How ToVest Solves Compliance Risks When Buying Tokenized Stocks

30 ธันวาคม 2568

Tokenized stocks open global, 24/7 access to equity exposure—but they also introduce new compliance risks around investor eligibility, custody, price accuracy, and cross-border rules. This article explains how ToVest builds safeguards into every layer of the experience so you can buy tokenized stocks confidently. We cover ToVest’s compliance-by-design controls, custody alignment with legal ownership, continuous risk monitoring, and what the buying process looks like end to end. If you’re wondering how ToVest ensures regulatory compliance and how to start buying tokenized stocks on ToVest, you’ll find the essentials—plus the protections that work quietly in the background to keep markets fair, secure, and audit-ready.

Understanding Compliance Risks in Tokenized Stocks

Tokenized stocks are blockchain-based representations of traditional shares that allow fractional ownership and always-on trading, but they often sit at the edge of existing rules, creating gray areas for issuers, venues, and investors. Common challenges include unclear legal status, inconsistent investor protections, and differing treatment across jurisdictions, as highlighted in an industry overview on tokenized stock compliance questions by StarCompliance.

In institutional surveys, 49% of firms cite custody rules, 47% point to AML/KYC, and 41% to cross-border compliance as top hurdles when adopting tokenized assets.

These concerns underscore the need for strong investor protections, rigorous AML/KYC measures, and cross-border compliance integrated into platform design.

ToVest’s Compliance-by-Design Framework

ToVest embeds regulatory logic directly into asset issuance, trading workflows, and data pipelines. This reduces manual intervention, minimizes legal and operational risk, and supports fast, verifiable audits.

Token Standards and Transfer Restrictions

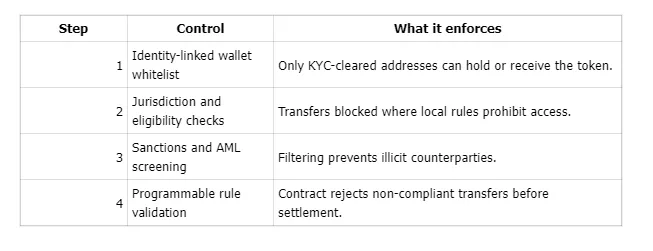

ToVest employs programmable token standards—such as ERC‑1400-style mechanisms—to enforce transfer rules at the smart contract level. Features like transfer restrictions, identity tagging, and whitelists ensure that only verified, eligible holders can receive or trade tokens.

How token transfer restrictions work:

Automating these checks inside token contracts reduces human error, removes friction for approved users, and keeps audit trails consistent and machine-verifiable.

Identity Verification and Holder Eligibility

Every investor must complete KYC/AML before accessing tokenized assets. ToVest collects and verifies names, birthdates, addresses, and supporting documents, then screens users against sanctions and watchlists in line with securities and financial crime rules. Identity-linked wallets and whitelisting ensure only eligible, verified participants transact, while jurisdictional screening helps maintain international regulatory compliance.

Custody Integration and Legal Ownership Alignment

ToVest integrates with regulated custodial infrastructure and transfer-agent workflows so on-chain balances map to enforceable, off-chain ownership records. This closes the “dual records” gap and aligns tokenized holdings with real-world share registries—critical for investor protections and corporate actions.

Ownership flow from purchase to registration:

- User buys a tokenized stock on ToVest (compliant address and order flow).

- Custodian settles and records the position in segregated, institution-grade storage.

- Transfer agent or registry linkage updates legal ownership records aligned to the token balance.

- Corporate actions and disclosures reflect the registered holder record.

Continuous Risk Monitoring and Data Analytics

ToVest augments programmable compliance with real-time analytics across on-chain and off-chain data to detect anomalies early and preserve market integrity.

Real-Time Risk Alerts and Anomaly Detection

By aggregating blockchain telemetry, order book activity, reference prices, and counterparty signals, ToVest builds dynamic risk profiles for each asset and venue. Real-time alerts flag unusual price divergence from the underlying equity, abnormal flow patterns, or suspicious transactions so the platform can intervene quickly with throttles, enhanced checks, or order halts.

On-Chain and Off-Chain Data Reconciliation

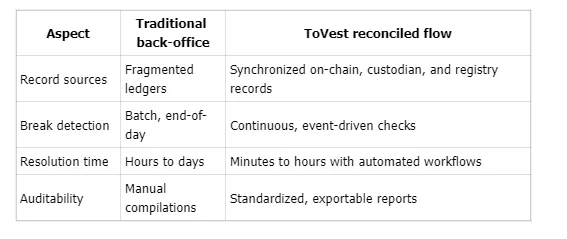

ToVest continuously reconciles token balances with custodial books and registered ownership records, reducing settlement breaks and operational disputes. This approach addresses the dual-records challenge common in tokenization and enhances transparency around who owns what, where, and under which rights.

