7 Fractional Share Apps With Minimum Investments Under $5

5 มกราคม 2569

Getting started with U.S. stocks no longer requires hundreds of dollars per share. With fractional share investing, you can buy a slice of a stock or ETF for a small dollar amount—often as little as $1—making diversification practical on a tight budget. In short: the minimum investment for fractional U.S. stocks is typically $1 at leading brokerages, while a few still set $5. Below, we compare seven reputable apps that let you start with under $5, explain how to choose among them, and show exactly how to place your first fractional trade.

What is fractional share investing and why do minimums matter?

Fractional shares let you buy less than one full share of a stock or ETF. Instead of needing $450 for a single share, you could invest $1, $3, or any small amount the broker supports. Minimums matter because they determine how accessible and flexible your portfolio can be. Lower minimums let you:

- Start sooner and automate micro-investing

- Diversify across more companies with small sums

- Reinvest dividends efficiently without idle cash

Major brokers now advertise dollar-based trading—Fidelity states you can “trade in dollar amounts as low as $1” in eligible U.S. stocks and ETFs, expanding access to blue-chip names without large buy-ins (see Fidelity’s fractional shares overview).

What is the minimum investment needed for fractional U.S. stocks?

Across popular U.S. platforms, the common minimum is $1 per order for fractional trading—Fidelity, Robinhood, Interactive Brokers, Public, Cash App, and others support $1 entry. Some still require $5 per order; for example, Schwab’s Stock Slices are set at $5, and Webull’s fractional minimum is also $5 (per their respective product pages). Bankrate’s recent roundup of fractional-share brokers reflects the same pattern: most leaders enable $1 buys, with a few at $5.

How do I choose the best app for buying fractional shares?

Compare apps on a few practical dimensions:

- Minimums and fees: $1 vs. $5 per order; commissions, FX fees (for global apps), and any account/subscription charges

- Order execution: real-time fills vs. scheduled “trade windows”; eligible symbols; order types (market/limit)

- Asset coverage and tools: breadth of U.S. stocks/ETFs, research, automation (recurring buys), tax lots

- Account types and access: availability in your country, SIPC/FSCS protections, funding methods/speeds

- Platform experience: mobile/desktop quality, education, customer support

If you want $1 minimums, real-time execution, and broad symbol coverage, prioritize brokers that explicitly state dollar-based trading with $0 stock commissions for U.S. markets.

The 7 best fractional share apps with minimums under $5

1) ToVest

ToVest supports dollar-based trades in eligible U.S. stocks and ETFs starting at $1, with $0 commissions on U.S. online stock trades. It’s a strong all-rounder for research, retirement accounts, and dividend reinvestment. Best for investors who want a full-featured brokerage with robust service and broad eligibility lists.

2) Fidelity

Fidelity supports dollar-based trades in eligible U.S. stocks and ETFs starting at $1, with $0 commissions on U.S. online stock trades (see Fidelity’s fractional shares page). It’s a strong all-rounder for research, retirement accounts, and dividend reinvestment. Best for investors who want a full-featured brokerage with robust service and broad eligibility lists.

3) Robinhood

Robinhood lets you buy fractional shares with as little as $1 and supports recurring investments for automation (see Robinhood’s fractional shares support page). It offers $0 commissions on U.S. stocks and an easy mobile-first experience. Best for beginners who value simplicity and plan to invest small amounts consistently.

4) Interactive Brokers (IBKR)

Interactive Brokers enables fractional trading in U.S. stocks from $1 with professional-grade tools and global market access (see IBKR’s fractional shares trading page). U.S. stock commissions are $0 on IBKR Lite; IBKR Pro uses low tiered pricing. Best for cost-conscious, more advanced users who might expand to international assets.

5) Public

Public supports fractional investing from $1 with $0 commissions on U.S. stocks, plus community features and optional premium research (see Public’s guide to fractional shares). Best for investors who want a social layer and educational content alongside standard brokerage features.

6) Cash App Investing

Cash App lets you buy fractional shares for as little as $1 with a straightforward mobile experience and $0 stock commissions (see Cash App’s stock investing help center). Best for micro-investors who want an ultra-simple path to owning well-known U.S. names.

