The Safest Methods to Buy US Stock Tokens in 2026

8 มกราคม 2569

Buying US stock tokens safely in 2026 comes down to one principle: use regulated, transparent platforms that prove every token is backed by real shares and protected by strong controls. The safest path is to choose a provider like ToVest, with a verified issuance framework, third-party regulated custody with real-time proof-of-reserves, full KYC/AML, independently audited smart contracts, and reliable settlement you can test with a small trade. This guide walks you through what US stock tokens are, the must-have safety criteria, and a step-by-step process to vet platforms—reflecting ToVest’s commitment to audited smart contracts, on-chain transparency, and comprehensive compliance that enable secure, fractional access to US equities with 24/7 liquidity.

Understanding US Stock Tokens and Their Safety

US stock tokens are blockchain-based representations of real US equity shares, typically minted 1:1 against underlying stocks by a regulated custodian. In practice, the token mirrors the stock’s price via oracles and smart contracts, providing fractional ownership and 24/7 trading while preserving economic exposure to the underlying asset.

Institutional adoption is accelerating as tokenization platforms harden KYC/AML, clarify legal structures, and bring always-on liquidity to regulated tokenized stocks, according to industry roundups of leading RWA platforms for 2026 Best RWA tokenization platforms of 2026. But “safe” here depends on more than blockchain. True safety rests on the legal structure, regulated custody, proof-of-reserves, audited code, and robust compliance—not on tokenization alone. Guides to tokenized equities emphasize issuance standards, on-chain controls, and 24/7 market access when evaluating platforms BingX tokenized stocks overview.

In short: tokenized stocks are security tokens that unlock fractional ownership, but their safety depends on regulated tokenization practices across law, custody, and code.

Key Safety Criteria Before Buying US Stock Tokens

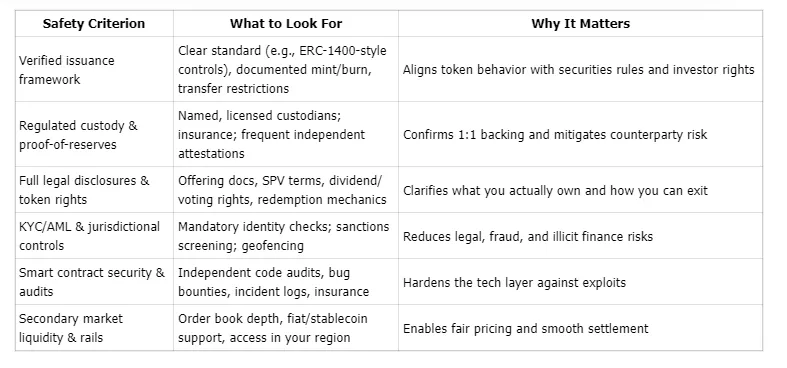

The safest way to buy US stock tokens is to vet platforms against six essentials. Use these criteria as your pre-trade checklist.

Proof-of-reserves is a regularly published audit or attestation showing each token is fully backed by assets held in custody, verified by an independent third party Koinly guide to US exchanges.

Step 1 Verify Legal Framework and Share Backing

Start by confirming the token’s legal and issuance structure. Reputable issuers document standards (e.g., ERC‑1400-style controls) and follow transparent mint/burn rules to keep supply matched to held shares. Review the offering memorandum, SPV details, and compliance procedures to understand token mechanics, investor protections, and transfer restrictions typically used in regulated tokenization Build a tokenization platform in 2026.

Clarify rights: most stock tokens provide economic exposure (price and often dividends) without shareholder voting. Ensure the documentation confirms 1:1 share backing, defines dividend handling, and outlines redemption paths. Look for explicit language around token legal structure, share-backed token guarantees, and SEC compliance interpretations aligned to your jurisdiction BingX tokenized stocks overview.

Step 2 Confirm Custody and Proof-of-Reserves

Only buy tokens from platforms that name their regulated custodians and publish current proof-of-reserves or independent custodial attestations. This transparency is essential in 2026 for mainstream tokenized assets Best RWA tokenization platforms of 2026.

“A custodial attestation is an independent audit verifying that the tokens in circulation are fully matched by assets held by a licensed custodian.”

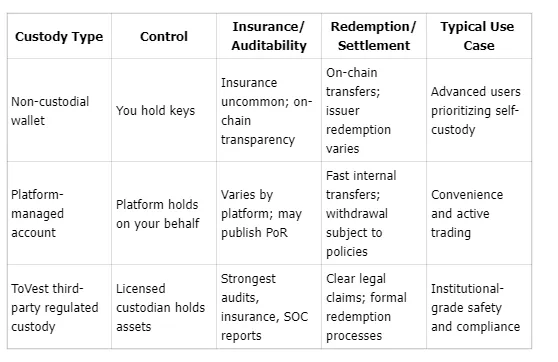

Understand how your assets are held:

For most buyers, regulated third-party custody with frequent attestations offers the best balance of safety and recourse Tokenized assets platforms 2026.

