Tokenized Stock Platforms Compared: Binance vs. Coinbase vs. Kraken

10 ธันวาคม 2568

The tokenization of U.S. stocks has created unprecedented opportunities for global investors, offering 24/7 trading, fractional ownership, and enhanced liquidity. Choosing the right platform is critical for security and cost efficiency.

This comparison focuses on the best platforms to trade on-chain U.S. stocks globally: Binance, Coinbase, and Kraken, highlighting their unique strengths for various investor profiles.

Overview of Tokenized Stock Trading Platforms

Tokenized stocks are digital representations of traditional equities that can be bought, sold, and held on a blockchain, enabling near-instant, 24/7 trading and global access to U.S. tokenized stocks.

The growing demand for tokenized stock trading platforms is driven by the desire for enhanced accessibility and flexibility in accessing real-world assets (RWAs).

Binance Tokenized Stock Features and Benefits

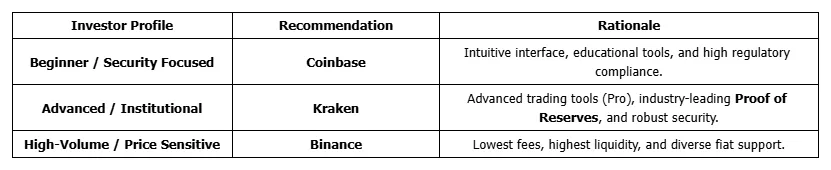

Binance appeals strongly to international, high-volume, and price-sensitive traders due to its vast ecosystem and low costs.

- Asset Portfolio & Liquidity: Binance supports over 400 cryptocurrencies globally and handles massive global volume (average daily spot trading volume of $\$14$ billion).

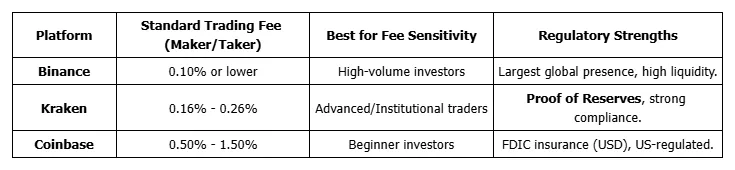

- Competitive Edge: Binance offers the lowest trading fees, typically starting at 0.10% or less. It provides advanced trading tools, including margin and perpetual futures, and supports over 40 languages, making it ideal for Binance for global investors.

- Regulatory Considerations: While offering broad access, Binance tokenized stocks and services may face regulatory scrutiny or limitations in certain jurisdictions.

Coinbase Tokenized Stock Features and Benefits

Coinbase is the go-to platform for beginners and US-based investors, prioritizing security and simplicity.

- User Experience: Renowned for its simple, clean UI, highly rated mobile app, and extensive educational resources, making it a perfect fit for Coinbase for beginners.

- Regulatory Strengths: Coinbase boasts strong regulatory compliance, offering FDIC insurance on US dollar balances and industry-leading security for crypto custody.

- Costs: Coinbase’s trading fees are the highest among the three, typically ranging from 0.50% to 1.50%. This may be a deterrent for cost-sensitive or high-frequency traders.

Kraken Tokenized Stock Features and Benefits

Kraken is a favourite among advanced and institutional traders, emphasizing security, regulatory rigor, and an advanced trading suite.

- Security & Trust: Kraken was the first exchange to pioneer a real-time Proof of Reserves system, providing cryptographic audits that verify client assets are fully backed, reinforcing client confidence.

- Trading Environment: Offers an advanced trading suite (Kraken Pro), supports over 450 cryptocurrencies, and provides global reach in over 190 countries.

- Fees: Kraken's fees are competitive, usually ranging from 0.16% to 0.26%. Its focus on compliance and security makes it one of the best exchanges for tokenized US stocks for experienced users. The platform offers access to tokenized stocks via xStocks for European and global clients.

Comparison of Trading Fees and Costs

Trading costs significantly impact returns, especially for active trading.

Note: These fees are for standard spot trading and may vary based on volume or the specific tokenized product traded.

Security Measures and Regulatory Compliance

When trading on-chain U.S. stocks, security is paramount.

- Proof of Reserves: This is a public, cryptographic audit that proves an exchange’s assets cover user deposits, directly enhancing transparency and client confidence. Kraken leads in this area.

- Coinbase provides high regulatory compliance and cold storage for the majority of crypto assets, plus FDIC insurance for USD balances.

- Binance utilizes a Secure Asset Fund for Users (SAFU), but generally faces more regulatory scrutiny than its US-compliant counterparts.

Advantages of Buying On-Chain U.S. Stocks for Global Investors

Tokenization fundamentally changes the investment landscape, delivering unique benefits primarily through the blockchain:

- 24/7 Trading and Instant Settlement: The elimination of traditional market hours and the use of blockchain infrastructure mean cross-border investments settle instantly, removing banking bottlenecks.

- Increased Accessibility: Investors worldwide gain exposure to US equities without legacy restrictions, high minimum order sizes, or institutional barriers typically found in traditional markets.

- Fractional Ownership: Blockchain allows for the division of expensive shares into affordable fractions, lowering the entry cost dramatically.

Tokenization is the process of converting traditional assets into digital tokens on a blockchain, making them tradable globally with enhanced speed and transparency.

Which Platform Is Best for Different Investor Profiles?

Choosing the right platform depends entirely on your experience and needs:

Frequently Asked Questions about Tokenized Stock Trading Platforms

What are tokenized stocks?

Tokenized stocks are blockchain-based digital representations of real-world stocks, allowing investors to trade fractions or whole shares online 24/7 without traditional market limitations.

Are tokenized stocks safe to trade?

Tokenized stocks can be safe when traded on secure, regulated platforms that employ robust security features like insurance, cold storage, and regular asset audits, like Kraken's Proof of Reserves.

Which platform has the lowest trading fees for tokenized stocks?

Binance typically offers the lowest trading fees for tokenized stocks among leading platforms, with rates starting at 0.10% or less, making it attractive for high-volume traders.

Can global investors buy US stocks on-chain?

Yes, many platforms allow global investors to buy US stocks on-chain through tokenization, overcoming many of the geographic and operational barriers found in traditional stock markets.

Would you like to learn more about the specific security features, like Proof of Reserves, that Kraken uses to protect client assets?