Why 2025 Is the Critical Year to Choose a Tokenized Stock Platform

25 ธันวาคม 2568

The window to select the best tokenized stock platform is narrowing fast. In 2025, regulatory clarity, institutional entry, and multi-chain maturity are converging to transition tokenized equities from experiment to infrastructure. Tokenized stocks are digital representations of traditional equity shares issued and settled on a blockchain, enabling 24/7 trading, fractional ownership, and global access. With market caps accelerating and liquidity deepening, investors—especially those outside the US—should secure platforms that balance compliance, custody, and interoperability. Year to date, tokenized stocks have grown 2,695%, the fastest of any tokenized asset class, making platform selection both urgent and consequential according to AMBCrypto analysis [1]. The scale ahead is vast: public equities are roughly $115 trillion globally versus tokenized stocks being closer to $16 million as recently as March 2025, underscoring how early we still are, per the IOSCO assessment of emerging risks [2].

The Rise of Tokenized Stocks in 2025

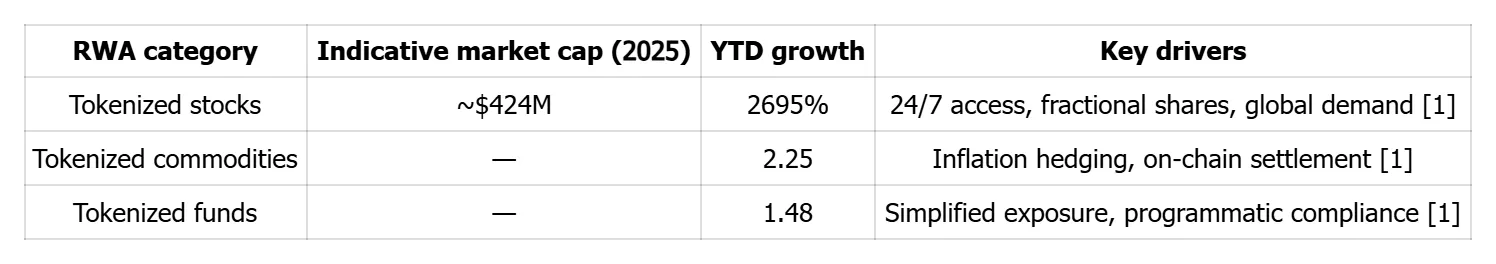

Tokenized stocks have become the breakout real-world asset (RWA) category of 2025. Year to date, market cap surged 2,695% to about $424 million—outpacing tokenized commodities (up 225%) and tokenized funds (up 148%) [1]. The catalysts are clear: always-on markets, fractional access for smaller tickets, and frictionless global participation.

Real-world asset tokenization is the process of issuing blockchain-based tokens that represent ownership interests in physical or traditional financial assets, enhancing accessibility, liquidity, and transparency.

RWA growth snapshot (2025 YTD):

Note: Published market caps for commodities and funds vary by source; growth rates reflect 2025 YTD trends reported by AMBCrypto [1].

Regulatory Advances Driving Market Adoption

Policy momentum has lowered the barrier to entry for issuers, platforms, and investors. In 2025, US regulators provided clarifications on digital asset market structures, while the SEC and CFTC advanced oversight approaches. Multiple jurisdictions—including the UAE, Singapore, the UK, and several US states—expanded regulatory sandboxes; an SEC no-action position further enabled new operational models, according to market trendlines compiled by Zoniqx and industry research from 21Shares [4][5].

A regulatory sandbox is a supervised environment where fintech companies can test innovative products and services under relaxed regulatory conditions, enabling faster development while regulators observe and assess potential risks and benefits.

Jurisdictional leadership matters. Asia—particularly Singapore, Hong Kong, and Japan—has moved quickly with fit-for-purpose licensing, while the UAE is attracting platforms and investors with pragmatic frameworks for tokenized markets [6]. The net effect: reduced compliance friction, clearer issuance pathways, and improved secondary trading prospects for tokenized equities.

