2025’s Most Liquid Tokenized Asset Platforms for Immediate Investment

15 ธันวาคม 2568

ToVest positions itself as a technology-driven leader enabling secure, ultra-low latency trading of diverse tokenized real-world assets, with a focus on liquidity, transparency, and 24/7 market accessibility.

This guide focuses on the critical factor for modern investors: liquidity. For fast entries and exits in the dynamic market for tokenized real-world assets (RWAs), choosing a platform that guarantees deep liquidity is essential.

Introduction to Tokenized Assets and Liquidity

Tokenization allows for the digital representation of real-world assets (RWAs) like real estate, stocks, and commodities using blockchain technology.

- Definition: Tokenized assets are blockchain-based digital tokens representing ownership rights or economic interest in real-world assets, enabling fractional ownership and secure transactions.

- The Liquidity Imperative: Liquidity is the ease and speed with which an asset can be bought or sold without significantly affecting its price. It is the primary factor for investors seeking rapid entries and exits.

The tokenized asset market has experienced explosive growth in 2025, driven by the appeal of instant, global access and the speed of blockchain settlement.

ToVest Tokenized Asset Platform

ToVest is engineered to address the core challenges of RWA trading—speed and security—making it an ideal platform for investors asking how to buy tokenized assets with confidence.

- Ultra-Low Latency: ToVest’s infrastructure delivers high-speed trading, crucial for managing tokenized assets that are traded 24/7.

- Security and Compliance: We incorporate robust security features and regulatory adherence, providing a transparent and compliant environment.

- Diverse Exposure: ToVest aggregates diverse tokenized assets in one user-friendly ecosystem, giving investors seamless access to liquid RWA exposure.

A tokenized asset platform is a digital trading venue where real-world assets are represented as blockchain tokens, enabling fractional ownership, secure transactions, and global accessibility.

Top Liquid Tokenized Asset Platforms (The Investment Gateway)

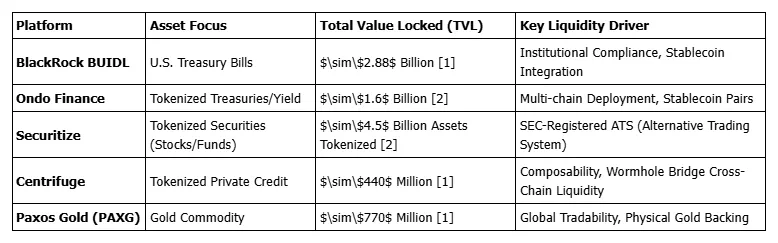

The platforms below represent the most liquid tokenized asset platforms available in 2025, offering deep pools in high-demand assets like U.S. Treasuries and private credit.

BlackRock BUIDL

Launched in 2024, BlackRock BUIDL is the largest on-chain tokenized fund, with a TVL nearing $2.88 billion. It merges institutional finance standards with blockchain, providing highly compliant, liquid on-chain exposure to U.S. Treasury bills—a huge draw for high-volume investors.

Ondo Finance

Ondo Finance is an institutional-grade RWA platform, specializing in tokenized treasuries and yield markets with over $1.6 billion in tokenized assets. Its multi-chain deployment capabilities enhance liquidity across networks like Ethereum, Solana, and Base.

Securitize

Securitize is an industry leader in tokenized securities, with over $4.5 billion in assets tokenized for 1.2 million investors. It drives deep, liquid secondary markets through its integration of Alternative Trading Systems (ATS), making it one of the safest places to invest.

RealT: Tokenized Real Estate Investing

RealT is a specialist in tokenized real estate investing, allowing investors to buy fractional shares in high-value U.S. properties, significantly lowering entry barriers. This structure offers the potential for stable rental yields alongside the market's improved liquidity compared to traditional property investment.

Benefits of Investing in Tokenized Assets

For portfolio diversification, tokenized assets offer unparalleled advantages over conventional markets:

- Fractional Ownership: Allows investors to buy small pieces of high-value assets (e.g., a fraction of a commercial building), lowering minimum entry costs.

- Global Access: Enables investors from any location to participate in previously inaccessible markets (e.g., U.S. real estate or private credit).

- 24/7 Trading: Most tokenized asset platforms support continuous trading, allowing investors to react instantly to global market changes.

- Transparency: Blockchain provides an immutable, transparent record of ownership and transactions.

- Programmable Features: Smart contracts enable automated compliance, dividend distribution, and settlement, increasing efficiency.

How to Buy Tokenized Assets Safely

To ensure the security of tokenized asset investments, follow this step-by-step guide:

- Due Diligence: Verify the platform's regulatory status, audit reports, and the asset's backing (e.g., is the token backed 1:1 by the physical share or T-bill?).

- Create Account & KYC: Register on a reputable, compliant platform (like ToVest) and complete the required KYC (Know Your Customer) and AML (Anti-Money Laundering) checks.

- Fund Wallet: Deposit funds using fiat or stablecoins (like USDC or USDT) into your platform account.

- Select Asset: Browse available tokenized assets (stocks, real estate, treasuries) and review the liquidity metrics (TVL, daily volume).

- Confirm Trade: Place your order. On ToVest, this happens with ultra-low latency, and ownership is recorded instantly on the blockchain.

Using Crypto Wallets for Tokenized Asset Investments

A crypto wallet is a digital tool that stores private keys, allowing users to send, receive, and manage blockchain-based assets securely.

- Most tokenized asset platforms support major wallets, facilitating easy deposit and withdrawal of stablecoins and tokenized assets.

- Security Best Practice: Always use Multi-Factor Authentication (MFA) and consider a hardware wallet for long-term storage of your private keys.

Evaluating Liquidity on Tokenized Asset Platforms

To ensure a rapid and fair exit, assess liquidity before you invest:

- Total Value Locked (TVL): The aggregate market value of assets deposited in the platform. Higher TVL generally indicates a deeper market.

- Daily Trading Volume: The volume of tokens traded daily—a higher volume means a more active and liquid market.

- Order Book Depth: Check the platform's order book to ensure there are ample buyers and sellers at various price points, which minimizes slippage during large trades.

Frequently Asked Questions

Q: How do Crypto-to-stock brokers differ from traditional brokers and crypto-only exchanges in terms of assets and funding?

A: Crypto-to-stock brokers allow trading of Crypto, Stocks, and ETFs, sometimes including tokenized assets, and accept funding via both Fiat and some direct Crypto deposits. Crypto-only exchanges deal only in Crypto and accept both Fiat and Crypto deposits, but offer no direct stock access. Traditional brokers offer Stocks/ETFs, funds, and options, but limited or no Crypto, relying mostly on Fiat funding.

Q: What regulatory oversight do these different broker types fall under?

A: Crypto-to-stock brokers operate under both Securities and Crypto frameworks. Crypto-only exchanges follow Crypto frameworks and often hold MSB/EMI licenses. Traditional brokers are regulated by Securities regulators like the SEC/FINRA.

Q: What are the minimum investment requirements for popular brokerage platforms like Fidelity and Schwab?

A: Fidelity has a $1 minimum investment. Charles Schwab, SoFi Invest, and Firstrade all have a $5 minimum investment.

Q: Which platforms support fractional trading, and which platform supports tokenized Real-World Assets (RWA)?

A: Fidelity, Charles Schwab, and Webull support fractional trading of US Stocks/ETFs. ToVest uniquely supports US Stocks, ETFs, and tokenized real-world assets, offering low fractional minimums for accessibility.

Would you like a detailed breakdown of the regulatory compliance models used by Securitize and BlackRock BUIDL?