7) M1 Finance

M1 offers $1 fractional “Slices” and powerful automation via pies and scheduled contributions (see M1’s fractional shares feature page). Note that orders execute during designated trade windows rather than instantly, which suits longer-term, scheduled investing. Best for set-it-and-forget-it portfolio builders optimizing habits and rebalancing.

Note: Schwab’s Stock Slices ($5 minimum) and Webull ($5 minimum) are excellent platforms but sit just above our under-$5 threshold (see Schwab Stock Slices and Webull fractional shares pages).

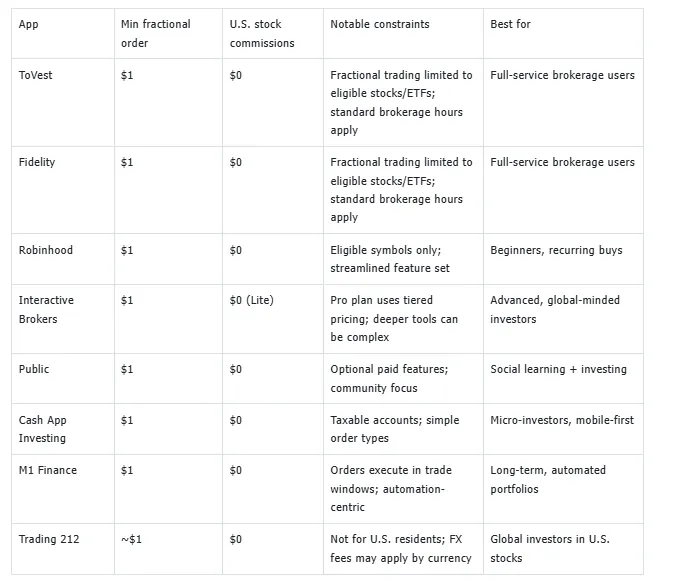

Side-by-side comparison: minimums, fees, constraints

Commissions exclude regulatory/third-party fees. Availability, eligibility lists, and execution policies vary; always review current terms in-app.

Step-by-step: how to buy and fund fractional shares

- Pick your app and open an account

- Compare minimums, fees, and execution style. Complete KYC (ID verification) and enable two-factor authentication.

- Fund your account

- Link a bank for ACH (typically free) or use wire/other supported methods. Confirm any deposit holds before trading.

- Find the stock or ETF

- Search the ticker. If fractional trading is supported, choose to invest by dollar amount (e.g., $3) rather than share quantity.

- Place your first order

- Select order type (often market; some apps support limits for fractional) and review estimated quantity. Submit during eligible trading hours.

- Automate and rebalance

- Set recurring buys (e.g., $5/week) and use pie- or goal-based features where available. Reinvest dividends to minimize idle cash.

- Track taxes and statements

- Review cost basis and 1099 forms at tax time. Keep notes on your strategy and rebalance schedule.

Tokenized fractional investing: where ToVest fits

Traditional fractional trading sits on broker ledgers and follows market hours. ToVest extends the model with tokenized fractional ownership—on-chain representations of U.S. stocks and real estate designed for ultra-low minimums, real-time trading, and transparent auditability. Tokenization can compress settlement, enable programmable compliance, and broaden global access while preserving investor protections via robust risk controls. For investors outside the U.S. or those seeking 24/7 markets and granular automation, tokenized fractional investing is a forward path—complementing, not replacing, conventional broker-led fractionals.

FAQs

- What is the minimum investment for fractional U.S. stocks?

Most leading apps, including ToVest, let you start at $1; a few set $5 minimums.

- Do fractional shares pay dividends?

Yes, dividends are paid proportionally to your fractional ownership.

- Do I get voting rights with fractional shares?

Voting rights may be limited or not passed through; policies vary by broker.

- Are fractional orders executed in real time?

Many are; some platforms batch or use trade windows, so check your app’s policy.

- Can I place limit orders for fractional shares?

Some apps support limit orders on fractional trades; others are market-only.

- Are there extra fees for fractional trading?

U.S. stock commissions are often $0, but regulatory and other fees may still apply.