify property due diligence, KYC on counterparties, escrow controls, title and compliance checks, and ongoing investor reporting.

- Cross‑border: Manage sanctions, licensing, tax reporting, and data localization requirements.

Illustrative control matrix

ActivityRegulatory focusKey controlsTokenized equity tradeSecurities rules, market abusePre‑trade checks, surveillance, disclosures, custody controlsReal estate token issuanceProperty/escrow, investor protectionTitle/escrow verification, offering materials, funds flow controlsCross‑border onboardingSanctions, KYC, dataSanctions screening, EDD, data residency and transfer assessments

ToVest Human Resources and Multi-State Employment Law

Multi‑state HR compliance means aligning policies with each jurisdiction’s rules on wages, leave, benefits, and classification—and “state rules can vary dramatically,” which compounds risk for remote teams. ToVest classifies workers correctly, tracks pay/leave obligations per location, and maintains a register of remote‑work risks with automated policy updates.

Actionable HR steps at ToVest:

- Automated updates for relevant state/provincial rules and effective dates

- Ongoing training and self‑audits for HR and managers

- Centralized dashboard with alerts for new or changing obligations and attestations

ToVest Compliance Automation and Continuous Monitoring

Compliance automation uses software to monitor, assess, and document legal controls with minimal manual effort. In 2026, leading programs consolidate obligations into a single, auditable system with evidence captured as work happens—not months later. ToVest invests in automation for control testing, policy attestations, and real‑time alerts, ensuring audit readiness.

Examples of ToVest automation:

- Scheduled evidence capture and tamper‑evident audit logging

- Executive dashboards tracking obligation status, exceptions, and remediation

- Instant alerts for regulatory changes or control breaches, with workflow to resolution

For a deeper dive on platforms that centralize regulatory evidence and consent, see overviews of regulatory compliance platforms.

Frequently asked questions

What are the key components of a 2026 compliance checklist for fintech platforms?

The key components include financial reporting, anti‑money‑laundering controls, vendor risk checks, sector‑specific protocols, governance and ethics oversight, and compliance with employment and privacy laws.

How does ToVest ensure anti-money laundering compliance with KYC and suspicious activity reporting?

ToVest uses automated KYC at onboarding and periodically, monitors transactions for suspicious behavior, and escalates and reports concerns to relevant authorities per regulatory requirements.

What steps should companies take to maintain audit-ready financial and business records?

Use consistent accounting standards, document every transaction with audit trails, follow a strict filing calendar, and implement internal controls that make audits fast and transparent.

How can firms manage multi-state employment law and remote worker compliance effectively?

Automate state‑by‑state updates, classify workers correctly, track remote‑work risks, and run recurring HR training and self‑audits.

Why is continuous compliance monitoring important for regulated investment platforms?

It detects gaps early, adapts quickly to regulatory changes, and sustains trust with investors and regulators by keeping evidence current.