How To Buy Fractional US Shares From Anywhere With These Five Services

9 ธันวาคม 2568

Accessing the lucrative U.S. stock market is no longer limited by geographical borders or high capital requirements. Thanks to advancements in fintech and blockchain technology, fractional US share investing platforms for global investors have democratized ownership.

This guide provides a comprehensive, step-by-step walkthrough and comparative look at the top services allowing global investors to gain US stocks access by purchasing fractions of shares.

What Are Fractional US Shares?

Fractional shares are portions of a single share of stock, allowing investors to buy and own less than one whole share. This enables investors to access high-priced stocks with any dollar amount, breaking down barriers to diversification and participation.

This method is critical for global investors because:

- Minimal Capital Required: You can invest in expensive blue-chip companies like Amazon or Google with as little as $1 to $5.

- Portfolio Diversification: It enables easy diversification across many sectors and companies, even with a small budget.

- Investment Flexibility: You can invest specific dollar amounts (Dollar-Cost Averaging, DCA) rather than worrying about the current share price.

5-Step Guide to Fractional US Share Investing

The process of buying fractional shares as a global investor is straightforward, provided you select the right platform.

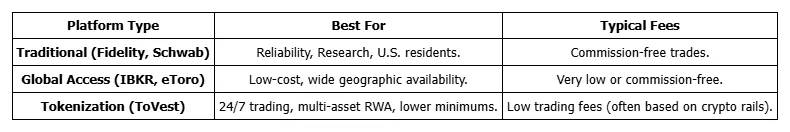

Step 1: Choose a Broker That Supports Fractional Shares & Global Access

The first and most critical step is selecting a platform that not only offers fractional share investing but also accepts non-U.S. residents.

- Traditional Brokers: Firms like Interactive Brokers (IBKR) and eToro offer wide international coverage.

- Next-Gen Platforms: Platforms like ToVest leverage tokenization (Real-World Assets) to offer 24/7 fractional equity access globally, often simplifying the account setup.

Step 2: Open and verify Your Brokerage Account

The international account opening process is now largely digital.

- Registration: Complete an online application, providing personal details.

- KYC/AML: You must complete the Know Your Customer (KYC) process, which requires identity verification. Prepare essential documents such as a government-issued ID and proof of residence (utility bill or bank statement).

- Global Tip: Check the platform's service agreement to confirm they accept residents from your country before starting the process.

Step 3: Fund Your Investment Wallet

Once your account is verified, you need to deposit funds.

- Funding Methods: Common methods include bank transfers, credit/debit card, or wire transfers.

- Crypto Option: Next-generation platforms like ToVest often allow deposits via stablecoins (USDT, USDC), which is faster and avoids traditional banking fees and delays for global investors.

- Fees: Be mindful of currency conversion and remittance fees, which vary significantly between platforms.

Step 4: Search and Select Your Desired US Stock

Access your platform's interface and find the stocks you wish to purchase fractionally.

- Search: Use the stock's name (e.g., "Apple") or its ticker symbol (e.g., "AAPL") to pull up the asset page. A ticker symbol is a short code used to uniquely identify publicly traded shares on an exchange.

- Fractional Order: On the order screen, choose the fractional order option. You will typically be prompted to place a fractional share order by dollar amount (e.g., "$50 worth of Tesla") rather than by the number of shares.

Step 5: Review and Confirm Your Purchase

Before finalizing, always review the details of your order.

- Review: Double-check the investment amount, the selected stock, and the estimated share fraction the broker calculates in real-time.

- Confirmation: Confirm the purchase. The platform will execute the order and record your fractional ownership, either via a traditional ledger or, in the case of tokenized platforms, on a transparent blockchain ledger.

Top Fractional US Share Investing Platforms for Global Investors

ToVest: Next-Generation Tokenized Equities

ToVest is a leading digital trading platform that extends the fractional investing paradigm by leveraging blockchain tokenization of real-world assets.

Tokenization is the process of converting ownership rights in real-world assets, such as stocks or property, into digital tokens recorded on a blockchain. This creates new ways to trade fractions of assets securely, efficiently, and transparently.