Institutional Validation and Market Legitimacy

Institutional adoption is transforming tokenized equities into a credible, liquid market. BlackRock’s BUIDL, a benchmark tokenized product, reached roughly $1.87 billion in 2025—signaling mainstream asset-manager engagement [4]. On the demand side, IOSCO reports that 11% of institutional investors were already allocating to tokenized assets in early 2025, with 61% expected to participate by 2026 [2]. On-chain, TVL and volumes are consolidating around credible issuers and market venues: Ondo Finance at about $349.1 million TVL and Backed Finance around $163.9 million in 2025 are indicative of growing depth [7]. This participation strengthens product–market fit, narrows spreads, and improves exit optionality for both retail and professional users.

Multi-Chain Ecosystems and Platform Interoperability

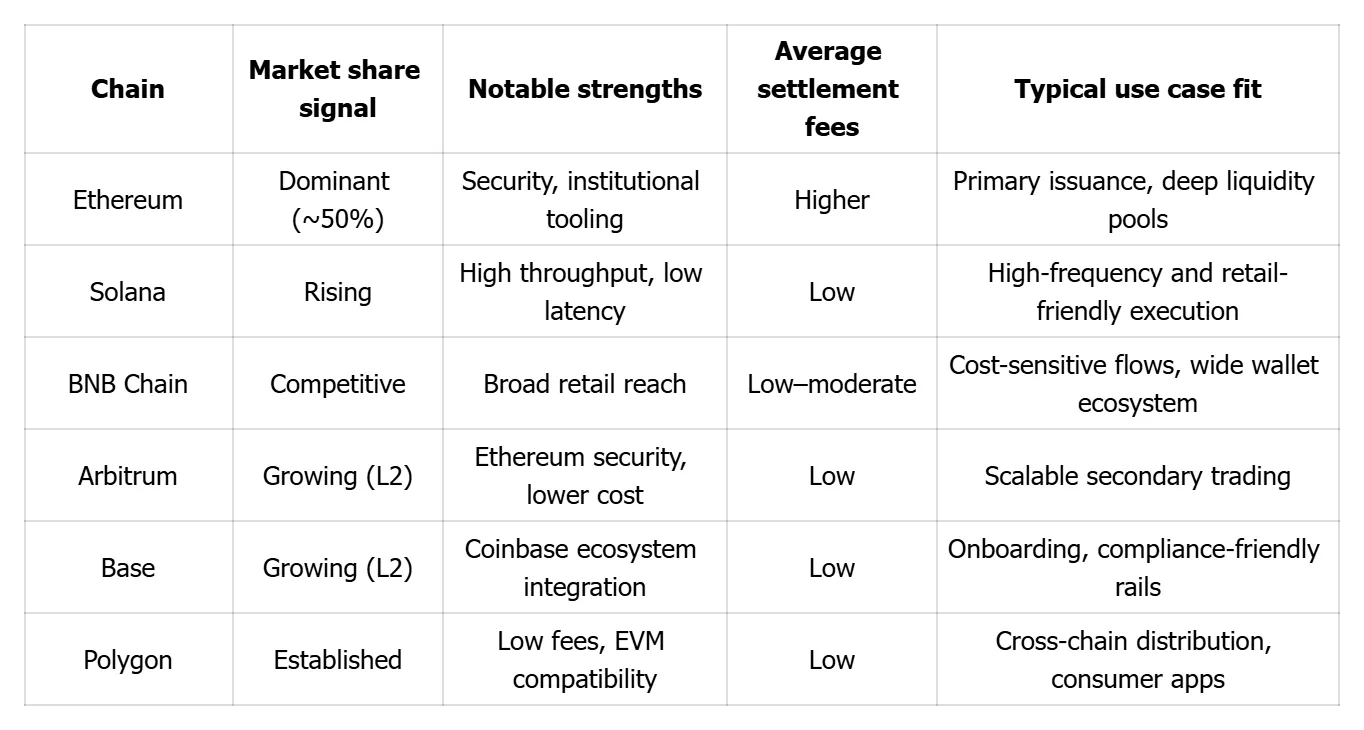

The best platforms are multi-chain by design. While Ethereum remains dominant at roughly 50% share in 2025, networks such as Solana, BNB Chain, Arbitrum, Base, and Polygon are capturing meaningful usage as issuers and market makers pursue speed and cost advantages [1][7]. Interoperability refers to a platform’s capacity to enable assets and transactions to move and settle seamlessly across multiple blockchain networks, enhancing user flexibility and reducing fragmentation [8]. In 2025, that capability is no longer a nice-to-have—it’s critical for asset coverage, cost management, and resilience.