Traditional vs. reconciled flows:

Custody, Valuation, and Security Controls

ToVest’s controls emphasize safe custody, accurate pricing, and hardened infrastructure to protect investors and maintain regulatory confidence.

Partnering with Regulated Custodians

A regulated custodian is a licensed, audited institution that securely manages digital asset storage and settlement. ToVest partners with such providers to reduce counterparty and operational risks, support asset segregation, and align with institutional best practices. Selection criteria include licensing, insurance coverage, proof-of-reserves or attestation practices, and operational transparency.

Price Feed Validation and Oracle Management

To keep tokenized stock prices aligned with the underlying equity, ToVest vets oracle providers and implements safeguards to validate off-chain market data. An oracle is a service that supplies smart contracts with external data—such as stock prices—to trigger actions reliably. Cross-source checks, outlier filters, and circuit breakers help prevent valuation drift and reduce market-manipulation risk.

Smart Contract Audits and Private Key Security

ToVest commissions regular, independent audits of smart contracts to find and fix vulnerabilities before deployment and during upgrade cycles. A private key is a cryptographic code that authorizes blockchain transactions; ToVest secures keys with multi-party controls, hardware security modules, and cold storage, reducing the likelihood of unauthorized access or loss.

Regulatory Alignment and Operational Compliance

ToVest continually updates workflows and controls to reflect changing rules across regions while keeping the user experience intuitive and transparent.

Jurisdictional KYC and AML Workflows

Onboarding and monitoring incorporate region-specific requirements for AML and KYC, with documented procedures, evidence retention, and periodic refresh cycles to pass audits and examinations. This supports cross-border compliance without compromising user privacy or speed.

Transfer Whitelists and Corporate Action Enforcement

A transfer whitelist is a list of pre-approved, verified accounts permitted to receive or transfer tokenized assets. ToVest enforces whitelists and embeds corporate actions—such as dividends, redemptions, and splits—into token logic where the asset structure allows. Where third-party tokens do not include voting or dividend rights, ToVest discloses those limitations clearly.

Disclosure and Investor Communication

Transparent, standardized disclosures help investors understand product features and limitations—such as legal rights, custody models, and market risks. ToVest supplements offering pages with FAQs and responsive support to minimize misunderstanding and facilitate dialogue with regulators and partners.

How to Buy Tokenized Stocks on ToVest

Buying tokenized stocks on ToVest is designed to be safe, straightforward, and compliant from the first click to final settlement.

Creating and Verifying Your Account

To create your account, sign up with your email and set up two-factor authentication. Prepare these documents for verification:

- Government-issued ID (passport or national ID)

- Proof of address (utility bill or bank statement)

- Selfie or liveness check, as prompted

Verification fulfills AML/KYC requirements and confirms regional eligibility before trading.

Funding Your Wallet and Depositing Crypto

Supported funding options include:

- Bank transfer: fiat rails where available

- Stablecoins: on-chain deposits of major USD-pegged assets

- Crypto transfers: deposits from your external wallet

Funds are credited after network confirmations and compliance checks. Settlement times vary by rail and chain congestion.

Navigating the Tokenized Stock Market Interface

Find and evaluate assets quickly:

- Search for the ticker or issuer name.

- Open the asset page to review disclosures, risk flags, and reference pricing.

- Use filters for sectors, regions, or liquidity bands.

- Review real-time charts and depth-of-book before placing an order.

Feature highlights:

Executing Trades with Real-Time Data and Margin Options

Ultra-low latency trading means orders route and confirm quickly, improving price realization in fast markets. To place a trade:

- Choose market or limit order.

- Enter size (including fractional amounts).

- Optional: enable approved margin or leverage, subject to eligibility and risk limits.

- Review estimated fees and confirm.

Execution uses consolidated reference data and surveillance to promote price fairness and stability.

Securing Your Tokenized Assets

ToVest safeguards assets with institutional custody, cold storage, private key controls, and account-level protections like two-factor authentication and withdrawal allowlists. If you self-custody, secure your private keys, use hardware wallets when possible, and consider platform custody for larger balances or long-term holds.

Frequently Asked Questions

What regulations apply to tokenized stock trading?

Tokenized stock trading is shaped by securities laws, AML/KYC rules, and jurisdiction-specific requirements that govern investor eligibility, disclosures, and market conduct.

How does ToVest protect against custody and counterparty risks?

ToVest relies on regulated custodians, segregated storage, and continuous counterparty monitoring to minimize the likelihood of asset loss or operational failures.

Can I trade tokenized stocks globally on ToVest?

Global access is available, but trading depends on your region’s regulations and eligibility confirmed during verification.

What investor protections exist with tokenized stocks?

Protections include whitelisting, identity-linked wallets, secure custody, transparent disclosures, and continuous compliance monitoring, though some traditional rights may not apply to all tokens.

How does ongoing compliance monitoring benefit users?

Real-time monitoring identifies anomalies early and enables swift responses, helping mitigate fraud, pricing errors, and market risk.