2026 Outlook: Risks and Rewards of Buying US Stocks with Crypto

15 มกราคม 2569

Crypto is becoming a real gateway to U.S. equities in 2026, offering faster settlement, 24/7 access, and fractional ownership—but also introducing new risks around volatility, compliance, and product design. This article weighs the risks and benefits of buying US stocks with crypto, focusing on tokenized stocks, stablecoin settlement, and crypto‑linked financial products. Tokenized stocks are digital assets that represent fractional or full ownership of a U.S.-listed equity and are issued and settled via blockchain. Our goal is to give global investors clear, practical guidance on using crypto to access U.S. shares. ToVest’s mission is to provide a secure, technologically advanced bridge between crypto and traditional capital markets—bringing transparency, speed, and risk management to tokenized equity exposure.

The Emerging Landscape of Crypto in US Stock Investment

Crypto rails are reshaping how global investors access U.S. equities. A renewed, accelerating push to tokenize real‑world assets is forecast for 2026, with on-chain wrappers for stocks and funds expected to scale meaningfully, according to the 2026 Crypto Outlook from Trakx’s industry survey and analysis (2026 Crypto Outlook). At the same time, the scale of crypto’s institutional footprint is expanding: Grayscale estimates that U.S.-listed crypto exchange-traded products (ETPs) and digital asset treasuries now hold roughly $220 billion, a sign of deepening and diversified on-ramps for investors (2026 Digital Asset Outlook).

Tokenization is the process of converting ownership rights in assets—such as U.S. stocks—into digital tokens recorded and transferred on a blockchain.

Key market players and instruments:

- Tokenized stock products (including platforms like ToVest)

- Stablecoin settlement rails (e.g., USDC, USDT)

- Crypto-linked ETFs, ETPs, and digital asset treasuries (DATs)

Benefits of Using Crypto for US Stock Purchases

Stablecoins are streamlining settlement by moving value quickly, programmatically, and often at lower cost. Multiple analysts expect stablecoins to handle more annual volume than U.S. ACH and become core payment plumbing for financial markets if current growth persists (Crypto Predictions 2026). Stablecoins are cryptocurrencies designed to maintain a stable value by being pegged to a reserve asset, commonly the U.S. dollar, and are widely used to facilitate rapid, low-cost settlement.

What that means for investors:

- 24/7 trading access across time zones, not bound to traditional market hours

- Instant or near‑instant funding and settlement via stablecoins

- Global accessibility with fewer frictions for cross‑border participation

- Fractional ownership of high‑priced U.S. shares, improving inclusivity and precision in position sizing

Mainstream integration is building: Grayscale estimates crypto exposure may already represent about 0.3% of total U.S. wealth management intermediary assets, underscoring a shift from niche experimentation to institutional evaluation (2026 Digital Asset Outlook).

Risks and Challenges of Buying US Stocks with Crypto

Volatility remains the headline risk. Crypto’s day‑to‑day price swings typically exceed those of broad U.S. equity benchmarks; in short, crypto remains markedly more volatile than many individual stocks and sectors (2026 Crypto Outlook). Exposure design matters, too: crypto‑tied equities—like miners—often behave like leveraged bitcoin, falling harder when bitcoin drops (US crypto stocks early 2026 commentary).

Digital Asset Treasuries (DATs) are firms that hold crypto as a core balance‑sheet strategy, which can increase their sensitivity to crypto market swings.

Design and operational risks are real. Rapid product innovation can outpace rigor; poorly structured token instruments or leverage assumptions can trigger forced deleveraging in stress scenarios (2026 Crypto Outlook).

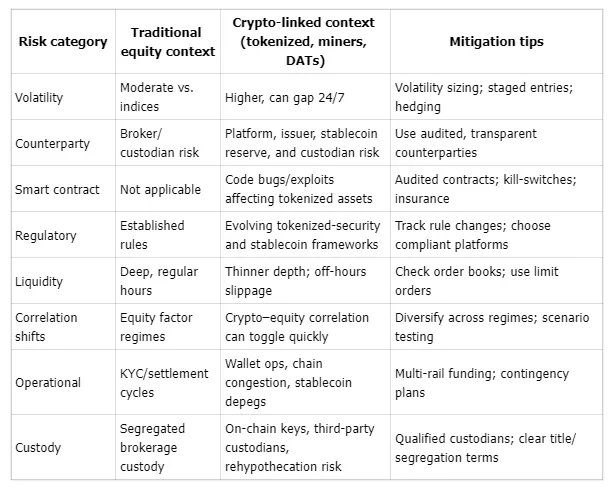

Risk comparison table:

Regulatory and Tax Considerations in Crypto-Equity Transactions

The rules are evolving. Some jurisdictions are clarifying tokenized‑security and stablecoin regimes, but shifting obligations can affect product access, disclosures, and investor protections (2026 Crypto Outlook). Regulatory risk is the potential for policy actions or law changes to materially alter availability, structure, or taxation of investments—including tokenized or crypto‑linked stocks.