Leading chains for tokenized stocks (2025 view):

Key Challenges and Trade-offs in Tokenized Stock Trading

Despite rapid progress, investors should calibrate expectations. On-chain trading volumes remain nascent—often under $1 million daily for some venues—while custody solutions and cross-border legal recognition of tokenized equity claims continue to evolve [7][6].

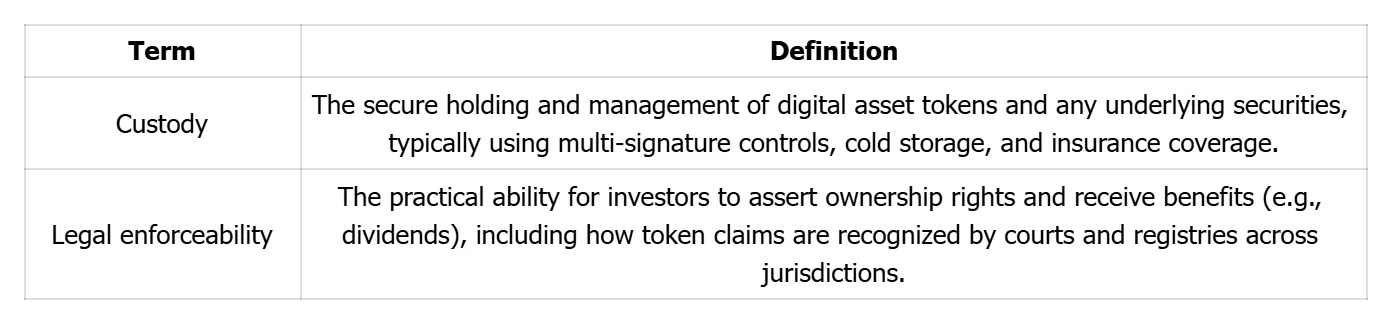

Key definitions:

Principal risks include:

