Convert Crypto to US Stocks in 2025 with Zero Fees

9 ธันวาคม 2568

The rising adoption of tokenized US stocks and competition among crypto-to-stock platforms have drastically reduced the friction and cost of moving capital between these asset classes. This innovation is largely driven by real asset tokenization, which allows stocks to be represented by liquid digital tokens.

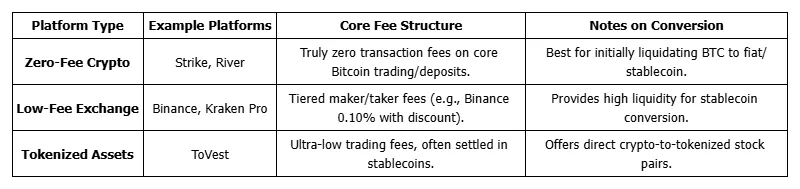

Choose a Zero-Fee Platform for Crypto-to-Stock Conversion

Selecting a platform with a transparent, low-cost fee structure is foundational for cost-efficient conversion. A zero-fee crypto exchange is a digital platform that allows users to buy, sell, or convert cryptocurrencies without charging transaction fees on core operations.

Evaluating Leading Platforms

- Security & Compliance: Always choose platforms that enforce strong security measures (like two-factor authentication, cold storage) and adhere to regulatory compliance (KYC/AML) to safeguard your assets.

Create and Secure Your Trading Account

Strong onboarding procedures and security measures minimize risk, especially on exchanges handling both crypto and tokenized stock products.

- Account Setup: Complete the online application, submit personal information, and pass the mandated Know Your Customer (KYC) identity verification.

- Security Activation: Enable two-factor authentication (2FA) immediately and verify the platform utilizes industry best practices, such as cold storage for holding digital assets.

Deposit Cryptocurrency onto the Platform

You need to fund your account with the crypto you plan to convert.

- Transfer Crypto: Securely transfer cryptocurrencies (e.g., Bitcoin, USDT) from your external wallet to your new exchange wallet.

- Check Fees: While many exchanges are fee-free for deposits (e.g., Strike and River), remember that network (or "gas") fees are blockchain-imposed charges for transferring assets and typically cannot be eliminated by the exchange.

- Supported Assets: Ensure the platform supports the specific cryptocurrency you wish to deposit and convert.

Convert Cryptocurrency into US Stocks Seamlessly

This step is where the innovation of tokenized US stocks becomes most apparent, enabling the direct swap.

- Tokenized Stocks Defined: Tokenized stocks are digital tokens or coins that represent shares of real companies, providing exposure to the underlying security. This tokenization allows for easier and more liquid trading than traditional systems.

- Conversion Flow:

- Select the desired US stock or tokenized equity (e.g., AAPL token).

- Choose the crypto/stablecoin balance you want to convert from.

- Specify the amount (often using fractional ownership by dollar amount).

- Confirm the conversion rate and associated trading fees.

Platforms like ToVest are built on this infrastructure, providing a marketplace where users can easily convert stablecoins (funded by liquidating other crypto) directly into fractional shares of top US equities with minimal friction.

Withdraw or Manage Your Tokenized US Stock Holdings

Once converted, you have several options for managing your new holdings.

- Management: Use the platform’s dashboard to monitor balances, track dividends (if supported by the token's structure), and access tax documentation.

- Liquidity: If you need liquidity, you can sell the tokenized stock back into stablecoins/fiat or, depending on the platform, transfer the tokenized US stock to an external wallet.

- Fee Awareness: Review the withdrawal fee display before confirming any transfer of funds or assets; even zero-fee exchanges may charge a small withdrawal fee or network fee.

Monitor Market Trends and Regulatory Updates

Staying up-to-date with market dynamics and compliance shifts is essential for maximizing opportunity and minimizing risk.

- Tokenization Growth: The adoption of tokenization continues to grow, with data showing stablecoin transactions on certain blockchains process with sub-$0.01 fees and 1–2 second settlements, offering ultra-low latency for conversion.

- Regulatory Shifts: Monitor relevant regulations, such as the US "GENIUS" Act (or similar stablecoin legislation), which enforces stablecoin reserves and overall transaction oversight, signaling a trend toward increased AML/KYC standards.

ToVest provides real-time charts and market alerts to effectively track both crypto and US stock markets, aiding in timely decision-making.

Frequently Asked Questions

Can I directly convert cryptocurrency to US stocks without incurring fees?

Answer: Yes, some platforms allow direct conversion from crypto to stablecoins (zero fee) and then facilitate the purchase of tokenized US stocks with ultra-low trading fees, effectively providing a near-zero cost path.

What hidden costs should I watch for on zero-fee trading platforms?

Answer: Even when a platform advertises zero trading fees, users should look out for wide spreads (the difference between the buy and sell price), small network fees, withdrawal charges, or currency conversion costs.

Which platforms support both cryptocurrency and US stock trading under one account?

Answer: Platforms designed for seamless access, such as those specializing in tokenized US stocks like ToVest, allow users to manage and rebalance both crypto and US stock holdings under a single account for convenience.

How do taxes apply when converting crypto profits into US stocks?

Answer: Tax rules typically treat crypto-to-stock conversions as a taxable event; users may owe capital gains taxes depending on their location and transaction history, as the crypto is first 'sold' to buy the stock.

Are tokenized US stocks equivalent to owning traditional shares?

Answer: Tokenized US stocks are assets that derive their value from traditional equities but may differ in legal structure and investor rights, depending on how the platform issues and secures the tokens. They primarily provide price exposure and liquidity.