- Unique Selling Point: Offers 24/7 access and blockchain settlement, differentiating it from traditional brokers who are bound by U.S. market hours.

- Global Accessibility: Designed from the ground up for global investors, integrating crypto funding rails (like USDT) for seamless cross-border transactions.

- Asset Class: Specializes in tokenized Real-World Assets (RWA), providing access to fractional U.S. equities alongside tokenized gold and other assets.

Interactive Brokers (IBKR): For Advanced Global Traders

Interactive Brokers is renowned for its low fees, advanced tools, and unparalleled global reach, making it ideal for experienced international investors.

- Fractional Trading: Gives access to over 10,500 US stocks and ETFs via fractional shares.

- Fees: Extremely low trading commissions, with highly competitive margin rates.

- Global Scope: Offers accounts to clients in over 200 countries and territories.

Fidelity: Best for Reliable U.S. Access

Fidelity is a top-tier traditional broker known for its reliability and excellent customer service.

- Fractional Trading: Its "Stocks by the Slice" feature allows purchases as low as $1, covering over 7,000 U.S. stocks and ETFs commission-free.

- Key Feature: Supports automatic dividend reinvestment into fractional shares, fueling long-term growth.

- Note: While a U.S. leader, international access can be more restricted than with IBKR or eToro.

Charles Schwab: The S&P 500 Specialist

Charles Schwab combines the reliability of a major institution with modern fractional investing features.

- Fractional Trading: Offers "Stock Slices," allowing the purchase of fractional shares of S&P 500 companies starting from just $5 per slice.

- Fees: Commission-free stock and ETF trading.

- Advantage: Provides robust research and tools, which is helpful for global investors researching US stocks access.

eToro: The Social Trading Platform

eToro blends commission-free fractional trading with a unique social investing experience, popular with a new generation of investors worldwide.

- Fractional Trading: Offers low stock and ETF fees and a seamless account opening process.

- Social Feature: Its "CopyTrader" feature allows users to automatically copy the trades of successful investors.

- Accessibility: Known for its wide accessibility for international account holders and simple user flows for fractional orders.

Key Benefits and Important Considerations for Global Investors

Benefits of Fractional Share Investing

Fractional shares are a powerful tool for accessible stock investing:

- Lowers Capital Barriers: Enables investment in top U.S. companies with as little as $1 to $5.

- Facilitates DCA: Makes it easy to employ dollar-cost averaging by investing a fixed amount monthly, regardless of share price volatility.

- Full Portfolio Diversification: You can spread $500 across 50 different stocks instead of buying one or two whole shares.

Important Considerations for Global Investors

While fractional US share investing platforms for global investors offer massive access, be aware of key hurdles:

- Platform Availability: Not all U.S.-based brokers (like Robinhood) accept non-U.S. residents. You must check your eligibility for each platform.

- Currency Conversion Fees: When funding your account with non-USD currency, you will incur conversion fees. Using platforms that accept stablecoins (like ToVest) can sometimes mitigate these costs.

- Tax Implications: Taxation of US stocks abroad is complex. Global investors must review local tax laws concerning U.S. dividends and capital gains and understand the IRS's W-8BEN form for non-U.S. persons.

Frequently Asked Questions

What are fractional US shares and how do they work?

Answer: Fractional US shares let investors buy a portion of a single share, making it possible to invest small amounts in high-priced stocks and build diversified portfolios easily.

Can I buy fractional US shares from outside the US?

Answer: Yes, many online brokerage platforms and tokenization services (like ToVest, IBKR, and eToro) now allow international investors to buy fractional US shares, though some country-specific restrictions may apply.

What is the minimum investment amount for fractional shares?

Answer: Minimum investments typically start as low as $1 to $5 on most major platforms, making fractional share investing accessible to nearly everyone.

Do fractional shares pay dividends and how are they handled?

Answer: Yes, if a stock pays dividends, holders of fractional shares are paid a proportional amount. Many platforms allow these to be automatically reinvested into more fractional shares.

Are fractional shares commission-free or subject to extra fees?

Answer: Most leading platforms offer commission-free trading for fractional shares. However, global investors must review each platform’s fee structure for potential currency conversion or withdrawal costs.