- Liquidity gaps and wider spreads during off-peak hours

- Limited or conditional voting/dividend rights depending on structure

- Fragmented regulation that can affect tax, settlement, and recourse

How to Choose the Best Tokenized Stock Platform in 2025

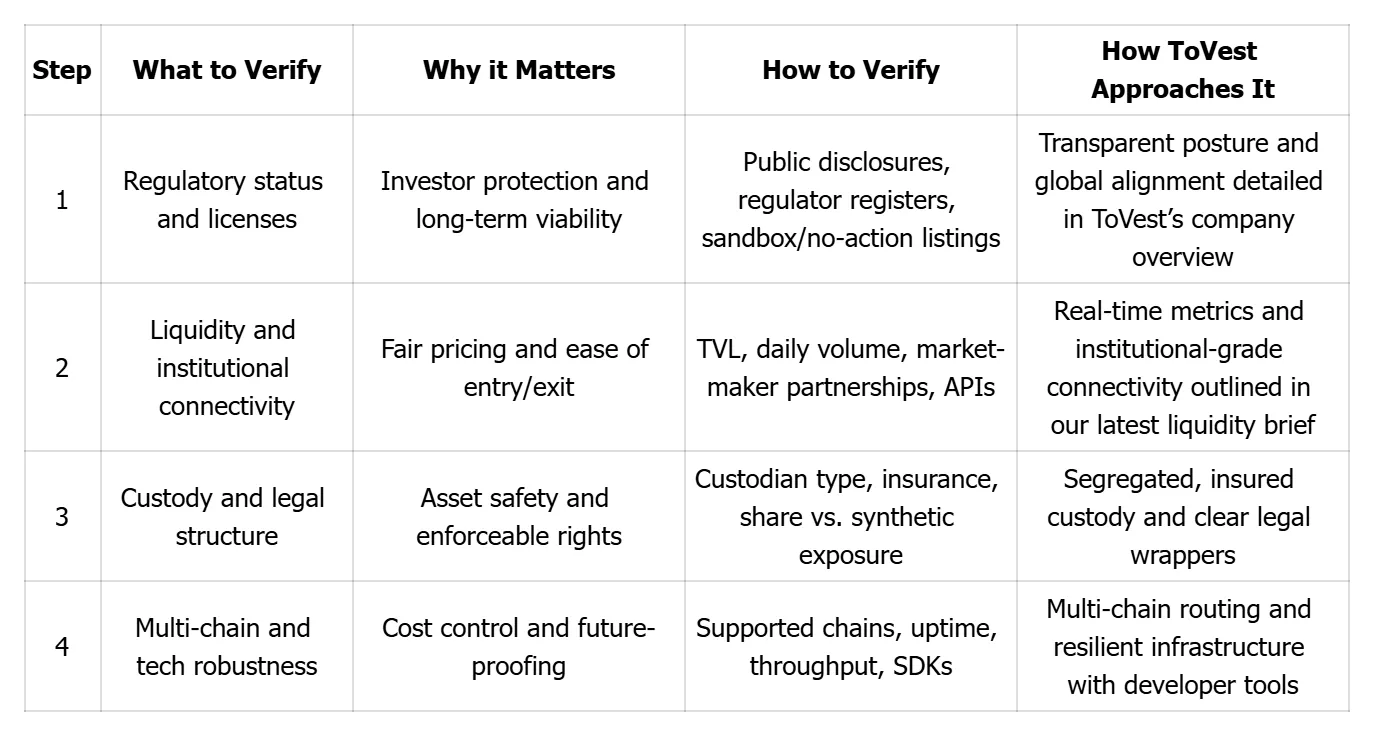

Use this four-step framework to evaluate platforms, whether you’re a US or non-US investor.

Selection flow at a glance:

See ToVest’s approach to security, licensing, and infrastructure on our About page: ToVest’s company overview (https://tovest.com/en-US/about). For methodology on liquidity tracking and data transparency, review our liquidity brief: ToVest liquidity insights (https://tovest.com/en-US/blog/report/574332).

Regulatory Compliance and Licensing

Treat regulatory standing as non-negotiable. Confirm licensing jurisdiction, approvals, and any sandbox or no-action participation; platforms operating under frameworks like the SEC or MiFID II typically offer stronger protections for international users [3]. Look for clear, up-to-date disclosures on the platform’s site.

Institutional Connectivity and Liquidity Metrics

Prioritize platforms that publish TVL, daily trading volume, bid–ask spreads, and market-maker relationships—and offer robust KYC/AML and API access for professional flows. Liquidity metrics are quantitative measures of how easily assets can be bought or sold with minimal price impact, including daily volume and spread depth.

Custody Solutions and Legal Enforceability

Evaluate whether the platform employs multi-signature controls, cold storage, and insurance; confirm if tokens convey direct share ownership or synthetic exposure. Given evolving standards, prioritize clear legal documentation and defined recourse paths in case of disputes or corporate actions [6].

Multi-Chain Support and Technology Infrastructure

Check supported chains, cross-chain mobility, uptime, and execution latency—ideally with SDKs for advanced users. Strong multi-chain support lowers fees, broadens access, and reduces the risk of dependency on any single network.

The Strategic Advantage of Acting in 2025

Early movers are capturing the best liquidity, issuer relationships, and on-chain network effects as asset coverage and volumes scale rapidly [1]. Waiting risks being locked out of deep pools as top platforms consolidate market share and institutional flow. Platforms that combine regulatory clarity, institutional ties, interoperability, and enforceable legal structures are best positioned to define the dominant networks of the next decade.

Frequently Asked Questions

What are tokenized stocks and how do they work?

Tokenized stocks are blockchain-based assets that represent shares in public companies, enabling 24/7, fractional trading and transparent settlement via smart contracts.

What should non-US investors consider when choosing a tokenized stock platform?

Confirm the platform’s licensing, cross-border access, local compliance obligations, and multi-currency funding to ensure smooth onboarding and withdrawals.

How do regulations impact the trading and ownership of tokenized stocks?

Regulations govern issuance, trading, and investor rights, affecting tax treatment, corporate actions, and the legal enforceability of token claims across jurisdictions.

What are the risks associated with tokenized stock platforms?

Key risks include thin liquidity on smaller venues, evolving legal frameworks, potential limits on shareholder rights, and technology or custody vulnerabilities.

How can investors assess the liquidity and security of a platform?

Review reported volumes and spreads, institutional partnerships, custody arrangements (including insurance), and the platform’s track record of secure operations.