Key oversight and compliance touchpoints:

- Principal regulators: SEC (securities), CFTC (derivatives), FINRA (broker‑dealers), U.S. Treasury/OFAC (sanctions), and IRS (tax); abroad, ESMA/EU national regulators, UK FCA, MAS (Singapore), and others.

- Common requirements: securities classifications for tokenized stocks, KYC/AML for platforms, cost‑basis and capital‑gains reporting, Form 1099 equivalents, and cross‑border transfer controls for stablecoins and tokens.

For current requirements and platform‑specific support, see ToVest’s investor compliance guidance in the Academy library (ToVest: Compliance essentials for tokenized equities).

Market Structure and Liquidity Implications of Tokenized Stocks

Institutions expect tokenization to enable on‑chain wrappers for funds and tokenized shares—delivering faster settlement, 24/7 markets, and fractional access (2026 Crypto Outlook). Liquidity, however, is not uniform: niche tokenized equities can trade with thin depth, and crypto‑equity correlations can break down in stress, raising execution risk (2026 Crypto Outlook).

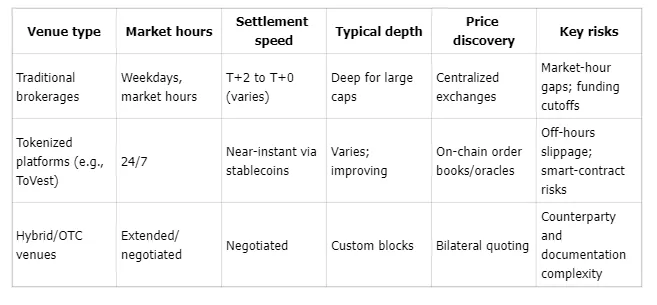

Liquidity comparison:

Liquidity refers to how quickly and efficiently an asset can be bought or sold without moving the price.

Institutional Adoption and Its Impact on Crypto-Linked Stock Trading

Institutional participation is set to scale. Bitwise expects more than 100 crypto‑linked ETFs to launch in the U.S. in 2026, broadening access and standardizing product design (Bitwise 2026 predictions). As asset managers, endowments, and pensions increase participation, their flows can deepen order books, strengthen governance, and push for tighter risk controls.

Factbox:

- US‑listed crypto ETPs and digital asset treasuries hold roughly $220B in assets—evidence that institutional rails are already meaningful (2026 Digital Asset Outlook).

Growing institutional adoption should support liquidity and price discovery, reducing reliance on retail-only activity and improving resiliency during market stress.

Technological Innovations Enabling Crypto-Based Stock Access

Platforms like ToVest leverage blockchain to deliver ultra‑low latency trading, robust analytics, and secure payment and settlement processing—bringing traditional market standards to tokenized equities. Fractional ownership allows investors to buy a portion of a high‑priced U.S. stock, opening blue‑chip exposure to smaller tickets and finer portfolio calibration.

Stablecoins and programmable settlement are maturing into core financial infrastructure for payments, settlement, and liquidity, enabling composable, automated workflows across venues (Crypto Predictions 2026). Meanwhile, the expanding use of audited smart contracts and scaled tokenization pilots is reducing manual handoffs and operational error paths, a vital step for institutional comfort (2026 Crypto Outlook).

Strategic Considerations for Investors Using Crypto to Acquire US Stocks

A disciplined approach can harness upside while containing risk. Industry analyses recommend focusing on counterparty and custody diligence, regulatory readiness, volatility sizing, and product design scrutiny to avoid hidden exposures (2026 Crypto Outlook).

Checklist for evaluating a platform or product:

- Security and transparency: audited smart contracts, proof of reserves/segregation, and clear custodial arrangements

- Regulatory posture: licensing, disclosures, investor protection regime, and jurisdictional scope

- Liquidity and exits: depth across hours, market‑making commitments, and fallback exit routes during outages

Monitor leading indicators of sustainable growth: flows into crypto ETFs and DATs, new stablecoin regulations, the progress of tokenization pilots, and the breadth of high‑quality market makers. Volatility sizing—adjusting allocation to more volatile assets to keep portfolio risk within target bands—can help right‑size exposure as regimes change.

Frequently Asked Questions about Buying US Stocks with Crypto

Will Crypto ETFs and Tokenization Make Buying US Stocks Easier in 2026?

Yes. With over a hundred new crypto‑linked ETFs expected and broader tokenization, access should be faster, more accessible, and supported by improved settlement technologies.

What Are the Projected Returns for US Stocks vs. Crypto in 2026?

Several 2026 outlooks see crypto‑related equities outpacing some tech segments, with bitcoin’s volatility moderating and correlations shifting to offer diversification in select windows.

Key Risks: Volatility and Regulatory Hurdles?

Yes—price swings can be sharp and rules are evolving, so investors should prepare for rapid market moves and confirm compliance and reporting obligations.

Rewards from Institutional Adoption and M&A?

Rising institutional participation and industry consolidation are strengthening product design and market plumbing, which can enhance reliability and access.

Best Strategies for Buying US Stocks with Crypto in 2026?

Use secure stablecoin or bank custody, diversify positions, and track flows, regulatory milestones, and tokenization progress to manage risk and seize new opportunities.