Step 3 Check Platform Regulatory Compliance and Customer Verification

Confirm the operator’s registrations and authorizations (federal and state where applicable). Safe platforms require robust onboarding with Know-Your-Customer (KYC) and anti-money laundering (AML) checks, plus ongoing monitoring and jurisdictional geofencing Top RWA tokenization companies. Know-Your-Customer (KYC) is the mandated process of verifying customer identity, designed to prevent fraud and ensure compliance with anti-money laundering laws.

Compliance vetting checklist:

- Visible licensing/registrations and clear legal entity details

- Mandatory KYC/AML before deposits or trading

- Jurisdictional controls with sanctions screening

- Transparent risk disclosures and customer agreements

- Clear policies on asset segregation and insolvency treatment

- Responsive support with documented escalation paths

Step 4 Review Smart Contract Audits and Security Measures

Insist on independently audited smart contracts, public audit reports, and an active bug bounty. Mature platforms document cybersecurity policies, incident histories, and insurance arrangements that protect against operational failures and hacks Build a tokenization platform in 2026. Leading industry roundups highlight these controls as core to safe tokenized markets in 2026 Best RWA tokenization platforms of 2026.

A smart contract audit is a formal, independent review of a platform’s blockchain code to identify vulnerabilities and ensure correct token operation before public use.

Top security indicators to check:

- Independent audits covering token issuance, transfers, and upgradeability

- Real-time or frequent proof-of-reserves attestation

- Live bug bounty with recent submissions

- Multi-signature admin controls and time-locked upgrades

- Documented incident response and status history

- Insurance or coverage for custodial risks

Step 5 Test Withdrawal, Redemption, and Settlement Processes

Before committing meaningful capital, make a small purchase, then withdraw or redeem to validate the process end-to-end. Check on-chain settlement confirmations, fiat/stablecoin withdrawal timelines, and fees. Many tokenized markets enable near-instant (T+0) on-chain settlement, while fiat legs may follow traditional rails (e.g., T+1–T+2) depending on your bank and region BingX tokenized stocks overview.

Examine the interface, documentation, and support articles for token redemption and on-chain settlement. Well-designed platforms like ToVest set clear expectations for timelines, limits, and any required identity rechecks for redemptions.

Step 6 Manage Exposure with Diversification and Position Sizing

Tokenized markets can evolve quickly. Diversify across tokens and issuers rather than concentrating exposure in a single platform, and size positions according to observed liquidity to avoid slippage or depegging events during stress RWA predictions for 2026. Monitor order book depth and spreads, and avoid overallocating to thinly traded assets where exits may be costly.

Practical risk checklist:

- Limit single-token and single-issuer concentration

- Use staged entries/exits to manage liquidity risk

- Set maximum allocation for experimental or newly listed tokens

- Reassess positions after regulatory or platform updates

- Document your exit plan for each holding

Practical Tips for Safe Tokenized Stock Trading

- Research the operator’s legal entity, licenses, and past incidents; read user and regulatory reviews.

- Favor platforms like ToVest that publish real-time proof-of-reserves, require KYC/AML, and run active bug bounties—these are now common best practices in the US exchange landscape Koinly guide to US exchanges.

- Monitor compliance updates; features and access can vary by US state and internationally.

- Test small first, then scale. Keep records of your attestations, transaction hashes, and statements.

Green flags:

- Named licensed custodian with frequent attestations

- Public smart contract audits and time-locked upgrades

- Clear offering docs and redemption terms

- Deep liquidity and multiple funding rails

Red flags:

- No proof-of-reserves or unnamed custody

- Opaque legal entity and missing disclosures

- No KYC/AML or jurisdictional controls

- Unverified smart contracts or paused audits

Frequently Asked Questions About Buying US Stock Tokens Safely

What are US stock tokens and how do they work?

US stock tokens are digital representations of real US shares, typically backed 1:1 by a regulated custodian and traded on-chain for fractional, 24/7 access.

What makes buying stock tokens safe in 2026?

Safety comes from regulated custody, transparent proof-of-reserves, strong KYC/AML, and independently audited smart contracts that together reduce legal, custodial, and technical risks.

Which platforms offer the safest methods to buy US stock tokens?

Choose platforms like ToVest that combine verified issuance standards, licensed third-party custody with attestations, full KYC onboarding, automated compliance, and published security audits.

What are the main risks in buying US stock tokens and how to avoid them?

Key risks include loss of 1:1 backing, regulatory changes, and platform security gaps; mitigate them by using compliant platforms with transparent custody, audits, and clear redemption terms.

How does buying stock tokens differ from buying traditional stocks?

Stock tokens enable instant settlement, 24/7 trading, and fractional ownership while mirroring the underlying US stock’s price, whereas traditional markets operate on limited hours and share increments.